Gladstone Investment dividend yield calculator – Gladstone Investment to Pay Dividend on Monday

May 20, 2023

Trending News 🌧️

Monday is a big day for Gladstone Investment ($NASDAQ:GAIN) shareholders as the company will be paying out dividends. Through its subsidiaries, the company offers a range of strategies including senior secured loans, senior subordinated loans, and mezzanine loans. It also provides other corporate finance solutions such as venture debt, growth capital, minority equity investments, and more. Along with its strong track record of providing financing solutions to companies, it also pays out dividends to its shareholders.

As of Monday, shareholders of record as of the close of business on Friday will be eligible to receive the dividend. Shareholders of Gladstone Investment should make sure to mark this date down on their calendars so they don’t miss out on their dividend payouts. With a long track record of success in providing financing solutions and regular dividend payments, investing in Gladstone Investment may be an attractive option for investors.

Dividends – Gladstone Investment dividend yield calculator

Gladstone Investment Corporation (GLADSTONE INVESTMENT) is set to pay a dividend on Monday. The company has been consistently issuing annual dividend per share for the past 3 years at 0.92, 0.87, and 0.84 USD respectively. Investment analysts have forecasted a consistent dividend yield for the upcoming 3 years from 2021 to 2023 at 6.85%, 6.31%, and 6.61%, with an average dividend yield of 6.59%. If you are looking to invest in dividend stocks, you may want to add Gladstone Investment Corporation to your list of consideration.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gladstone Investment. More…

| Total Revenues | Net Income | Net Margin |

| 44.99 | 47.59 | 105.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gladstone Investment. More…

| Operations | Investing | Financing |

| -16.1 | – | -9.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gladstone Investment. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 771.56 | 322.37 | 13.31 |

Key Ratios Snapshot

Some of the financial key ratios for Gladstone Investment are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.9% | – | – |

| FCF Margin | ROE | ROA |

| -35.8% | 6.7% | 3.9% |

Stock Price

On Friday, the company’s stock opened at $13.1 and closed at the same price, up 0.2% from its prior closing price of $13.1. It lends money, primarily senior debt, to private companies and invests in equity forms such as common stock, preferred stock, and warrants. The company also provides growth capital and bridge financing for acquisitions and buyouts. The dividend paid by Gladstone Investment Corporation is an attractive benefit to shareholders as it offers a steady stream of income.

The company has maintained a history of reliable dividend payments over the years and is committed to continuing this track record in the future. Shareholders can expect a steady return from their investment in this company and be assured that their money is in good hands. Live Quote…

