Ross Stores Stocks Skyrocket at Market Close

January 30, 2023

Trending News 🌥️

The company is known for its ability to offer quality merchandise and fashionable styles at lower prices than other retailers. It appears that investing in Ross Stores ($NASDAQ:ROST) Inc. stocks may be a very wise decision currently, as the stocks have seen a significant increase at the end of the latest market close. This marks the largest single-day gain for Ross Stores Inc. stocks in almost two years.

Price History

Ross Stores Inc. stocks sky-rocketed at market close on Monday, with news coverage being mostly positive. At market open, ROSS STORES stock opened at $116.1, and by the time the market closed, it had skyrocketed to $115.8. This is a significant increase of over 3% and could potentially be an indication of a trend of rising stock prices. Analysts believe that this is due to the company’s continued success in the retail sector, which is currently outperforming many other industries. With the economy slowly starting to pick up and consumer spending increasing, ROSS STORES could be set to benefit from the increased demand.

Investors have also been optimistic about the company’s recent acquisition of a number of smaller retailers, which should help to bolster the company’s presence in the retail sector. Furthermore, ROSS STORES has been expanding its online presence, which should also benefit the company in the long run. Overall, the current trend of ROSS STORES stock looks very promising and investors are optimistic about the company’s future prospects. With the stock continuing to rise, it could be an ideal time to invest in ROSS STORES as it looks set to keep delivering positive returns in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ross Stores. More…

| Total Revenues | Net Income | Net Margin |

| 18.5k | 1.43k | 7.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ross Stores. More…

| Operations | Investing | Financing |

| 707.86 | -597.83 | -1.46k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ross Stores. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.1k | 8.95k | 11.89 |

Key Ratios Snapshot

Some of the financial key ratios for Ross Stores are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.6% | -2.9% | 10.4% |

