Affiliated Managers Reports Mixed Q4 Results, EPS Beats Expectations

May 2, 2023

Trending News 🌥️

Affiliated Managers ($NYSE:AMG) Group, Inc. (AMG), an asset management company, recently reported its fourth-quarter earnings results. The company’s non-GAAP earnings per share (EPS) of $4.18 exceeded expectations by $0.03, however the revenue of $517.4M fell short of expectations by $21.85M. AMG also provides clients with access to a variety of non-discretionary, discretionary and alternative investment strategies through its distribution and product platform. Moving forward, AMG is focused on expanding its network of affiliated firms and continuing to invest in new technologies and services to aid in its growth.

Price History

On Monday, Affiliated Managers reported mixed results for its fourth quarter earnings, with earnings per share (EPS) beating analyst expectations. The stock opened at $142.9 and closed the day at $145.1, a 0.5% increase from the previous closing price of $144.4. Despite the mixed results, the overall performance was seen as positive by investors, resulting in a modest stock increase. The company attributed the drop to a decrease in base fees and a rise in operating expenses.

Overall, Affiliated Managers reported a mixed fourth quarter performance, with EPS beating analyst expectations and net income declining year-over-year. Despite the mixed results, investors remained optimistic, resulting in a slight rise in the stock price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Affiliated Managers. More…

| Total Revenues | Net Income | Net Margin |

| 2.33k | 1.15k | 23.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Affiliated Managers. More…

| Operations | Investing | Financing |

| 1.05k | -109.9 | -1.4k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Affiliated Managers. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.88k | 4.24k | 90.23 |

Key Ratios Snapshot

Some of the financial key ratios for Affiliated Managers are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.3% | 4.9% | 79.9% |

