Apollo Global Management Opens London Office, Strengthening European Presence

April 18, 2023

Trending News ☀️

Apollo Global Management ($NYSE:APO), a leading global alternative investment manager, has announced the opening of a new office in London in order to strengthen its presence within the European market. The company has extensive experience in private equity, credit, real estate and infrastructure investments and seeks to create long-term value for its clients and strategic partners through effective management. The new London office will serve as an important hub for the firm’s European operations and will provide an opportunity for the firm to further expand its presence within the continent. The addition of the London office is part of Apollo Global Management’s ongoing commitment to providing its clients with the best possible service and capabilities.

It will be headed by Managing Director Robert Kole and will be supported by a team of experienced professionals from across the firm’s network. The opening of the London office reflects Apollo Global Management’s commitment to growth, innovation and providing superior investment opportunities for clients across Europe. By having a local presence in London, Apollo Global will be well positioned to meet the needs of its clients, as well as to capitalize on investment opportunities across the continent.

Stock Price

On Monday, APOLLO GLOBAL MANAGEMENT opened its new office in London, solidifying its presence in the European market. This move comes as the firm continues to invest across the continent and expand its operations. The opening of this office demonstrates APOLLO GLOBAL MANAGEMENT’s commitment to the European market and signals that the firm is expanding its international presence. The opening of the new office was celebrated by APOLLO GLOBAL MANAGEMENT stock, which opened at $64.7 and closed at $65.2, up by 0.4% from last closing price of 65.0.

This increase in stock price shows investors’ confidence in the company and its ability to generate returns by investing in European markets. The London office is just the latest sign of APOLLO GLOBAL MANAGEMENT’s commitment to the European markets. With this new office, the firm is positioned to strengthen its foothold in the region and capitalize on the many opportunities that exist in the European market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for APO. More…

| Total Revenues | Net Income | Net Margin |

| 10.97k | -4.17k | -27.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for APO. More…

| Operations | Investing | Financing |

| 3.79k | -23.44k | 28.71k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for APO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 259.33k | 252.1k | 0.7 |

Key Ratios Snapshot

Some of the financial key ratios for APO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 55.2% | 98.9% | -51.0% |

