Canadian High dividend yield – Canadian High Income Equity Fund Announces 0.04 Cash Dividend

January 30, 2023

Dividends Yield

Canadian High dividend yield – On January 25th, 2023, CANADIAN HIGH ($TSX:CIQ.UN) Income Equity Fund announced a 0.04 cash dividend. CANADIAN HIGH is a publicly listed company based in Canada and has been consistently paying dividends over the past 3 years, with an average annual dividend per share of 0.48, 0.48 and 0.51 CAD. This impressive dividend yield of 6.75% has made the company attractive to investors looking for dividend stocks. The ex-dividend date for 2023 is January 30th, meaning that investors must own the stock prior to this date in order to be eligible to receive the dividend. The respective dividend yields over the past 3 years have been 6.13%, 6.21% and 7.92%, showing a steadily increasing trend which is likely to continue in 2023. It has an impressive portfolio of investments across the country and is well-positioned to capitalize on any potential future market opportunities due to its strong financials and management team.

Additionally, the company has a strong focus on sustainability which further adds to its appeal for long-term investors. Overall, CANADIAN HIGH is an excellent choice for investors looking for a reliable dividend stock. With its impressive track record of dividend payments and its focus on sustainability, it is likely to be an attractive investment for years to come. The upcoming 0.04 cash dividend is a great opportunity for investors to benefit from the company’s strong performance and should not be overlooked.

Share Price

The stock opened at CA$7.2 and closed at CA$7.1, resulting in a 1.9% decrease from the previous day’s closing price of CA$7.2. This dividend payout is the second of the company’s planned quarterly dividend payments for 2020. It is managed by a team of experienced analysts and portfolio managers and works to provide long-term capital appreciation and current income. The fund’s top holdings include Royal Bank of Canada, Canadian Imperial Bank of Commerce, and Suncor Energy Inc. Other holdings include Telus Corporation, Enbridge Inc., Cenovus Energy Inc., Bank of Nova Scotia, and Bank of Montreal. The Canadian High Income Equity Fund offers investors access to a diversified portfolio of high yield securities, as well as the potential for strong returns.

Investors should note that the fund’s performance may be affected by changes in interest rates, political developments, economic conditions, and other factors. The 0.04 cash dividend announced on Wednesday marks the second of the company’s planned quarterly dividend payments for 2020. Investors should consider their individual financial circumstances before making any investment decisions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Canadian High. More…

| Total Revenues | Net Income | Net Margin |

| -0.7 | -0.83 | 118.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Canadian High. More…

| Operations | Investing | Financing |

| 3.12 | – | -3.14 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Canadian High. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.7 | 0.1 | 7.12 |

Key Ratios Snapshot

Some of the financial key ratios for Canadian High are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -33.1% | – | – |

