Carlos Whitaker Makes Significant Investment in Blackstone Secured Lending Fund on May 26, 2023

June 9, 2023

☀️Trending News

On May 26, 2023, Carlos Whitaker, President of __________ (company name), made a significant investment in the Blackstone Secured Lending ($NYSE:BXSL) Fund. He purchased 3895 shares of the fund for a total of $100024, which was reported in a Form 4 filing. Blackstone Secured Lending Fund is a publicly-traded investment fund focused on providing investors with high-yield returns from secured and unsecured credit opportunities. The fund takes an active approach to evaluating investments, selecting only those companies and securities that have the potential to generate strong returns. The fund has a diversified portfolio of investments across different sectors, providing investors with exposure to a wide variety of debt markets.

In addition, the fund has a track record of outperformance, as evidenced by its performance over the past five years. The fund is managed by Blackstone, one of the world’s leading alternative asset management firms. The firm has a long and successful track record managing investments across different asset classes. Blackstone’s expertise and expertise in the credit markets gives it a leg up on other fund managers when it comes to evaluating and selecting investments for its portfolio. Carlos Whitaker’s investment in the Blackstone Secured Lending Fund is yet another example of the confidence that Blackstone’s management team have in the fund’s potential to generate strong returns for investors. With his investment in the fund, Mr. Whitaker joins a long list of investors who have already found success with the Blackstone Secured Lending Fund.

Share Price

The stock opened at $25.7 and closed at the same price, up by 0.2% from its prior closing price of $25.6. It appears that Whitaker’s investment has given a small boost to the share price of the Fund. This investment comes as a part of Blackstone’s ongoing efforts to diversify its portfolio and increase its presence in the financial sector.

The significance of this investment is yet to be seen, but it could potentially signal a shift in investor sentiment towards the Blackstone Secured Lending Fund and the broader financial sector. It will be interesting to monitor the Fund’s performance in the coming weeks and months to determine the impact of Whitaker’s investment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BXSL. More…

| Total Revenues | Net Income | Net Margin |

| 420.67 | 436.11 | 103.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BXSL. More…

| Operations | Investing | Financing |

| 847.98 | – | -892.16 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BXSL. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.85k | 5.66k | 26.1 |

Key Ratios Snapshot

Some of the financial key ratios for BXSL are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 25.6% | – | – |

