Premier Investments [ASX:PMV] Reaches All-Time High in 1HFY23 Sales!

March 31, 2023

Trending News ☀️

Premier Investments ($ASX:PMV) ASX:PMV is an Australian-based integrated retail investment company, listed on the Australian Securities Exchange. The company specialises in sourcing, developing and marketing apparel, footwear, and homewares via a portfolio of iconic brands such as Peter Alexander, Dotti, Smiggle and Portmans. The company recently announced record sales in the first half of Fiscal Year 23, reaching an all-time high. These results demonstrate the continued success of Premier Investments ASX:PMV, with the company delivering a solid financial performance in the first half of its fiscal year despite the turbulent economic conditions resulting from the pandemic.

Stock Price

Monday was a volatile day for PREMIER INVESTMENTS ASX:PMV as the stock opened at AU$25.9 but closed at AU$24.7, which was 2.5% lower than the last closing price of 25.3. Despite this small decline, the company’s 1HFY23 sales have hit an all-time high, indicating a promising outlook for the company despite the instability of the current market. The company’s shares have also seen steady growth since the beginning of the year and are currently trading at their highest level in recent months. With these positive results, investors are likely to remain confident in the long-term prospects of the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Premier Investments. More…

| Total Revenues | Net Income | Net Margin |

| 1.63k | 295.87 | 18.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Premier Investments. More…

| Operations | Investing | Financing |

| 395.05 | -20.79 | -370.56 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Premier Investments. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.44k | 647.11 | 11.28 |

Key Ratios Snapshot

Some of the financial key ratios for Premier Investments are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.3% | 29.1% | 25.1% |

