Envestnet Asset Management Increases Investment in Sixth Street Specialty Lending,

May 19, 2023

Trending News ☀️

Envestnet Asset Management Inc. recently increased its investment in Sixth Street Specialty ($NYSE:TSLX) Lending, Inc., an alternative credit platform that provides capital solutions to middle-market companies. Sixth Street Specialty Lending specializes in providing non-bank loans and capital markets solutions to companies in need of capital. The company has access to a wide range of financing sources, including private equity, debt, ABS, and structured finance. The company’s unique approach to alternative credit and capital markets has enabled it to offer customized financing solutions to middle-market companies. Its commitment to providing flexible and affordable solutions has enabled it to become a trusted partner for many businesses. Sixth Street Specialty Lending has a strong track record of providing financing solutions to middle market businesses across a variety of industries.

In addition, the company has invested in developing and deploying innovative technology solutions to improve the efficiency and accuracy of its offerings. By leveraging its expertise in capital markets, Sixth Street Specialty Lending is able to provide tailored capital solutions that meet the needs of its clients. The additional resources will enable Sixth Street Specialty Lending to extend its reach by expanding its offerings and continuing to offer high-quality capital solutions to middle-market companies.

Market Price

The stock of Sixth Street Specialty Lending opened at $17.8 and closed at the same price, representing a 0.6% increase from the closing price of $17.7 the day prior. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for TSLX. More…

| Total Revenues | Net Income | Net Margin |

| 156.42 | 120.12 | 76.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for TSLX. More…

| Operations | Investing | Financing |

| -379.19 | – | 381.43 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for TSLX. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.97k | 1.62k | 16.59 |

Key Ratios Snapshot

Some of the financial key ratios for TSLX are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.5% | – | – |