| FCF Margin | ROE | ROA |

| 34.5% | 742.3% | -1.3% |

Analysis

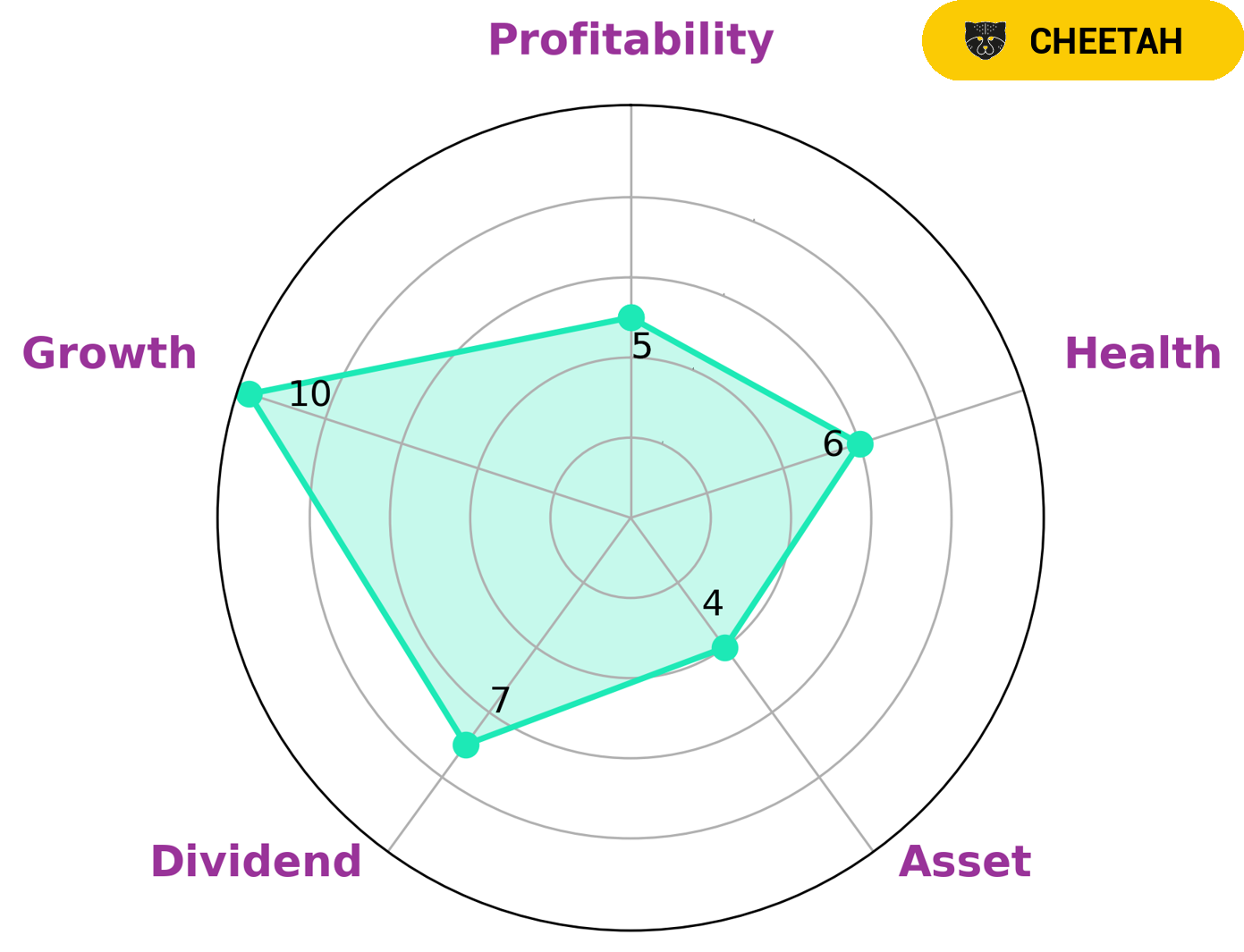

GoodWhale analyzed APOLLO GLOBAL MANAGEMENT’s wellbeing with our tool. Through our Star Chart, we determined that APOLLO GLOBAL MANAGEMENT is classified as ‘cheetah’ – a type of company that has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. Investors that may be interested in such a company are those with a higher risk tolerance who are looking for potential returns in the short term. APOLLO GLOBAL MANAGEMENT is strong in dividend and growth, and medium in asset and profitability. In terms of their health score, APOLLO GLOBAL MANAGEMENT has an intermediate rating of 6/10, indicating that they are likely to pay off debt and fund future operations. More…

Peers

The competition between Apollo Global Management Inc and its competitors is fierce. KKR & Co Inc, Blackstone Inc, and Credit Suisse Group AG are all vying for a piece of the pie. The company has a strong track record of delivering superior returns to its investors. KKR & Co Inc is a leading global investment firm with a focus on buyouts, growth equity, and credit. Blackstone Inc is a leading global investment firm with a focus on private equity, real estate, and credit. Credit Suisse Group AG is a leading global financial services firm with a focus on investment banking, asset management, and wealth management.

– KKR & Co Inc ($NYSE:KKR)

KKR & Co Inc is a leading global investment firm that manages multiple alternative asset classes, including private equity, energy, infrastructure, real estate, credit, and hedge funds. The company has a market cap of 44.65B as of 2022 and a return on equity of 4.34%. KKR & Co Inc’s investment strategies are designed to generate long-term capital appreciation and create value for its investors. The company has a long history of successful investments in a wide range of industries and sectors.

– Blackstone Inc ($NYSE:BX)

Blackstone is a leading global investment firm specializing in private equity, credit, and hedge fund investments. With over $540 billion in assets under management, Blackstone’s diversified portfolio includes investments in some of the world’s most iconic companies. Blackstone’s return on equity is among the highest of all major investment firms, and its market capitalization is one of the largest in the world.

– Credit Suisse Group AG ($OTCPK:CSGKF)

Credit Suisse Group AG is a Swiss multinational investment bank and financial services company headquartered in Zurich, Switzerland. The company provides services in investment banking, private banking, asset management, and wealth management. Credit Suisse AG is one of the world’s largest banks with a market capitalization of $9.96 billion as of 2022. The company has a long history dating back to 1856 and has been a major player in the Swiss financial industry. Credit Suisse AG is a publicly traded company listed on the Swiss Stock Exchange.

Summary

Apollo Global Management, a leading global alternative investment manager, has recently opened a new office in London to expand its presence in Europe. The move introduces a major player in the private equity and credit markets to the region, making it easier for investors to access Apollo’s portfolio solutions. Apollo is well-known for its unique strategies which prioritize long-term capital appreciation and absolute returns. The firm’s diverse strategies, combined with its global coverage, allow investors to access attractive opportunities from multiple asset classes and geographies.

In addition, Apollo Global Management’s proprietary analytics and market relationships provide its investors with deep insights into investment decisions. As it expands into Europe, investors can look forward to further growth opportunities and increased access to Apollo’s portfolio solutions.

Recent Posts