| FCF Margin | ROE | ROA |

| 44.8% | 38.8% | 13.1% |

Analysis

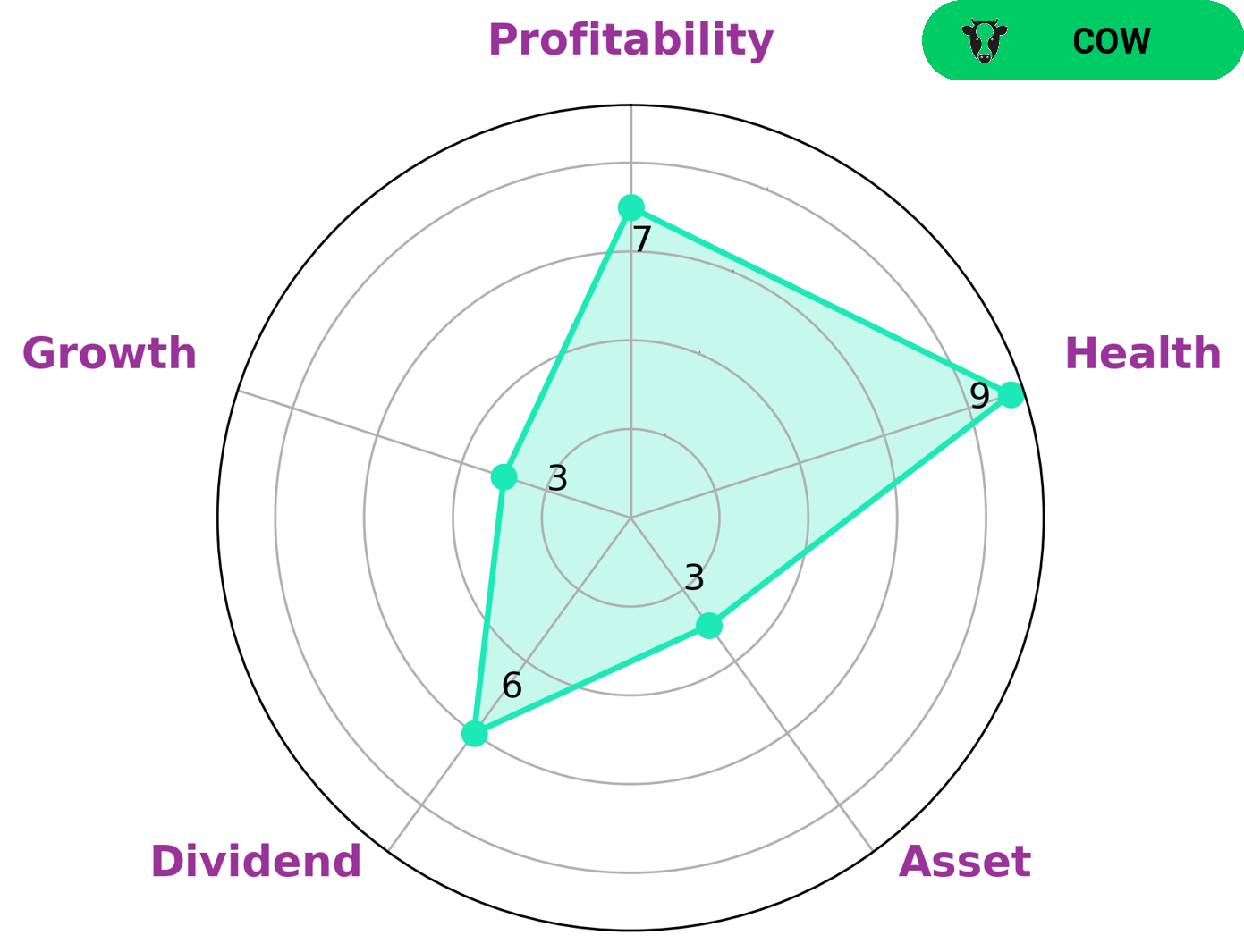

GoodWhale conducted an analysis of AFFILIATED MANAGERS and found that it is classified as a ‘cow’ according to the Star Chart. As such, AFFILIATED MANAGERS is a company that has the track record of paying out consistent and sustainable dividends. Investors seeking reliability in dividend yields may be interested in this company. GoodWhale also found that AFFILIATED MANAGERS has a high health score of 9 out of 10 with regard to its cashflows and debt, indicating that the company is capable of safely riding out any crisis without the risk of bankruptcy. Furthermore, the company is strong in profitability, medium in dividend and weak in asset and growth. This information, coupled with its reliable dividends, may be attractive to investors seeking a safe and reliable return on their investments. More…

Peers

Its competitors are BlackRock Inc, CI Financial Corp, and Pinnacle Investment Management Group Ltd.

– BlackRock Inc ($NYSE:BLK)

BlackRock Inc is a publicly traded company with a market capitalization of $90.05 billion as of early 2021. The company operates as an investment management firm and has a strong focus on exchange-traded funds (ETFs). As of early 2021, BlackRock managed nearly $8 trillion in assets on behalf of its clients. The company has a return on equity (ROE) of 12.63%.

BlackRock was founded in 1988 and has grown to become one of the largest asset managers in the world. The company is headquartered in New York City and has offices in dozens of countries around the globe. BlackRock serves a wide range of clients, including institutional investors, financial advisors, and individual investors.

– CI Financial Corp ($TSX:CIX)

As of 2022, CI Financial Corp has a market cap of 2.54B and a Return on Equity of 30.25%. The company is a leading provider of financial services in Canada, with a focus on asset management and wealth management. The company has a strong track record of delivering superior performance for its clients and shareholders.

– Pinnacle Investment Management Group Ltd ($ASX:PNI)

Pinnacle Investment Management Group Ltd is a global asset management firm with over $1.67 billion in assets under management. The company offers a wide range of investment products and services to institutional and retail investors across the globe. Pinnacle is headquartered in Sydney, Australia and has offices in London, New York, Hong Kong, and Singapore.

Summary

The company’s earnings and revenue were likely affected by the pandemic and financial market conditions which have impacted investments across the board. Despite the revenue miss, investors remain optimistic about AMG as the company remains well-positioned to benefit as markets continue to recover. Investors should keep an eye on the company’s future performance to get a better read on market trends.

Recent Posts