ROSS STORES Reports Fourth Quarter Earnings Results For FY2023 on February 28 2023

March 12, 2023

Earnings Overview

On February 28 2023, ROSS STORES ($NASDAQ:ROST) announced their earnings results for the fourth quarter of FY2023, which ended on January 31 2023. Total revenue was USD 447.0 million, a 21.9% year-on-year increase. Reported net income amounted to USD 5214.2 million, reflecting a 3.9% rise compared to the same period in the previous year.

Transcripts Simplified

Ross Stores reported a 1% increase in comparable store sales for the quarter, driven by growth in average basket size. Operating margin of 10.7% was up 90 basis points from 9.8% in the prior year, due to higher merchandise margin, lower incentive compensation, and other cost savings. For fiscal 2023, the company is planning comparable store sales to be relatively flat, and earnings per share for the year to be in the range of $4.65 to $4.95. This guidance also includes an estimated benefit to earnings per share from the extra 53rd week.

Net interest income is estimated to be $115 million, and depreciation amortization expense including stock-based amortization is forecast to be about $570 million. The company plans to open approximately 100 new locations comprised of about 75 Ross and 25 dd’s DISCOUNTS for fiscal 2023.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ross Stores. More…

| Total Revenues | Net Income | Net Margin |

| 18.7k | 1.51k | 8.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ross Stores. More…

| Operations | Investing | Financing |

| 1.69k | -654.07 | -1.41k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ross Stores. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.42k | 9.13k | 12.03 |

Key Ratios Snapshot

Some of the financial key ratios for Ross Stores are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.2% | -2.5% | 10.6% |

| FCF Margin | ROE | ROA |

| 5.5% | 30.0% | 9.3% |

Price History

Company officials attributed the growth to strong sales in apparel and footwear, improved margins on merchandise, and cost controls. The company’s stock opened at $110.9 on Tuesday, but closed the day at $110.5, down by 0.3% from its previous closing price. The company’s Chief Financial Officer attributed the strong performance to strong same-store sales growth and efficient inventory management.

Overall, the financial performance of ROSS STORES in the fourth quarter of FY2023 was solid, and the company’s stock looks set to continue its upward trajectory in the coming months. Investors should keep a close eye on the company’s developments in order to determine if it is a good investment opportunity. Live Quote…

