BROOKFIELD CORP Reports Fourth Quarter FY2022 Earnings Results on February 9 2023.

March 29, 2023

Earnings Overview

On February 9 2023, BROOKFIELD CORP ($NYSE:BN) announced their financial results for the fourth quarter of FY2022, which ended on December 31 2022. Compared to the same period of the previous year, total revenue for the quarter dropped by 128.6% to USD -0.3 billion, whereas net income rose by 11.1% to USD 24.2 billion.

Price History

At the opening bell, BROOKFIELD CORP stock opened at $38.0 and closed at $36.7, down by 0.2% from the previous closing price of 36.8. The company plans to invest in infrastructure and renewable energy assets, as well as pursue strategic acquisitions during the fiscal year. Overall, BROOKFIELD CORP reported strong fourth quarter results and is optimistic about its outlook for FY2023. The company is well-positioned to capitalize on growth opportunities in the coming year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Brookfield Corp. More…

| Total Revenues | Net Income | Net Margin |

| 92.77k | 1.91k | 3.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Brookfield Corp. More…

| Operations | Investing | Financing |

| 8.04k | -21.05k | 16.26k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Brookfield Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 441.28k | 299.39k | 28.27 |

Key Ratios Snapshot

Some of the financial key ratios for Brookfield Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.0% | 11.8% | 18.7% |

| FCF Margin | ROE | ROA |

| 0.3% | 24.6% | 2.5% |

Analysis

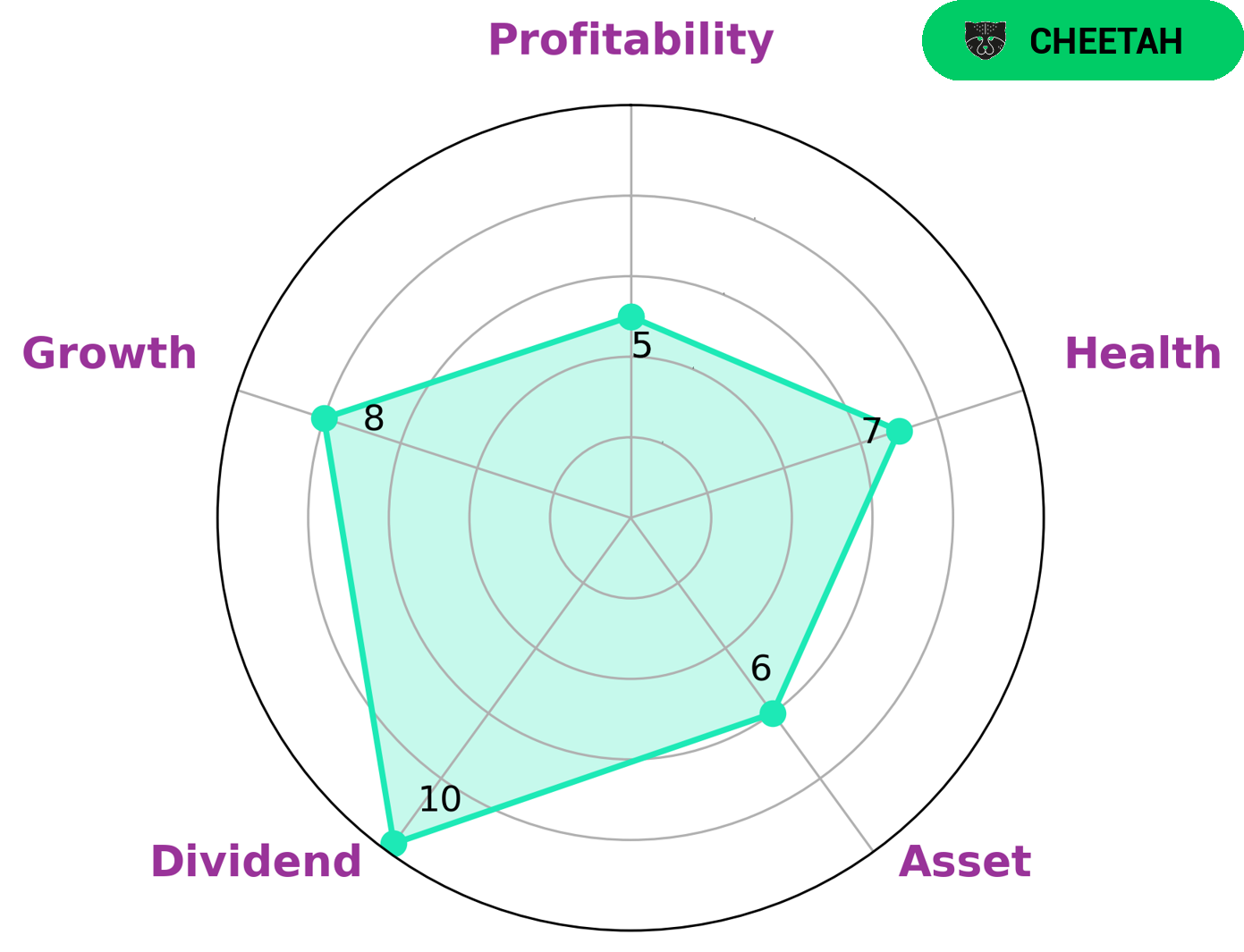

At GoodWhale, we conducted an analysis of BROOKFIELD CORP‘s fundamentals and drew some interesting conclusions. According to our Star Chart, BROOKFIELD CORP is strong in dividend, growth, and medium in asset, profitability. Additionally, BROOKFIELD CORP scored highly on our health score with a 7/10. This indicates that the company is financially sound and capable of sustaining operations even during times of crisis. We classify BROOKFIELD CORP as a ‘cheetah’ company, meaning it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are willing to take on higher risks may be interested in such a company. More…

Summary

Analysts are closely watching Brookfield Corp’s fourth quarter of FY2022 earnings report as the company’s total revenue decreased by 128.6% compared to the same period of the previous year. Despite this significant drop in revenue, the firm was still able to achieve a net income increase of 11.1%. Investors should be encouraged by this news, as it shows that Brookfield Corp is still able to generate profits despite the decreased revenue. Going forward, investors should monitor the company’s performance to get a better understanding of its financial health and outlook.

Recent Posts