Lululemon Athletica Stock Intrinsic Value – Lululemon to Create 2,600 Jobs in Vancouver Following Immigration Exemption

May 27, 2023

Trending News ☀️

Lululemon Athletica ($NASDAQ:LULU) is a publicly traded apparel company based in Vancouver, Canada. It’s known for its premium-quality yoga and athletic apparel for men and women. Following the Canadian government’s decision to exempt the company from certain immigration rules, Lululemon has announced that it will be expanding its headquarters in Vancouver. The exemption of immigration rules means that Lululemon will no longer be required to reach a certain threshold of job creation in order to bring in foreign workers. This change in policy has allowed Lululemon to expand its operations in Vancouver and provide more job opportunities for local residents.

The expansion of Lululemon’s headquarters is expected to have a positive impact on the Vancouver economy. The influx of jobs created by the company is likely to stimulate economic growth in the city, providing much needed employment and support to the local community. This news is sure to be welcomed by job seekers in the area and is sure to provide them with stable employment and a greater sense of financial security going forward.

Market Price

On Friday, LULULEMON ATHLETICA opened its stock at $342.3 and closed at $340.3, a decrease of 0.6% from last closing price. This is a major development for Lululemon in Vancouver, as the additional jobs will provide the city’s economy with a major boost. Additionally, the new positions will likely help diversify the existing job market and aid in reducing the city’s unemployment rate. The move is likely to be welcomed by the city’s residents as it provides them with more opportunities for employment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lululemon Athletica. More…

| Total Revenues | Net Income | Net Margin |

| 8.11k | 854.8 | 13.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lululemon Athletica. More…

| Operations | Investing | Financing |

| 966.46 | -569.94 | -467.49 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lululemon Athletica. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.61k | 2.46k | 23.83 |

Key Ratios Snapshot

Some of the financial key ratios for Lululemon Athletica are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 26.8% | 24.7% | 21.3% |