| FCF Margin | ROE | ROA |

| -444.4% | -5.1% | -5.3% |

VI Analysis

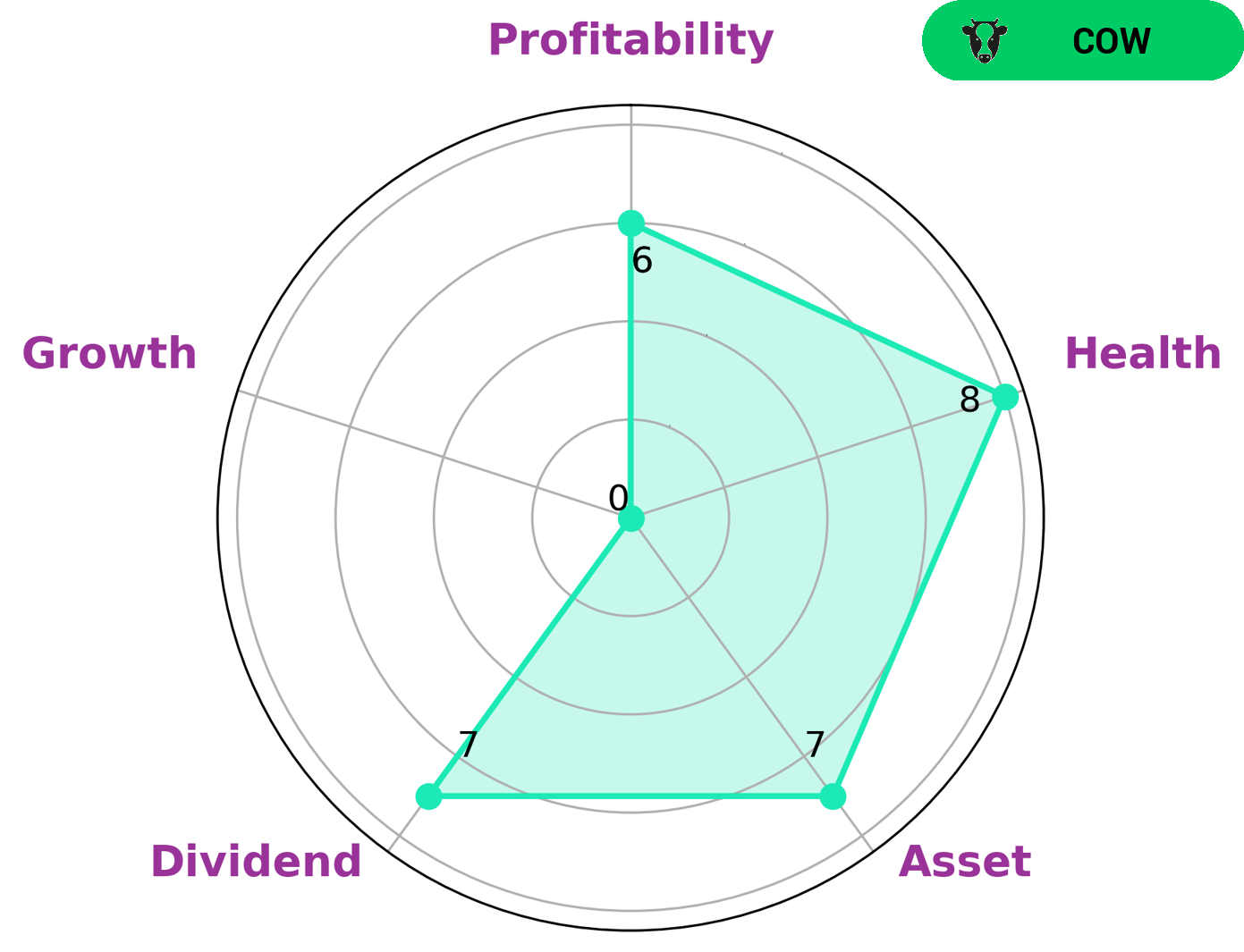

The VI app offers investors a comprehensive review of CANADIAN HIGH’s fundamentals, which demonstrate its long-term potential. According to the VI Star Chart, CANADIAN HIGH is classified as a ‘cow’, a type of company that has a track record of paying out consistent and sustainable dividends. The company is strong in terms of assets and dividend, while its profitability and growth are rated as medium. CANADIAN HIGH also has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is strong enough to sustain future operations in times of crisis. This makes the company attractive to investors who are looking for investments that can provide steady returns over the long term. Investors who are looking for a reliable and dependable investment should consider CANADIAN HIGH as an option. Investors who are more risk-averse may appreciate the safety that CANADIAN HIGH provides from its strong asset and dividend base, while those who are looking for higher returns may be drawn to the potential for growth that the company offers. No matter what type of investor you are, CANADIAN HIGH can provide a suitable investment opportunity. More…

VI Peers

The competition between Canadian High Income Equity Fund and its competitors, Shriram Asset Management Co Ltd, PhenixFIN Corp, Global Dividend Growth Split Corp, is intense. All of these companies provide a range of services with the ultimate goal of maximizing returns for their investors. Each company has its own unique approach to investing, and they all bring something unique to the table.

– Shriram Asset Management Co Ltd ($BSE:531359)

Shriram Asset Management Co Ltd is an Indian asset management company that specializes in investments in various asset classes, such as equities, bonds, and structured products. As of 2023, the company had a market capitalization of 1.12 billion and a return on equity (ROE) of -2.55%. Despite a negative return on equity, Shriram Asset Management Co Ltd has been able to remain profitable and grow its market capitalization over the years. The company operates through its various subsidiaries, which include Shriram Wealth Advisors Ltd and Shriram Mutual Fund Ltd. It offers a range of products to both retail and institutional investors, including mutual funds, exchange-traded funds, portfolio management services, structured products, and wealth management services.

– PhenixFIN Corp ($NASDAQ:PFX)

PhenixFIN Corp is a financial services company that provides a range of services, including asset management and wealth management. The company currently has a market cap of 70.75M as of 2023, indicating a positive outlook for its future growth. Furthermore, its Return on Equity (ROE) stands at -3.05%, which suggests that the company is not generating a lot of profits from its current operations. Despite this, PhenixFIN Corp is continuing to make strategic investments in order to ensure that it remains competitive in the industry.

– Global Dividend Growth Split Corp ($TSX:GDV)

Global Dividend Growth Split Corp is a closed-end investment fund that invests in a diversified portfolio of dividend-paying equity securities of Canadian companies. As of 2023, the company has an estimated market capitalization of 146.51M. The company has a policy of distributing all or part of its net income to shareholders in the form of cash dividends, providing investors with a steady stream of income. The fund also seeks to capitalize on market opportunities by using a disciplined investment approach that seeks to maximize returns while minimizing risk.

Summary

CANADIAN HIGH has been a great dividend stock to consider for the last three years, offering an impressive annual dividend per share of 0.48, 0.48 and 0.51 CAD. The respective dividend yields in 2020, 2021 and 2022 respectively were 6.13%, 6.21% and 7.92%, with an average dividend yield of 6.75%. The ex-dividend date for 2023 is January 30th, so investors have a chance to capitalize on this stock’s solid dividend yield. CANADIAN HIGH offers investors a reliable history of dividend payments and a solid dividend yield to grow their investments.

Additionally, the stock remains a great choice for investors looking for a long-term investment opportunity or those looking for income from dividends. With its high dividend yield and steady history of dividend payments, CANADIAN HIGH is a great stock to consider for any investor’s portfolio.

Recent Posts