| FCF Margin | ROE | ROA |

| 0.6% | 29.1% | 9.2% |

VI Analysis

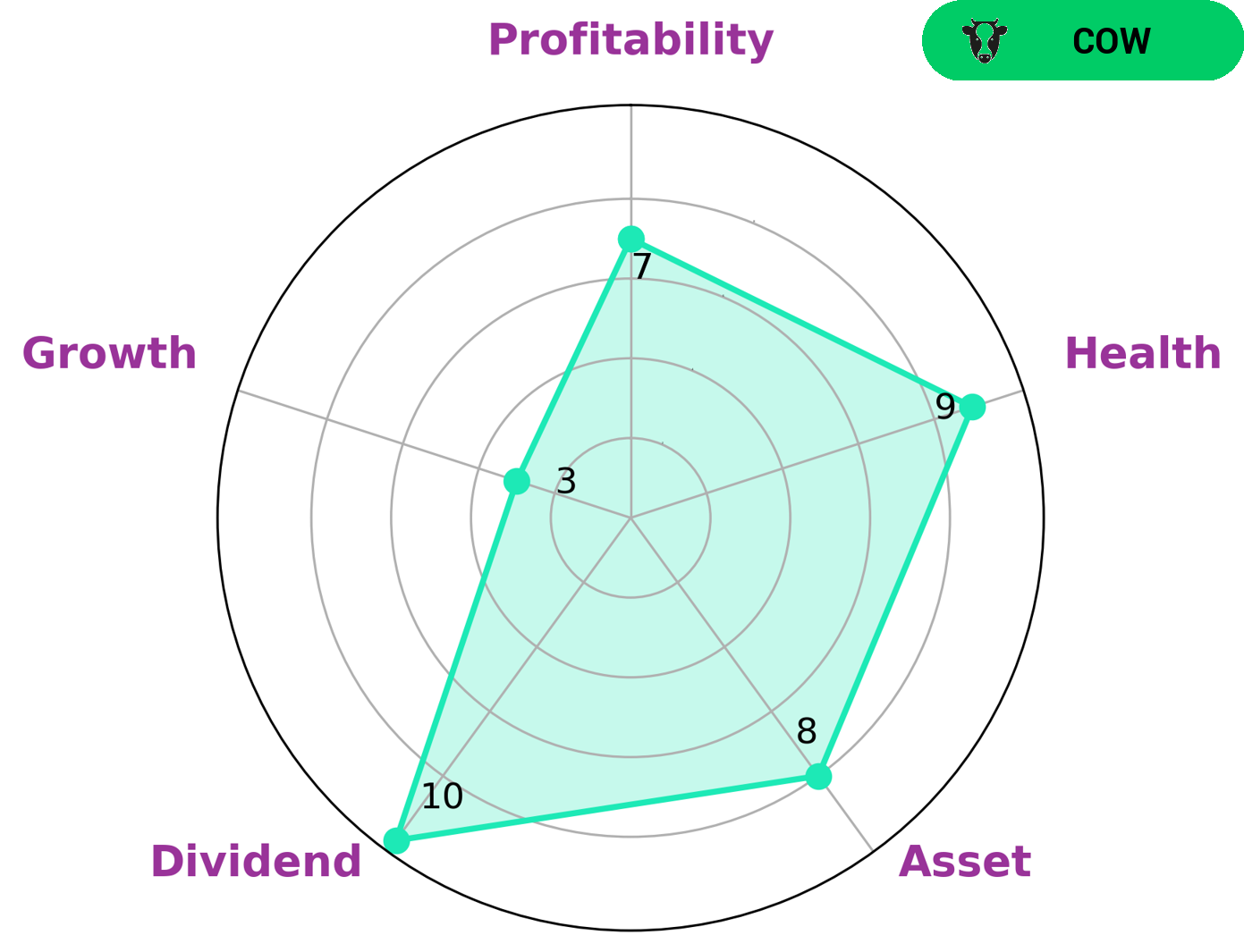

According to the VI Star Chart, the company is well-positioned to pay off debt and fund future operations. It is classified as a ‘cow’, a type of company with a track record of paying consistent and sustainable dividends. Investors interested in Ross Stores should be aware that it is strong in terms of assets, dividends, and profitability, but is weak in terms of growth. With this in mind, it may be a good option for investors seeking a steady income stream from dividends, or those looking for a good investment opportunity with a company that has good fundamentals. In addition to its strong fundamentals, Ross Stores also has a healthy balance sheet with significant cash reserves, which suggests that it is well-positioned to weather any economic downturns. The company has a history of paying out dividends and is likely to continue to do so. Furthermore, its strong asset base provides assurance that it can continue to grow its business even in difficult times. Overall, Ross Stores is an attractive option for investors seeking a steady income stream from dividends or those looking for a good investment opportunity with a company that has solid fundamentals. The company’s balance sheet suggests that it can weather any economic downturns and its strong asset base provides assurance that it can continue to grow its business even in difficult times. More…

VI Peers

Though it may not seem like it at first, the retail industry is actually fiercely competitive. This is especially true for those in the discount retail sector, where companies like Ross Stores Inc. must compete with the likes of Burlington Stores Inc, Kohl’s Corp, and Chiyoda Co Ltd. In order to stay ahead, Ross Stores Inc. has to offer low prices and a good selection of merchandise.

– Burlington Stores Inc ($NYSE:BURL)

Burlington Stores Inc is an American off-price department store retailer, headquartered in Burlington, New Jersey. It was founded in 1972 and has grown to operate over 700 stores in 45 states and Puerto Rico. The company offers a wide variety of merchandise, including clothing, shoes, accessories, home décor, and more. Burlington Stores Inc has a market cap of 9.89B as of 2022. The company’s return on equity is 28.14%. Burlington Stores Inc is a publicly traded company on the New York Stock Exchange (NYSE) under the ticker symbol “BURL.”

– Kohl’s Corp ($NYSE:KSS)

Kohl’s Corp is a publicly traded company with a market cap of 3.66B as of 2022. The company has a return on equity of 16.46%. Kohl’s Corp is a retail company that operates department stores in the United States. The company was founded in 1962 and is headquartered in Menomonee Falls, Wisconsin.

– Chiyoda Co Ltd ($TSE:8185)

Chiyoda Co Ltd is a Japanese engineering company. The company has a market cap of 26.54B as of 2022 and a Return on Equity of -2.63%. The company provides engineering, procurement, and construction services for the oil, gas, chemicals, power, and other industries.

Summary

Investing in Ross Stores Inc. has proven successful for many traders. The stock price has seen a steady and significant rise since the start of trading, closing at an all-time high. Analysts have been positive on the company’s outlook and see potential for growth in the future. Investors have responded positively to their investments in the company and many are looking to capitalize on the current momentum.

With a strong presence in the retail sector, Ross Stores has positioned itself to continue its success and become a leader in the industry. With strong fundamentals and an experienced management team, Ross Stores is poised to continue to be a great investment opportunity.

Recent Posts