EAI dividend yield – Groupe Bruxelles Lambert SA Declares 2.75 Cash Dividend

June 10, 2023

🌥️Dividends Yield

On May 25 2023, Groupe Bruxelles Lambert ($BER:EAI) SA declared a 2.75 EUR cash dividend per share, offering investors an attractive dividend yield of 3.07% over the past three years. This dividend payment comes as a part of the company’s commitment to return value to its shareholders. The next ex-dividend date for GROUPE BRUXELLES LAMBERT SA is set for May 11 2023. Investors who purchase before this date will be eligible to receive the 2.75 EUR dividend when it is paid out on May 25 2023.

By declaring a 2.75 EUR dividend per share on May 25 2023, the company is once again returning value to its shareholders and offering an opportunity for investors to take advantage of this reliable dividend income. With an upcoming ex-dividend date of May 11 2023, now is the perfect time for investors to consider adding GROUPE BRUXELLES LAMBERT SA to their list of investments.

Share Price

The stock opened at €73.0 and closed at €73.0, representing a 2.5% decrease from the prior closing price of €74.8. This news has been met with both excitement and skepticism from analysts who remain unsure of the long-term impact this dividend will have on Groupe Bruxelles Lambert SA’s stock price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for EAI. More…

| Total Revenues | Net Income | Net Margin |

| 8.57k | -584.7 | -6.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for EAI. More…

| Operations | Investing | Financing |

| 805.4 | -255.2 | 51.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for EAI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 33.4k | 16.58k | 109.53 |

Key Ratios Snapshot

Some of the financial key ratios for EAI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.8% | -24.8% | -1.8% |

| FCF Margin | ROE | ROA |

| 2.0% | -0.6% | -0.3% |

Analysis

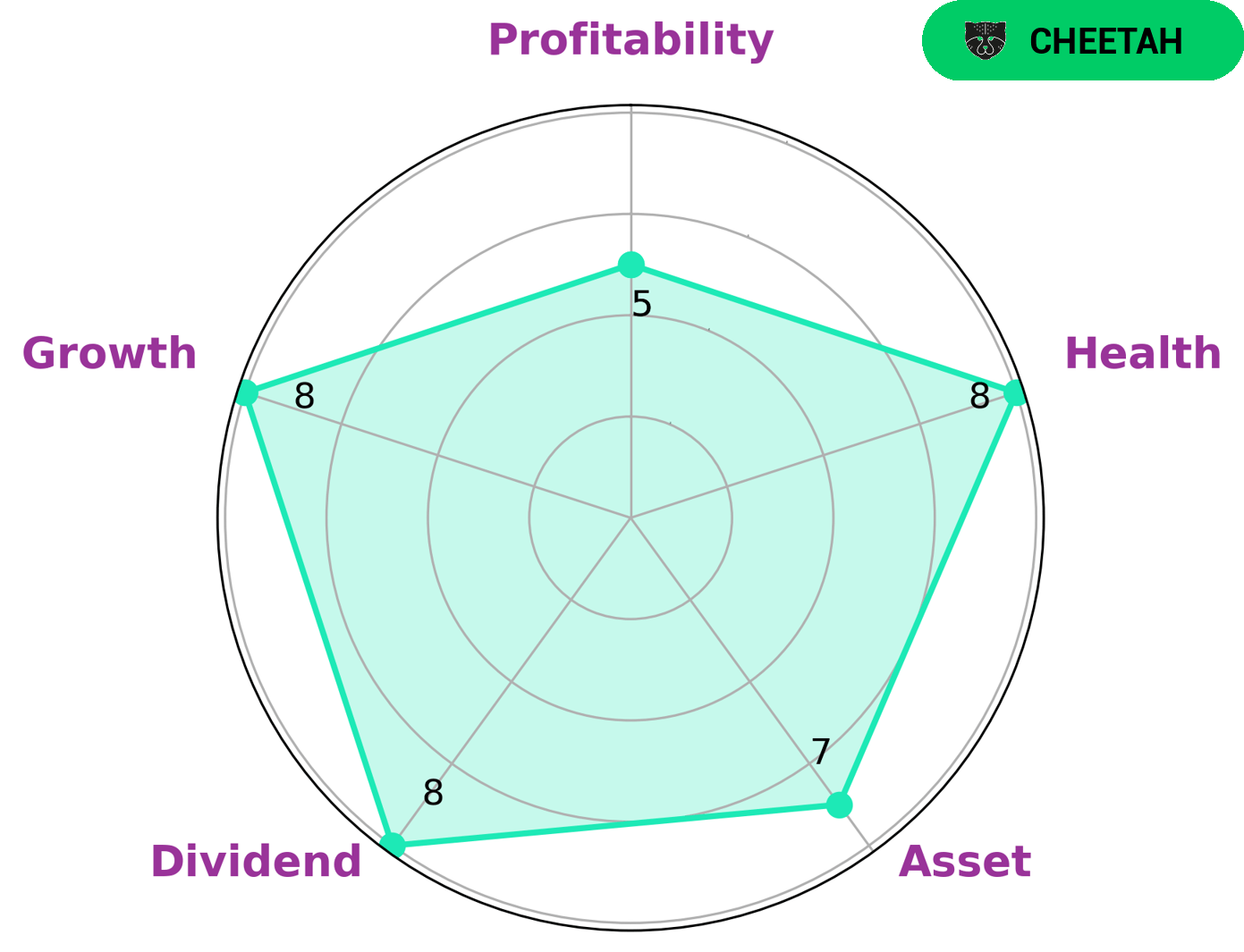

At GoodWhale, we recently conducted an analysis of GROUPE BRUXELLES LAMBERT SA’s financials. We found that the company currently has a high health score of 8/10, which indicates that it is capable of sustaining future operations even in times of crisis. Moreover, GROUPE BRUXELLES LAMBERT SA is classified as a ‘cheetah’ type of company. This means that it has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. Given these characteristics, we believe that the company may be appealing to investors who are looking for growth, along with a degree of stability. Specifically, the company has strong assets, dividends and growth, and medium-level profitability. In summary, GROUPE BRUXELLES LAMBERT SA is a strong company with potential for long-term growth. More…

Summary

GROUPE BRUXELLES LAMBERT SA is an attractive option for investors seeking a steady annual dividend yield. The company has issued an average annual dividend per share of 2.75 EUR over the past three years, resulting in a 3.07% yield. This makes it an attractive choice for those looking to build a long-term portfolio of dividend-paying stocks. Moreover, shareholders are likely to benefit from a low payout ratio and record of stable dividend increases over time, making it a sound investment for those wanting to maximize returns on their capital.

Recent Posts