CARLYLE GROUP Invests $55 Million in Hack the Box’s Series B Funding Round

January 13, 2023

Trending News 🌥️

Carlyle Group ($NASDAQ:CG) has invested in many high-profile companies such as Dell, Hilton, and CIT Group. Recently, the company has invested $55 million in Hack the Box’s Series B funding round. Hack the Box is a global cyber security training and consulting company based in San Francisco. The investment was led by Carlyle, in partnership with existing investors such as Index Ventures and Greylock Partners. The new funds will be used to accelerate the growth of the company’s cyber security platform and expand its offerings.

Hack the Box has a large community of dedicated members who use their platform for cyber security skill development, certifications, and consulting services. The company also offers a range of tools and training programs for cyber security professionals. With this investment from Carlyle Group, Hack the Box is well-positioned to become a global leader in the cyber security industry. This is just one of the many investments that Carlyle has made in the tech sector in recent years, indicating the company’s strong commitment to technology and innovation.

Market Price

This news has been largely met with positivity, and those who have invested in the company have seen a small bump in their stock price. On Thursday, CARLYLE GROUP opened at $33.3 and closed at $33.4, up by 0.8% from the previous closing price of 33.1. They are one of the world’s largest investors in private equity, real estate, infrastructure, and credit. Through their portfolio companies, they help create and manage innovative products and services that provide meaningful value to their customers, stakeholders, and society. The investment in Hack the Box is part of CARLYLE GROUP’s strategy to focus on innovative companies that are shaping the future. Hack the Box is a cloud-based platform designed to facilitate collaboration between developers, testers, and security professionals.

It helps organizations accelerate the development process by providing a secure environment to test applications. This investment will help Hack the Box continue to offer their platform as an important tool for enterprise security teams. The additional capital will also be used to expand their team and develop new features to further improve the user experience. This is a promising investment for CARLYLE GROUP and Hack the Box, and it will be interesting to see how it plays out in the coming months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Carlyle Group. More…

| Total Revenues | Net Income | Net Margin |

| 4.01k | 1.75k | 53.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Carlyle Group. More…

| Operations | Investing | Financing |

| 230.1 | -877.6 | -311.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Carlyle Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 21.42k | 14.99k | 16.47 |

Key Ratios Snapshot

Some of the financial key ratios for Carlyle Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.7% | – | – |

