AllianceBernstein Holding L.P. Reports Q4 Earnings Beat and Revenue of $802.11M Despite 6% Yearly AUM Decline.

February 12, 2023

Trending News 🌥️

ALLIANCEBERNSTEIN HOLDING L.P ($NYSE:AB) is a publicly-traded asset management firm that provides global institutional and retail clients with investment and research services. In the fourth quarter of 2020, ALLIANCEBERNSTEIN HOLDING L.P reported Non-GAAP Earnings Per Share (EPS) of $0.70, exceeding expectations by $0.13. Revenue for the quarter was $802.11 million. The company’s performance was driven by higher average fee rates and higher asset flows into equity strategies, particularly U.S. equity strategies. AUM in equities rose 8% compared to the same period a year ago, while AUM in fixed income decreased by 10%. For the entire year, AUM decreased by 6%, which was largely attributable to market volatility and outflows in certain strategies.

Overall, ALLIANCEBERNSTEIN HOLDING L.P reported a solid set of results for the fourth quarter, despite the challenging economic environment. Despite the decline in AUM, the company managed to post strong earnings and revenue figures. The company also managed to effectively manage its operating costs and maintain solid margins despite the challenging conditions. Going forward, the company will continue to focus on managing its costs and capitalizing on growth opportunities in order to drive long-term value for shareholders.

Share Price

AllianceBernstein Holding L.P. reported their fourth quarter earnings on Wednesday, beating analyst expectations and reporting revenue of $802.11 million. This is despite a 6% year-over-year decline in their assets under management (AUM). The stock opened at $39.4 and closed at $39.8, up 0.2% from the last closing price of $39.7. The quarterly earnings report revealed a 4% increase in total operating revenues from the prior year’s quarter, at $802.11 million.

The company attributed the AUM decline mainly to outflows in their U.S. Retails & Financial Intermediaries segment and outflows in their International Retail segment, partially offset by inflows in their Institutions & Private Wealth segment. The company will continue to focus on cost reductions and other efficiency measures in order to maintain strong financial performance going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AB. More…

| Total Revenues | Net Income | Net Margin |

| 305.5 | 274.17 | 89.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AB. More…

| Operations | Investing | Financing |

| 375.82 | -3.4 | -351.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AB. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.99k | 419.97 | 15.63 |

Key Ratios Snapshot

Some of the financial key ratios for AB are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.7% | – | – |