| FCF Margin | ROE | ROA |

| -242.4% | 5.7% | 2.6% |

Analysis

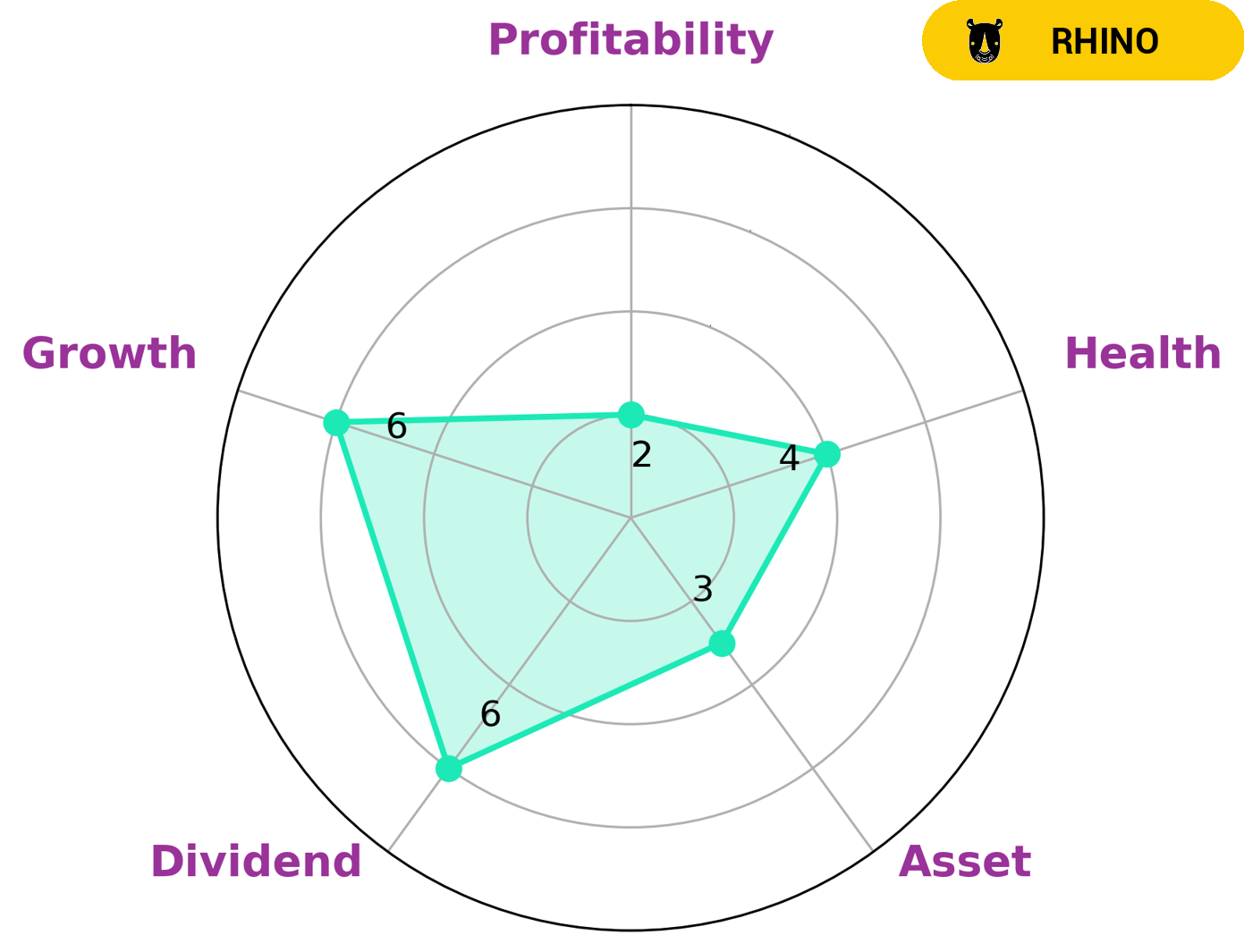

As GoodWhale, we did an analysis of SIXTH STREET SPECIALTY LENDING’s wellbeing. We looked at their financial performance and used our Star Chart to classify them as ‘Rhino’, a type of company that has achieved moderate revenue or earnings growth. We believe that investors seeking portfolio diversification and moderate risk may be interested in this type of company. In terms of the specific financial performance indicators, SIXTH STREET SPECIALTY LENDING is strong in dividend, medium in growth and weak in asset and profitability. Overall, their health score is 4/10, which indicates that they might be able to pay off debt and fund future operations. More…

Peers

It competes in the specialty lending space with other companies such as Golub Capital BDC Inc, Portman Ridge Finance Corp, and OFS Capital Corp. All four companies strive to provide innovative and tailored financial solutions to meet the needs of their customers.

– Golub Capital BDC Inc ($NASDAQ:GBDC)

Golub Capital BDC Inc is a business development company (BDC) that provides middle-market companies with flexible financing solutions. As of 2023, it has a market cap of 2.25 billion and a Return on Equity of 3.77%. The company’s market capitalization is an indication of its financial strength and market presence, while its ROE shows its ability to generate profits from its invested capital. As an investment firm, Golub Capital BDC Inc has the ability to provide customized financing solutions to its clients and has proven its worth in the middle-market financing space.

– Portman Ridge Finance Corp ($NASDAQ:PTMN)

Portman Ridge Finance Corp is an asset management company that specializes in providing capital solutions to financial institutions and corporations. The company has a market capitalization of 214.28M as of 2023, which represents the total market value of its outstanding stock. The company has a negative return on equity (-1.97%) which is indicative of the low profitability of its investments. Portman Ridge Finance Corp is facing challenges in its ability to generate profits on its investments, which is impacting its overall market capitalization.

– OFS Capital Corp ($NASDAQ:OFS)

OFS Capital Corp is a publicly traded business development company that provides debt and equity capital to lower middle-market companies. It acts as an alternative source of financing for companies that may not be able to access traditional bank financing in the current market. As of 2023, OFS Capital Corp has a market capitalization of 133.66M, which is a measure of the company’s total value based on the current market price of its shares. Additionally, its Return on Equity (ROE) is 2.34%, which measures the company’s profitability by assessing how much profit it has earned on its shareholders’ equity over a certain period of time.

Summary

Sixth Street Specialty Lending, Inc. is an investment firm specializing in providing capital to middle-market companies. This is a sign of positive growth for Sixth Street as Envestnet is a well-respected asset management firm, known for making smart investments. Analysts are expecting the company to benefit from this new influx of capital in terms of increased liquidity and potential new partnerships.

It is likely that Sixth Street will be able to leverage these resources to further expand its services and diversify its portfolio of investments. Overall, this is a positive development for the company and its investors.

Recent Posts