Analysis

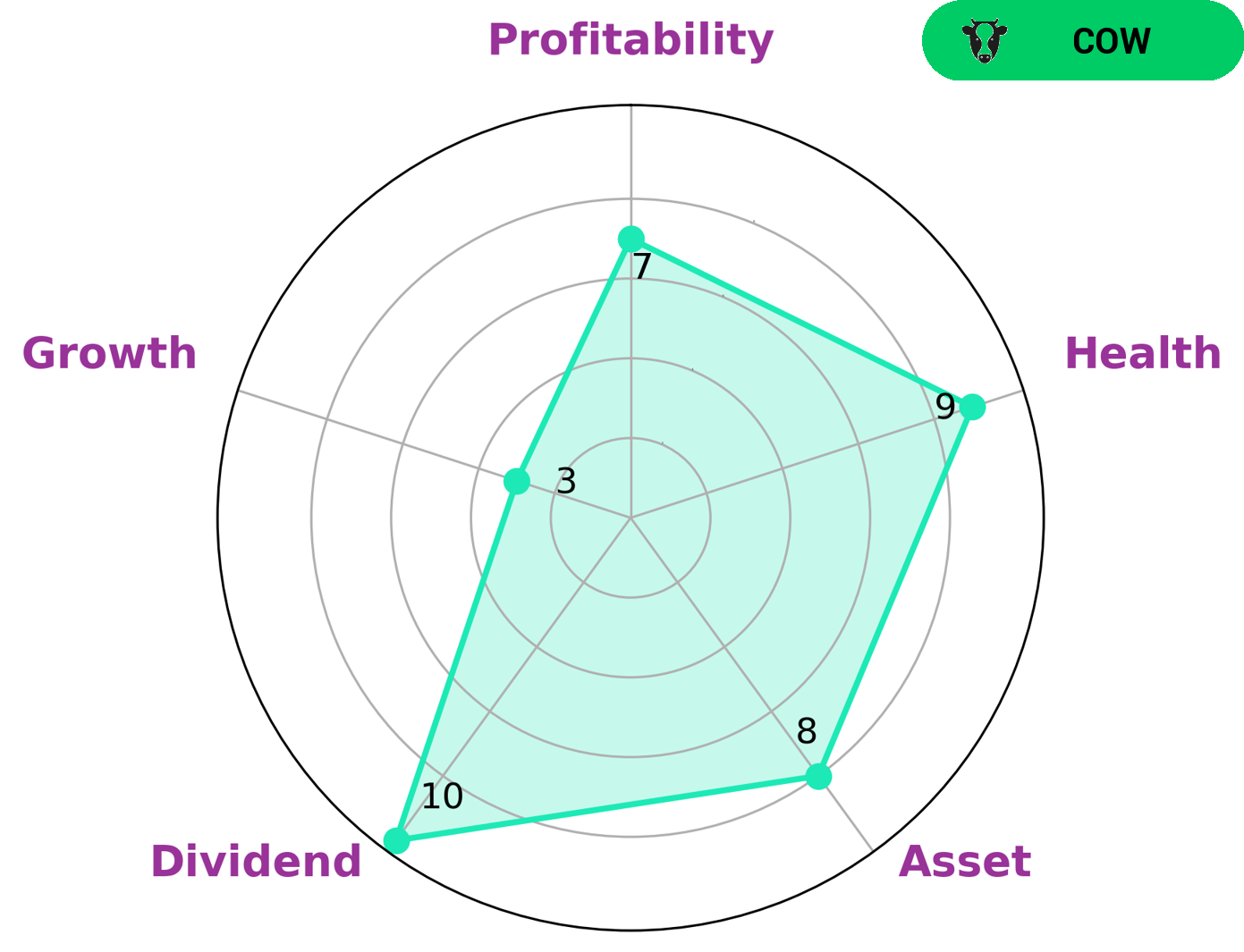

GoodWhale has conducted an analysis of ROSS STORES‘s fundamentals and based on our Star Chart, we’ve determined that the company has a high health score of 9/10. This score reflects the company’s capability to pay off debt and fund future operations. We would classify ROSS STORES as a ‘cow’, meaning that it has the track record of paying out consistent and sustainable dividends. ROSS STORES is strong in asset, dividend, and profitability, but weak in growth. This makes it a great investment for the more conservative investor, such as those looking for a steady income stream or those who are looking to diversify their portfolio with a reliable stock. ROSS STORES’s strong fundamentals also make it attractive to value investors who are looking for a good company at a reasonable price. More…

Peers

Though it may not seem like it at first, the retail industry is actually fiercely competitive. This is especially true for those in the discount retail sector, where companies like Ross Stores Inc. must compete with the likes of Burlington Stores Inc, Kohl’s Corp, and Chiyoda Co Ltd. In order to stay ahead, Ross Stores Inc. has to offer low prices and a good selection of merchandise.

– Burlington Stores Inc ($NYSE:BURL)

Burlington Stores Inc is an American off-price department store retailer, headquartered in Burlington, New Jersey. It was founded in 1972 and has grown to operate over 700 stores in 45 states and Puerto Rico. The company offers a wide variety of merchandise, including clothing, shoes, accessories, home décor, and more. Burlington Stores Inc has a market cap of 9.89B as of 2022. The company’s return on equity is 28.14%. Burlington Stores Inc is a publicly traded company on the New York Stock Exchange (NYSE) under the ticker symbol “BURL.”

– Kohl’s Corp ($NYSE:KSS)

Kohl’s Corp is a publicly traded company with a market cap of 3.66B as of 2022. The company has a return on equity of 16.46%. Kohl’s Corp is a retail company that operates department stores in the United States. The company was founded in 1962 and is headquartered in Menomonee Falls, Wisconsin.

– Chiyoda Co Ltd ($TSE:8185)

Chiyoda Co Ltd is a Japanese engineering company. The company has a market cap of 26.54B as of 2022 and a Return on Equity of -2.63%. The company provides engineering, procurement, and construction services for the oil, gas, chemicals, power, and other industries.

Summary

ROSS STORES reported impressive financial results for the fourth quarter of FY2023, with total revenue increasing 21.9% year over year to USD 447.0 million. Net income was also up 3.9% to USD 5214.2 million. The strong results reflect the company’s success in navigating the pandemic and indicate that ROSS STORES is well positioned for continued growth and value for investors.

Analysts are bullish on the company’s prospects, citing the growing demand for its discounted merchandise and robust online sales. Moving forward, ROSS STORES is expected to capitalize on the current market conditions and maintain its position as a leader in the retail industry.

Recent Posts