Brokerages Set $42.50 Target Price for AllianceBernstein Holding L.P. Stock

April 21, 2023

Trending News 🌥️

ALLIANCEBERNSTEIN ($NYSE:AB): AllianceBernstein Holding L.P. is a global asset management firm that provides investment solutions for both retail and institutional investors. The company focuses on delivering customized solutions, specializing in portfolio construction and manager selection. AllianceBernstein services are based on a long-term, fundamental and active investment philosophy. The stock has a consensus rating of “Hold” from the six analysts covering it. Moreover, out of these six analysts, two rate the stock as “Buy” while four rate it as “Hold”.

The focus on long-term fundamentals and active investing has enabled AllianceBernstein to generate consistent returns for its investors. The company has also been successful in creating value-added services to customers, such as integrated wealth management solutions and customized portfolio construction services. As such, AllianceBernstein’s stock has been able to maintain its value despite the volatile markets.

Price History

The stock opened at $35.4 and closed at $36.4, indicating a greater confidence in the resilience of ALLIANCEBERNSTEIN HOLDING L.P stock despite volatile market conditions. The target price set by brokerages suggests that the stock is likely to maintain steady growth in the near future. Investors are encouraged to take a closer look at ALLIANCEBERNSTEIN HOLDING L.P to make informed decisions on their investments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AB. More…

| Total Revenues | Net Income | Net Margin |

| 305.5 | 274.17 | 89.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AB. More…

| Operations | Investing | Financing |

| 362.61 | -1.77 | -360.85 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AB. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.07k | 1.62 | 18.22 |

Key Ratios Snapshot

Some of the financial key ratios for AB are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.7% | – | – |