| FCF Margin | ROE | ROA |

| 4.0% | 34.9% | 19.2% |

Analysis – Lululemon Athletica Stock Intrinsic Value

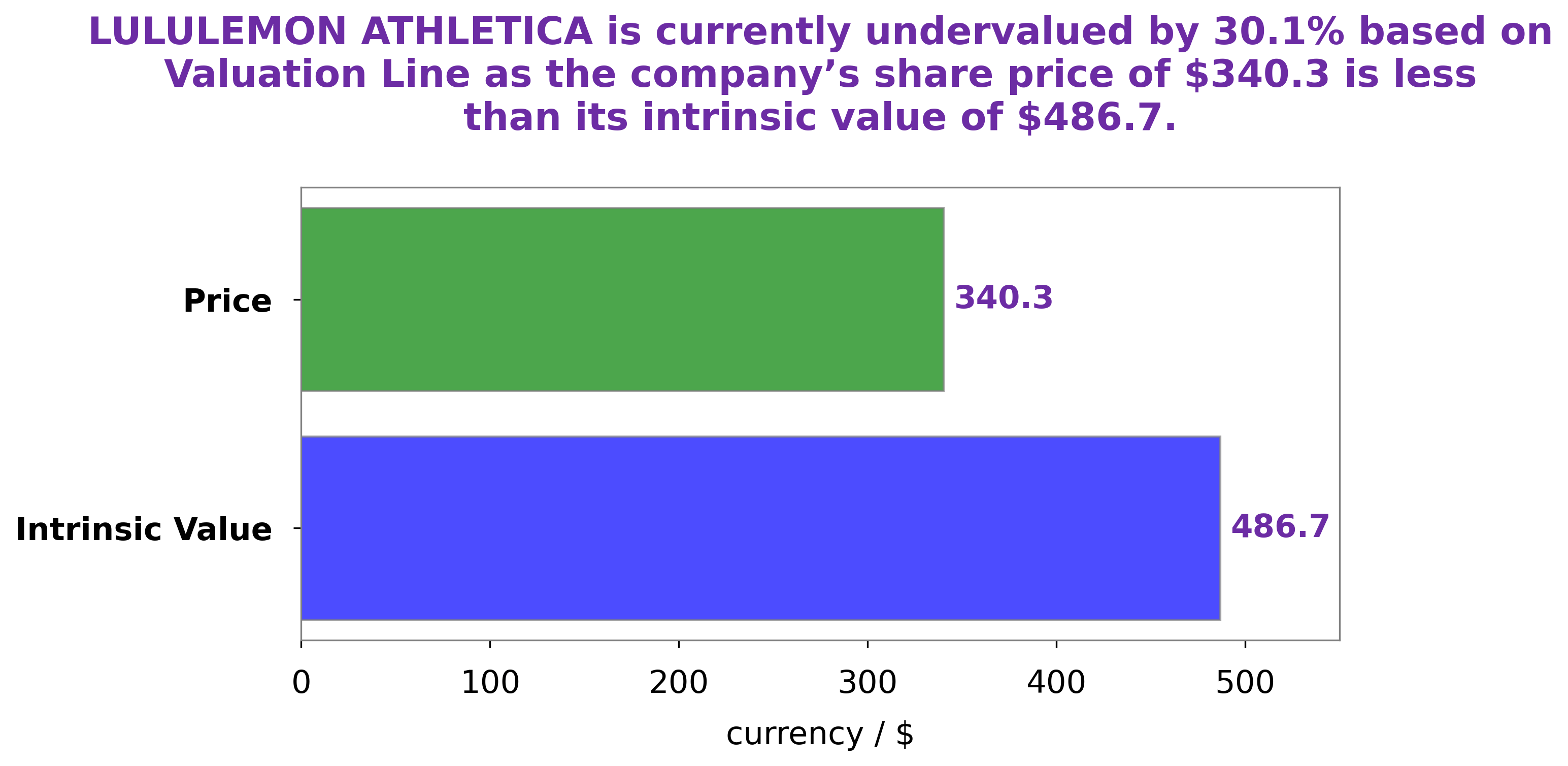

At GoodWhale, we’ve conducted an analysis of the fundamentals of LULULEMON ATHLETICA. Through our proprietary Valuation Line, which takes into account a range of factors such as price-to-earnings ratio, free cash flow, and return on equity, we have determined the fair value of a LULULEMON ATHLETICA share to be around $486.7. Currently, LULULEMON ATHLETICA stock is trading at $340.3, which means that it is undervalued by 30.1%. This presents investors with a great opportunity to invest in a company with strong fundamentals and an attractive valuation. We believe that now is a good time to buy and take advantage of the potential upside of this stock. More…

Peers

Lululemon Athletica Inc is a yoga-inspired, technical athletic apparel company for women. The company operates in the United States, Canada, and Australia. Lululemon Athletica Inc’s main competitors are Buckle Inc, Citi Trends Inc, and Tilly’s Inc.

– Buckle Inc ($NYSE:BKE)

Buckle Inc is a leading retailer of casual apparel, footwear, and accessories for young men and women in the United States. As of 2022, the company has a market capitalization of 1.77 billion dollars and a return on equity of 55.65%. Buckle Inc operates over 450 stores in 44 states across the country, and offers its products through its website and catalog. The company’s mission is to provide great fashion at a great value for its customers.

– Citi Trends Inc ($NASDAQ:CTRN)

Citi Trends Inc is a value-priced retailer of urban fashion apparel, accessories and home décor. The company operates over 600 stores in 31 states. Citi Trends’ mission is to be the largest and most convenient source of trend-right fashion at the right price for our target demographic of urban youth.

– Tilly’s Inc ($NYSE:TLYS)

Tilly’s Inc is a company that operates in the retail industry. The company has a market cap of 239.38M as of 2022 and a return on equity of 19.35%. The company operates through two segments: stores and e-commerce. The company offers a variety of products including apparel, footwear, and accessories for men, women, and children. The company operates stores in California, Arizona, Nevada, and Texas.

Summary

Lululemon Athletica Inc. is an attractive investment opportunity given its strong financial performance in recent years. With strong brand recognition and a strong commitment to providing quality athleisure apparel, Lululemon Athletica offers investors a reliable growth opportunity.

Recent Posts