| FCF Margin | ROE | ROA |

| 123.0% | 12.2% | 9.6% |

Analysis

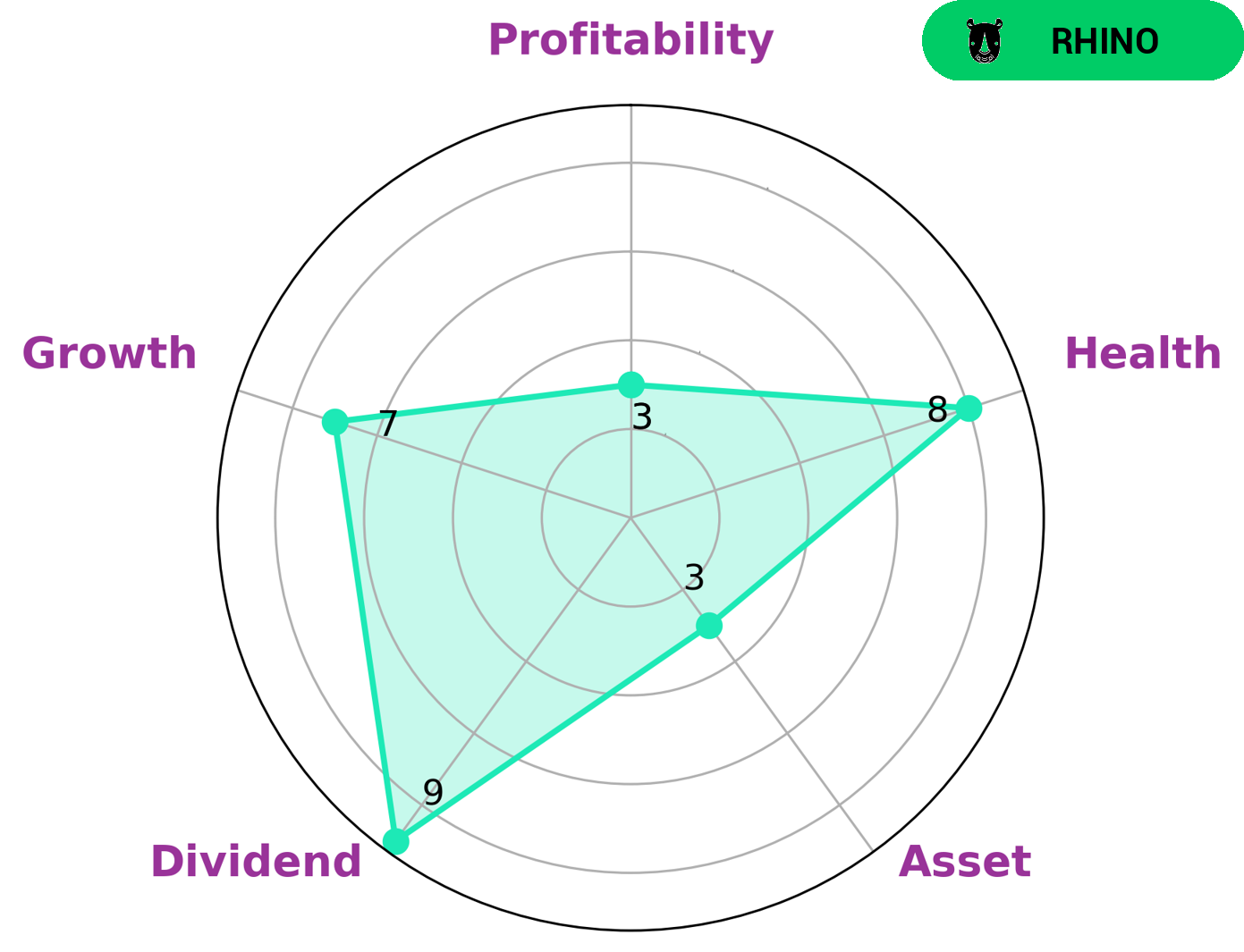

GoodWhale conducted an analysis of ALLIANCEBERNSTEIN HOLDING L.P’s wellbeing and found that it had strong dividend and growth, but weak asset and profitability according to the Star Chart. ALLIANCEBERNSTEIN HOLDING L.P also had a high health score of 8/10, indicating that it is capable of safely riding out any crisis without the risk of bankruptcy. It is classified as a ‘rhino’ company, meaning that it has achieved moderate revenue or earnings growth. This type of company may be of interest to investors looking for investments with steady returns and moderate growth potential. Investors looking for a more long-term investment may also be attracted to the company’s high health score and ability to handle any economic crises that may arise. Additionally, those looking for dividend income may also find ALLIANCEBERNSTEIN HOLDING L.P’s dividend attractive. It is important to note that this type of company may not be suitable for everyone, as it does not have the same potential for high returns as more aggressive investments. Furthermore, investors should also be aware of the company’s weak asset and profitability when deciding whether to invest in the company or not. Overall, ALLIANCEBERNSTEIN HOLDING L.P may be an attractive option to those looking for steady returns with moderate growth potential. Investors should carefully consider the company’s strengths and weaknesses before deciding to invest in it. More…

Peers

The company competes with WisdomTree Investments Inc, Ashmore Group PLC, and Onex Corporation. All four companies offer a wide range of investment products and services.

– WisdomTree Investments Inc ($NASDAQ:WETF)

Ashmore Group PLC is a United Kingdom-based investment management company. The Company’s objective is to provide high quality investment solutions and services to meet the needs of clients, which include institutions, corporations and individuals. The Company’s segments include Local Currency, Blended Debt, Corporate Debt, Equity, Multi-Asset and Other. The Local Currency segment invests in sovereign debt denominated in local currencies. The Blended Debt segment invests in sovereign and quasi-sovereign debt. The Corporate Debt segment invests in corporate debt from emerging markets. The Equity segment invests in stocks of companies in emerging markets. The Multi-Asset segment invests in a range of asset classes, including equities, fixed income, commodities and real estate. The Other segment includes the Company’s cash and cash equivalents.

– Ashmore Group PLC ($LSE:ASHM)

Onex Corporation is a private equity and investment management firm with a market cap of 5.84B as of 2022. The company has a Return on Equity of 5.95%. Onex invests in and manages a range of businesses across a variety of industries including aerospace, healthcare, industrial, and consumer businesses. The company has a global reach with operations in North America, Europe, and Asia.

Summary

AllianceBernstein Holding L.P. reported fourth quarter earnings that beat analyst expectations despite a 6% yearly decline in assets under management (AUM). Revenue for the quarter totaled $802.11 million, representing a drop from the prior year. Despite the decrease in AUM, the company managed to increase its operating income by 8% on a year-over-year basis. The company’s investments in technology, cost savings initiatives, and strategic acquisitions helped to cushion the blow of the lower AUM.

AllianceBernstein Holding L.P. is still well-positioned to capitalize on long-term growth opportunities through its strong balance sheet and diversified business mix. Going forward, investors should continue to monitor the company’s performance closely as it capitalizes on its investment themes and new partnerships.

Recent Posts