| FCF Margin | ROE | ROA |

| -10.7% | 24.1% | 6.7% |

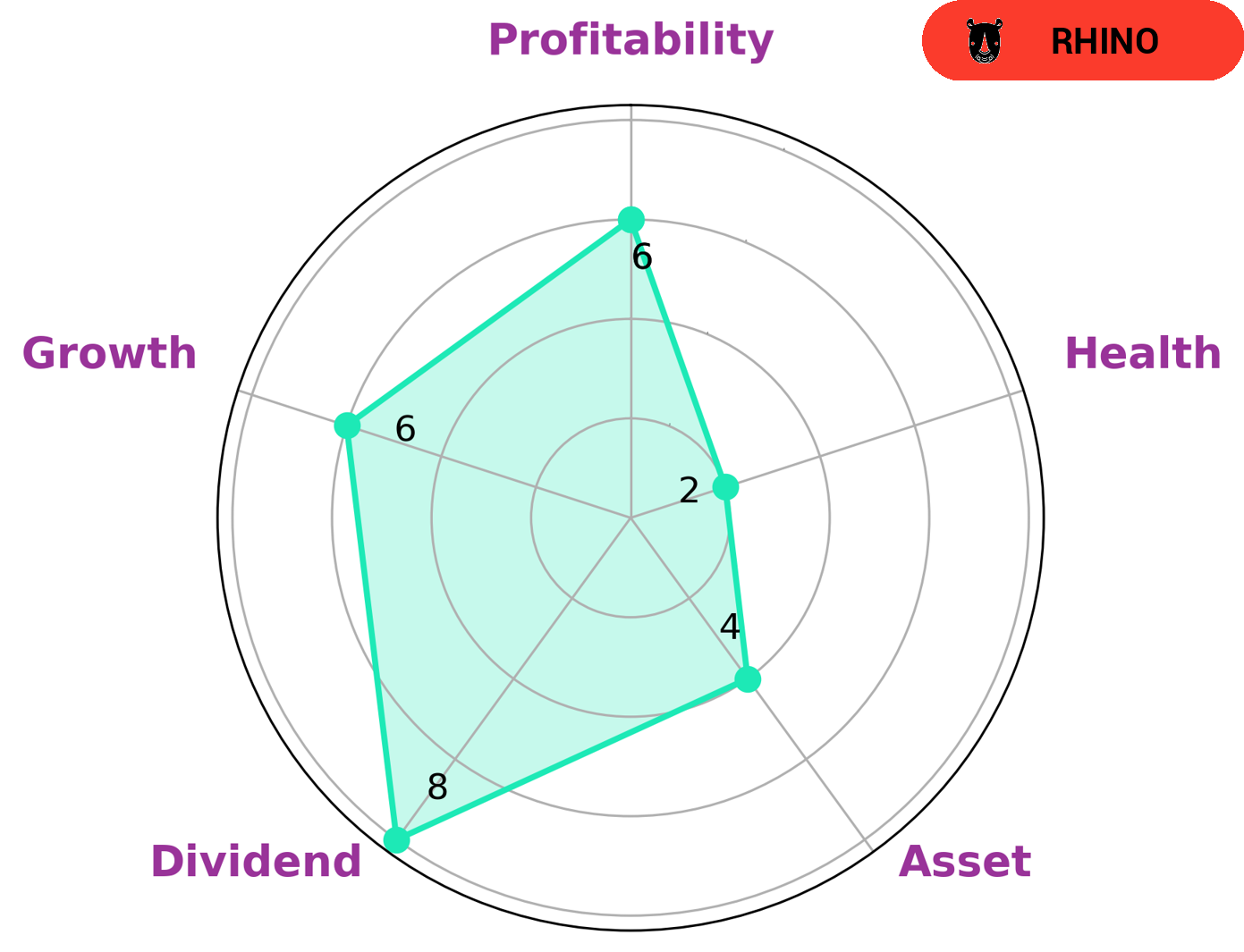

VI Analysis

Investors looking for strong dividend yields and moderate growth potential may find the Carlyle Group an attractive option. According to the VI Star Chart, the company is strong in dividend and medium in asset, growth, and profitability. However, its health score is low, at 2 out of 10, which indicates that it is less likely to weather any crisis without the risk of bankruptcy. As such, it may be suitable for investors who are willing to take a higher risk in exchange for potentially higher returns. The Carlyle Group is classified as a ‘rhino’, which means that it has achieved moderate revenue or earnings growth. This makes it an ideal choice for investors who want to diversify their portfolios without taking on too much risk. It may also appeal to those who seek long-term investments with steady returns. In addition, the company’s fundamental metrics reflect its long-term potential. Investors may be interested in its financial performance over time to gain an understanding of how it is likely to fare in the future. Furthermore, the VI app simplifies the process of analyzing the company’s fundamentals and can help investors make informed decisions about whether to invest in the Carlyle Group. More…

VI Peers

Carlyle’s purpose is to invest wisely and generate superior returns for our investors. Carlyle has a track record of successful investments across multiple asset classes, industries and geographies. Carlyle’s competitive advantages include: (1) A deep and experienced management team with an average of 26 years of investment experience; (2) A global footprint with approximately 1,800 employees in 31 offices across six continents; (3) Strong relationships with corporate executives, government officials and other key decision-makers around the world; and (4) A commitment to being a responsible steward of capital.

– Blackstone Inc ($NYSE:BX)

Blackstone is an alternative asset manager and financial services firm. The company has a market cap of $62.59 billion as of 2022. Blackstone specializes in private equity, real estate, and hedge fund investments. The company has over $600 billion in assets under management. Blackstone was founded in 1985 by Peter G. Peterson and Stephen A. Schwarzman.

– Franklin Resources Inc ($NYSE:BEN)

Franklin Resources Inc. is an investment management company that provides investment products and services to individuals, families, institutions, and financial intermediaries. The company has a market cap of $10.83 billion and a return on equity of 12.45%. The company’s products and services include mutual funds, institutional separate accounts, and private equity and venture capital funds. Franklin Resources Inc. was founded in 1947 and is headquartered in San Mateo, California.

– KKR & Co Inc ($NYSE:KKR)

KKR & Co Inc is a leading global investment firm that offers a wide range of investment strategies. They have a market cap of 38.62B as of 2022 and a Return on Equity of 17.48%. The company has a long history of success and is a trusted name in the industry. They offer a variety of services including private equity, credit, and real estate.

Summary

The Carlyle Group is a global alternative asset manager that recently invested $55 million in Hack the Box’s Series B Funding Round. This investment marks another successful venture for the firm, which has a long history of successful investments and returns. Analysts have noted that the firm’s focus on investing in high-growth sectors such as technology and healthcare has been a major factor in its success.

With this latest investment, Carlyle Group has further solidified its place as one of the leading investment firms in the world. This strategic move is seen as a positive step for the company and investors alike.

Recent Posts