| FCF Margin | ROE | ROA |

| 23.4% | 14.8% | 10.5% |

Analysis

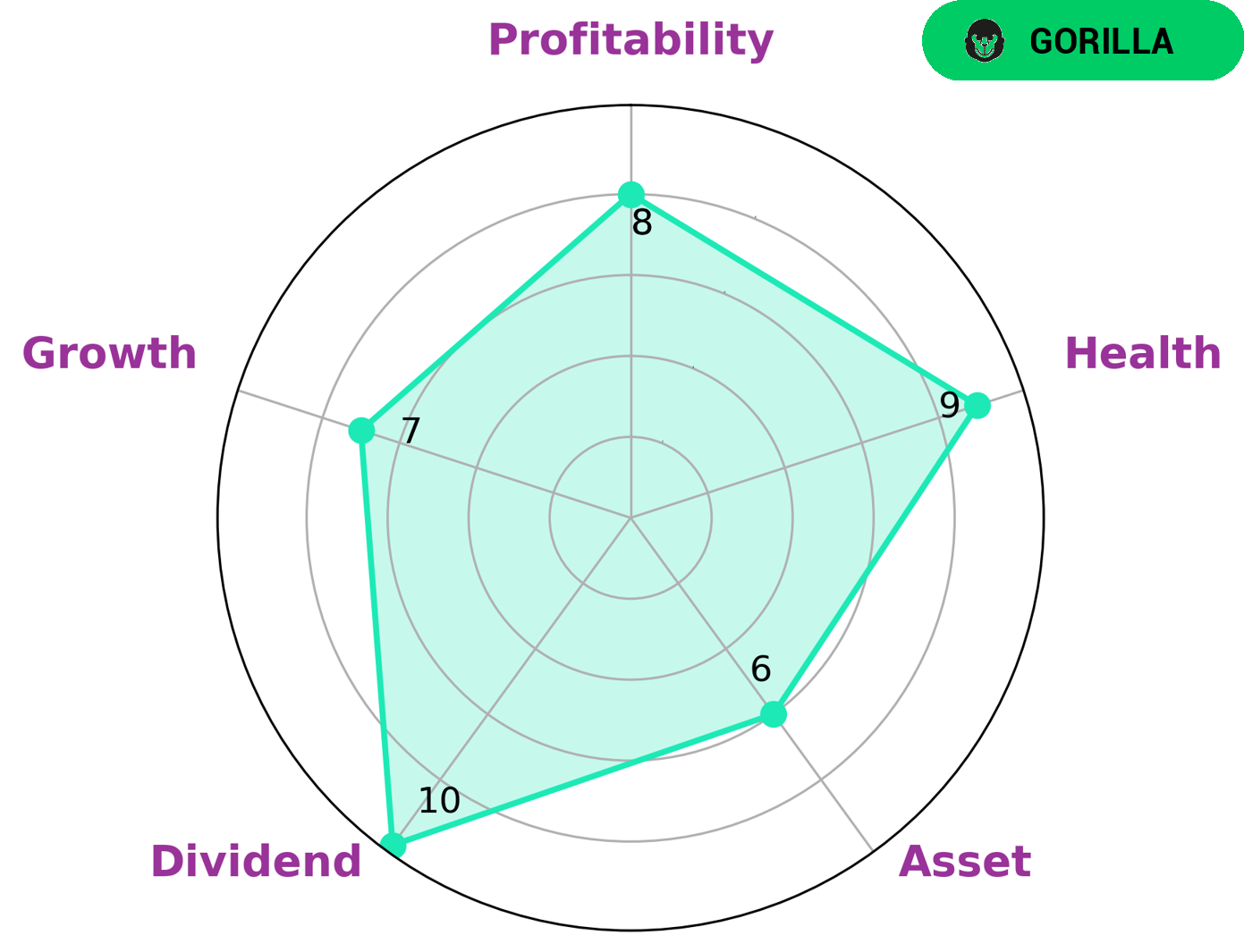

At GoodWhale, we conducted a financial analysis of PREMIER INVESTMENTS. According to our Star Chart, the company is strong in dividend, growth, and profitability, and medium in assets. We classified it as a ‘gorilla’, which is a type of company that achieved stable and high revenue or earning growth due to its strong competitive advantage. Given these qualities, PREMIER INVESTMENTS is likely to be an attractive option for long-term investors who either want stock appreciation or steady dividends. It also has a high health score of 9/10 when it comes to cashflow and debt, indicating that the company is capable of sustaining future operations in times of crisis. More…

Peers

Premier Investments Ltd is one of the largest retail and apparel companies in Australia. It operates several successful brands, including Smiggle, Peter Alexander, and Dotti. The company competes in the same market as other large Australian companies such as Moab Minerals Ltd, Best & Less Group holdings Ltd, and Super Retail Group Ltd. All of these companies are committed to providing quality products and services to their customers, making them formidable competitors in the retail market.

– Moab Minerals Ltd ($ASX:MOM)

Moab Minerals Ltd is a mining company that specializes in the extraction and production of minerals. The company has a market cap of 6.54M as of 2023, which is considered to be relatively small compared to many other large mining companies. The company also has a Return on Equity of -5.0%, which suggests that it is not performing well financially. Despite this, Moab Minerals Ltd still remains an important player in the minerals production industry and is positioned to capitalize on future market opportunities.

– Best & Less Group holdings Ltd ($ASX:BST)

Best & Less Group Holdings Ltd is a retail and fashion group based in Australia. The company is the parent company of the Best & Less, Best & Less Kids and Big W chains. As of 2023, the company has a market capitalization of 253.24M. The company is focused on providing quality products and services at competitive prices and strives to offer customers a wide range of fashion, homewares and footwear products. The company has a strong presence in the Australian market and continues to invest in expanding its product range and services.

– Super Retail Group Ltd ($ASX:SUL)

Super Retail Group Ltd is a leading retailer in Australia. It operates in a variety of retail sectors, including sporting and recreational goods, automotive parts and accessories, and outdoor lifestyle products. The company has a market cap of 2.51B as of 2023, making it a mid-sized player in the retail industry. Additionally, Super Retail Group Ltd has a Return on Equity (ROE) of 17.61%, indicating that the company has managed to generate a high return on the resources invested by its shareholders. This figure is well above the industry average, indicating that the company is an efficient and profitable operator.

Summary

Premier Investments (ASX:PMV) has achieved record-high sales in the first half of FY23. The increase reflects the company’s strong performance in its apparel business, as well as its increased focus on digital marketing and e-commerce sales. In terms of outlook, Premier Investments is expected to continue its strong financial performance in FY23, driven by both its existing business activities and efficiency improvements. Overall, the results show that Premier Investments remains a great investment opportunity for long-term investors.

Recent Posts