| FCF Margin | ROE | ROA |

| 118.7% | 10.5% | 9.2% |

Analysis

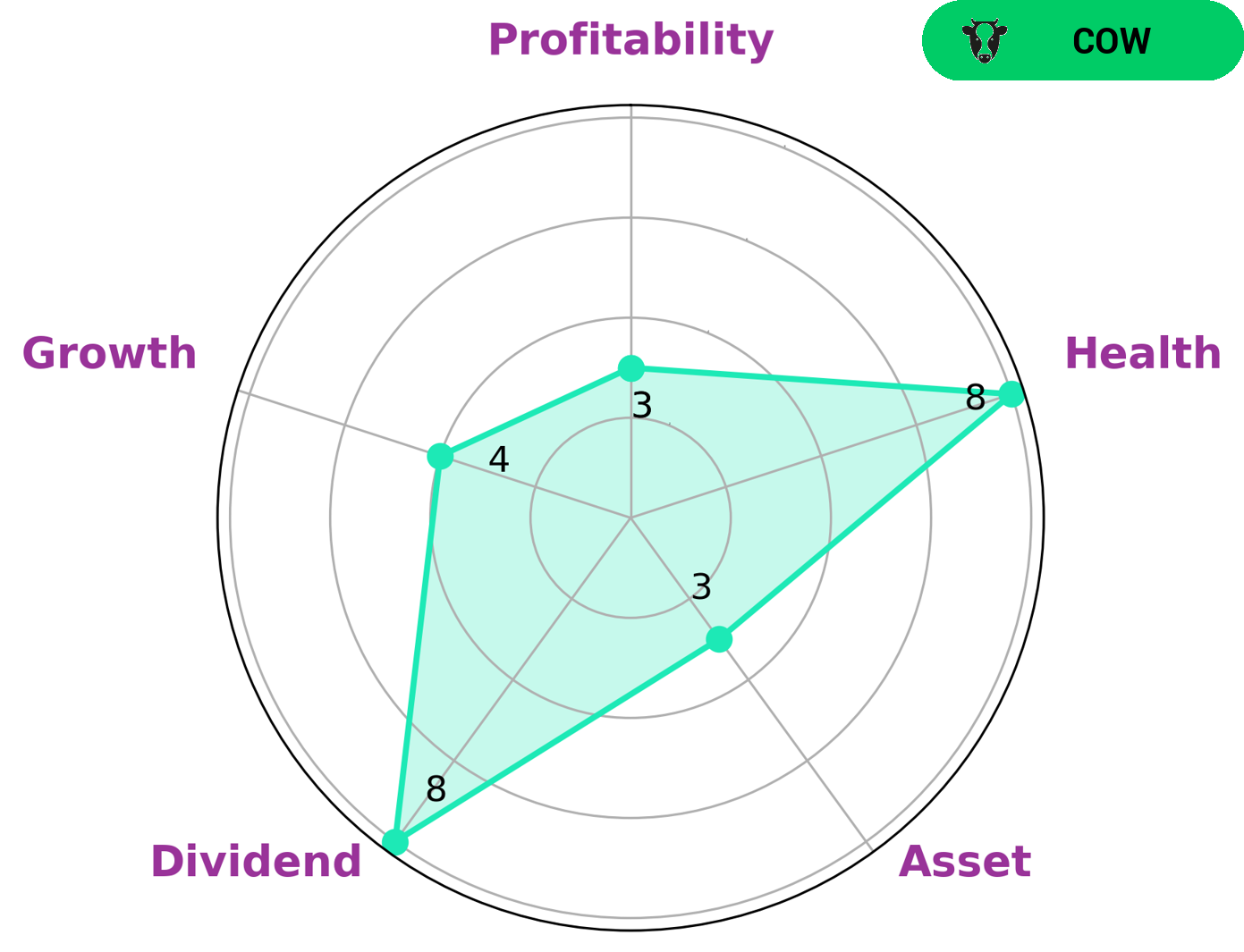

GoodWhale conducted an analysis of ALLIANCEBERNSTEIN HOLDING L.P’s wellbeing and based on our Star Chart, we found that the company had a high health score of 8/10. This indicates that the company is capable to sustain future operations in times of crisis, considering its cashflows and debt. Furthermore, based on our research, we have classified ALLIANCEBERNSTEIN HOLDING L.P as ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. In terms of investing potential, ALLIANCEBERNSTEIN HOLDING L.P is strong in dividend, medium in growth and weak in asset, profitability. This makes it an attractive choice for investors who are looking for steady returns in the form of dividends. Along with its ability to sustain itself during times of crisis, this company might be an interesting choice for those looking to invest in a stable and reliable company. More…

Peers

The company competes with WisdomTree Investments Inc, Ashmore Group PLC, and Onex Corporation. All four companies offer a wide range of investment products and services.

– WisdomTree Investments Inc ($NASDAQ:WETF)

Ashmore Group PLC is a United Kingdom-based investment management company. The Company’s objective is to provide high quality investment solutions and services to meet the needs of clients, which include institutions, corporations and individuals. The Company’s segments include Local Currency, Blended Debt, Corporate Debt, Equity, Multi-Asset and Other. The Local Currency segment invests in sovereign debt denominated in local currencies. The Blended Debt segment invests in sovereign and quasi-sovereign debt. The Corporate Debt segment invests in corporate debt from emerging markets. The Equity segment invests in stocks of companies in emerging markets. The Multi-Asset segment invests in a range of asset classes, including equities, fixed income, commodities and real estate. The Other segment includes the Company’s cash and cash equivalents.

– Ashmore Group PLC ($LSE:ASHM)

Onex Corporation is a private equity and investment management firm with a market cap of 5.84B as of 2022. The company has a Return on Equity of 5.95%. Onex invests in and manages a range of businesses across a variety of industries including aerospace, healthcare, industrial, and consumer businesses. The company has a global reach with operations in North America, Europe, and Asia.

Summary

Investment analysts have recently issued reports on AllianceBernstein Holding L.P. stock, and the consensus amongst them is to hold. Six research firms have given the stock an average recommendation of “Hold”, with an average price target of $42.50. Investors should research the stock before making any decisions on whether to buy or sell. Additionally, investors should assess the company’s financials and management strategy to determine if the stock is worth investing in for the long-term.

Recent Posts