| FCF Margin | ROE | ROA |

| 201.6% | 6.6% | 2.8% |

Analysis

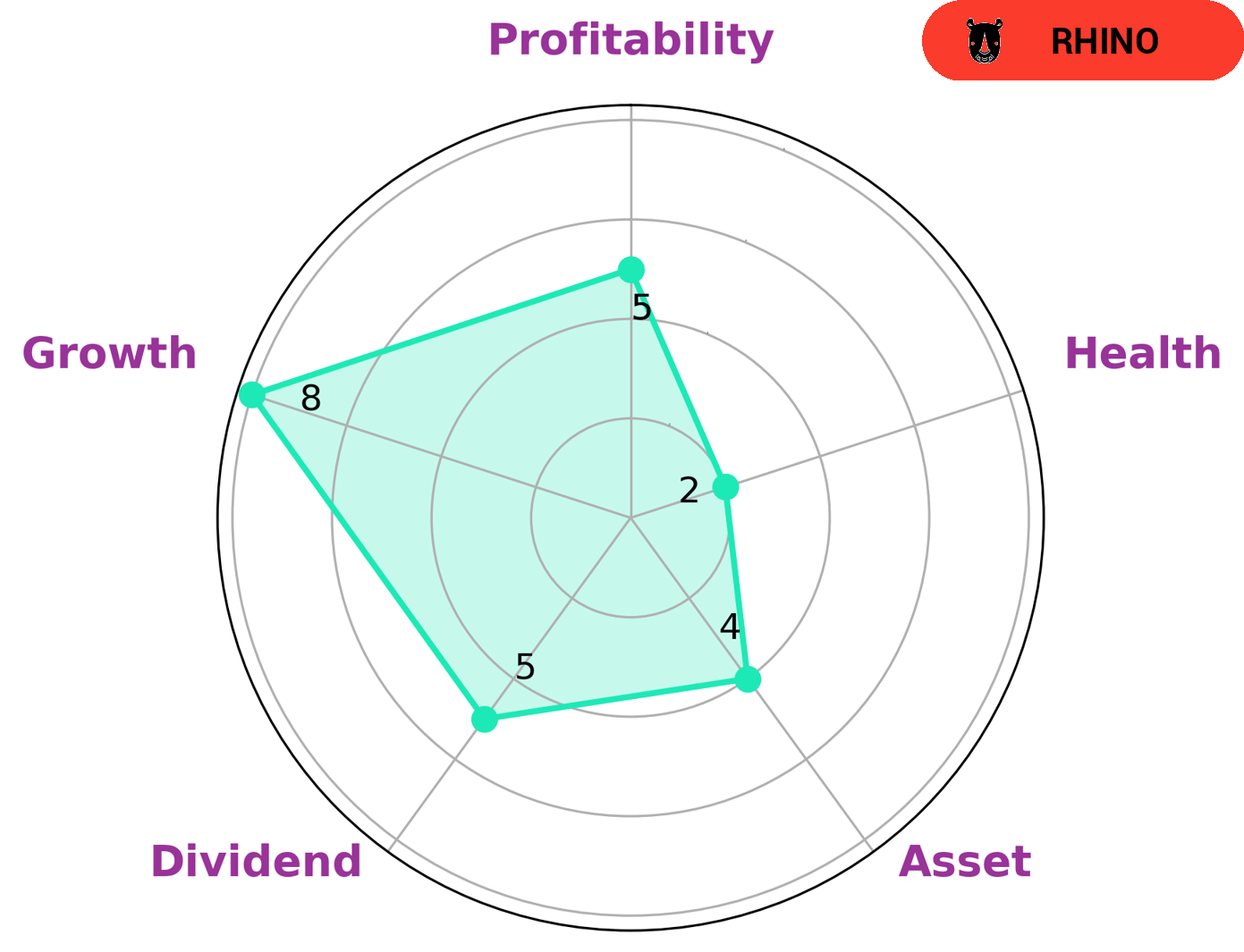

At GoodWhale, we conducted an analysis of BLACKSTONE SECURED LENDING FUND’s wellbeing. Our star chart shows that the company is strong in growth, and medium in asset, dividend, and profitability. This low score is indicative of the company’s cashflows and debt, which suggests that it is less likely to pay off debt and fund future operations. We classified BLACKSTONE SECURED LENDING FUND as a ‘rhino’, which is a type of company that has achieved moderate revenue or earnings growth. As such, investors who are looking for companies that have achieved this level of growth may find BLACKSTONE SECURED LENDING FUND interesting. More…

Peers

The competition between Blackstone Secured Lending Fund and its competitors, Princeton Capital Corp, OFS Capital Corp, and Franklin BSP Lending Corp, is intense as each strives to provide the best lending services to their clients. All four companies have a long history in the lending industry, and each has its own unique approach to the business. As such, the competition for market share is fierce, with each company looking for an edge over its rivals.

– Princeton Capital Corp ($OTCPK:PIAC)

Princeton Capital Corp is a financial services company that provides investment and asset management services. As of 2022, its market capitalization was 42.17 million, reflecting its financial strength and market presence. Furthermore, its return on equity (ROE) was 12.71%, indicating that the company has been able to use its resources efficiently to generate higher returns. Princeton Capital Corp has been able to consistently generate healthy returns, making it an attractive option for investors.

– OFS Capital Corp ($NASDAQ:OFS)

OFS Capital Corp is a closed-end investment company that specializes in providing customized financing solutions to mid-market companies. The company’s market capitalization as of 2022 is 146.52M, making it a mid-sized entity in the investment sector. Its Return on Equity (ROE) of 2.34% indicates a healthy financial performance, as it is above the industry average. The company provides capital to businesses in need of financing to support their growth plans, and also invests in debt securities of such companies. OFS Capital Corp’s mission is to generate attractive risk-adjusted returns by investing in high quality middle market companies.

– Franklin BSP Lending Corp ($OTCPK:BDVC)

Franklin BSP Lending Corp is a financial services company that specializes in providing consumer loans, mortgages, and other types of banking services. As of 2022, the company has a market cap of 1.29B and a Return on Equity of 4.33%. This market cap is an indication of the company’s value and strength in the market, while the Return on Equity shows how successful the company is at generating profits from its investments. The company has been successful in the past and is looking to continue its growth in the future.

Summary

Blackstone Secured Lending Fund (BSLF) is a closed-end fund that provides investors with access to attractive income opportunities in the rapidly growing secured lending asset class. BSLF has historically achieved attractive returns by investing in secured loan assets with strong credit characteristics. Recent purchases by President Carlos Whitaker suggest the fund is attractive to investors, as he acquired 3895 shares for $100024 on May 26, 2023. Investors interested in BSLF should consider its strong track record of providing high returns, its diversified portfolios of secured loan assets, and its potential to provide attractive income in a low interest rate environment.

Recent Posts