Analysis

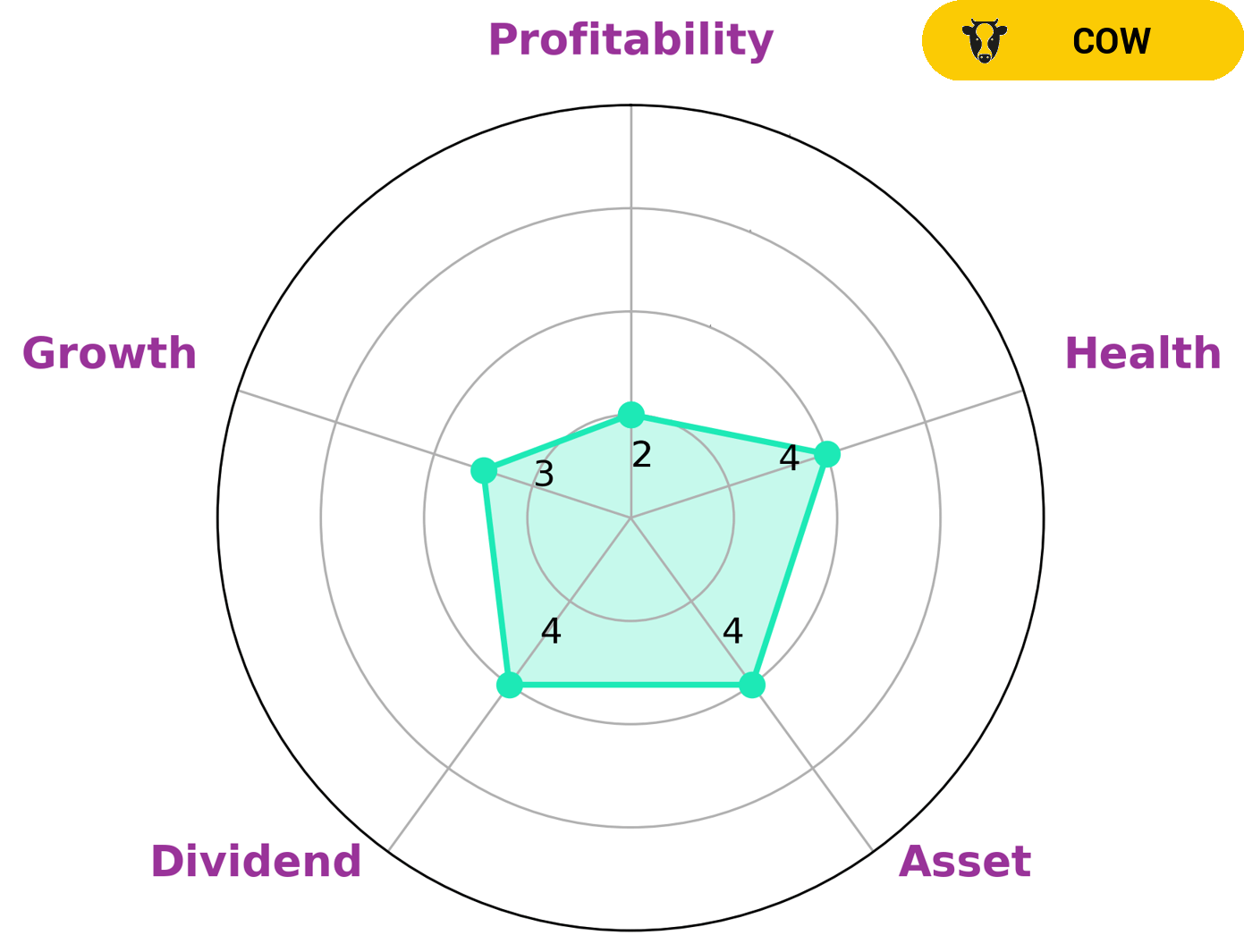

GoodWhale conducted an analysis of GLADSTONE INVESTMENT‘s wellbeing and, based on our Star Chart, classified the company as a ‘cow’. We concluded that this type of company has a track record of paying out consistent and sustainable dividends. The analysis revealed that GLADSTONE INVESTMENT has an intermediate health score of 4/10 with regard to its cashflows and debt, indicating that it is likely to sustain future operations in times of crisis. While GLADSTONE INVESTMENT is strong in assets and dividend, it is weak in growth and profitability. Given its solid dividend record and intermediate health score, this type of company may be attractive to investors who are looking for a steady return but may not be interested in investing in higher-risk, higher-growth enterprises. More…

Peers

Gladstone Capital’s competitors include BlackRock Capital Investment Corporation, Urbana Corporation, and other private equity firms.

– Gladstone Capital Corp ($NASDAQ:GLAD)

Gladstone Capital Corporation is a publicly traded business development company that provides debt and equity financing solutions for small and mid-sized businesses in the United States. The Company invests in a variety of industries, including manufacturing, healthcare, business services, and technology. As of 2022, the Company had a market capitalization of 339.27 million and a return on equity of 9.31%.

– BlackRock Capital Investment Corp ($NASDAQ:BKCC)

BlackRock Capital Investment Corporation is a business development company specializing in investments in middle market companies. The firm also invests in companies with public equity, mezzanine, senior and junior debt, and real estate. It seeks to invest between $5 million and $50 million in companies with enterprise value between $25 million and $250 million. The firm primarily invests in the United States. BlackRock Capital Investment Corporation was founded in 1999 and is based in Greenwich, Connecticut.

– Urbana Corp ($TSX:URB.A)

Urbana Corp is a holding company that operates through its subsidiaries. The company has a market cap of 164.73M as of 2022 and a Return on Equity of 3.8%. Urbana Corp’s subsidiaries engage in the business of real estate development, construction, and management. The company was founded in 1992 and is headquartered in Vancouver, Canada.

Summary

Gladstone Investment Corporation is a publicly traded business development company that provides long-term debt and equity capital investments to small and middle market businesses. The company recently announced that it would go ex-dividend on Monday, meaning that investors of record will be entitled to receive a cash dividend payment on the declared date. Those looking to invest in Gladstone Investment should do their due diligence to understand the risks involved before making any decisions. Analysts have noted that the company has a track record of solid financial performance with a good balance sheet, steady cash flows, and reasonable debt levels. As an income-oriented investor, Gladstone Investment could be an attractive investment opportunity due to its regular dividend payments.

However, it is advised to carefully assess the potential risk associated with the company before investing.

Recent Posts