GAP Reports Third Quarter Earnings Results for FY2024

November 28, 2023

🌥️Earnings Overview

GAP ($NYSE:GPS) reported their earnings results for the third quarter of FY2024, ending October 31 2023, on November 16 2023. Their total revenue for the quarter was USD 3767.0 million, a 6.7% drop from the same period last year. Additionally, their net income declined with a 22.7% decrease from the previous year, amounting to USD 218.0 million.

Price History

The earnings report showed that GAP stock opened at $13.8 and closed at $13.7, down by 2.8% from its last closing price of 14.1. This indicates that GAP is managing its inventory efficiently and effectively and is in good shape going into the fourth quarter and beyond. Overall, the earnings report for GAP was positive and encouraging. Despite the slight drop in stock price, GAP is in a strong financial position and is well-positioned to continue to drive growth and success throughout the rest of the year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gap. More…

| Total Revenues | Net Income | Net Margin |

| 14.83k | 44 | 0.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gap. More…

| Operations | Investing | Financing |

| 1.55k | -311 | -570 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gap. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.05k | 8.59k | 6.12 |

Key Ratios Snapshot

Some of the financial key ratios for Gap are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.8% | -15.9% | 2.2% |

| FCF Margin | ROE | ROA |

| 7.8% | 9.1% | 1.9% |

Analysis

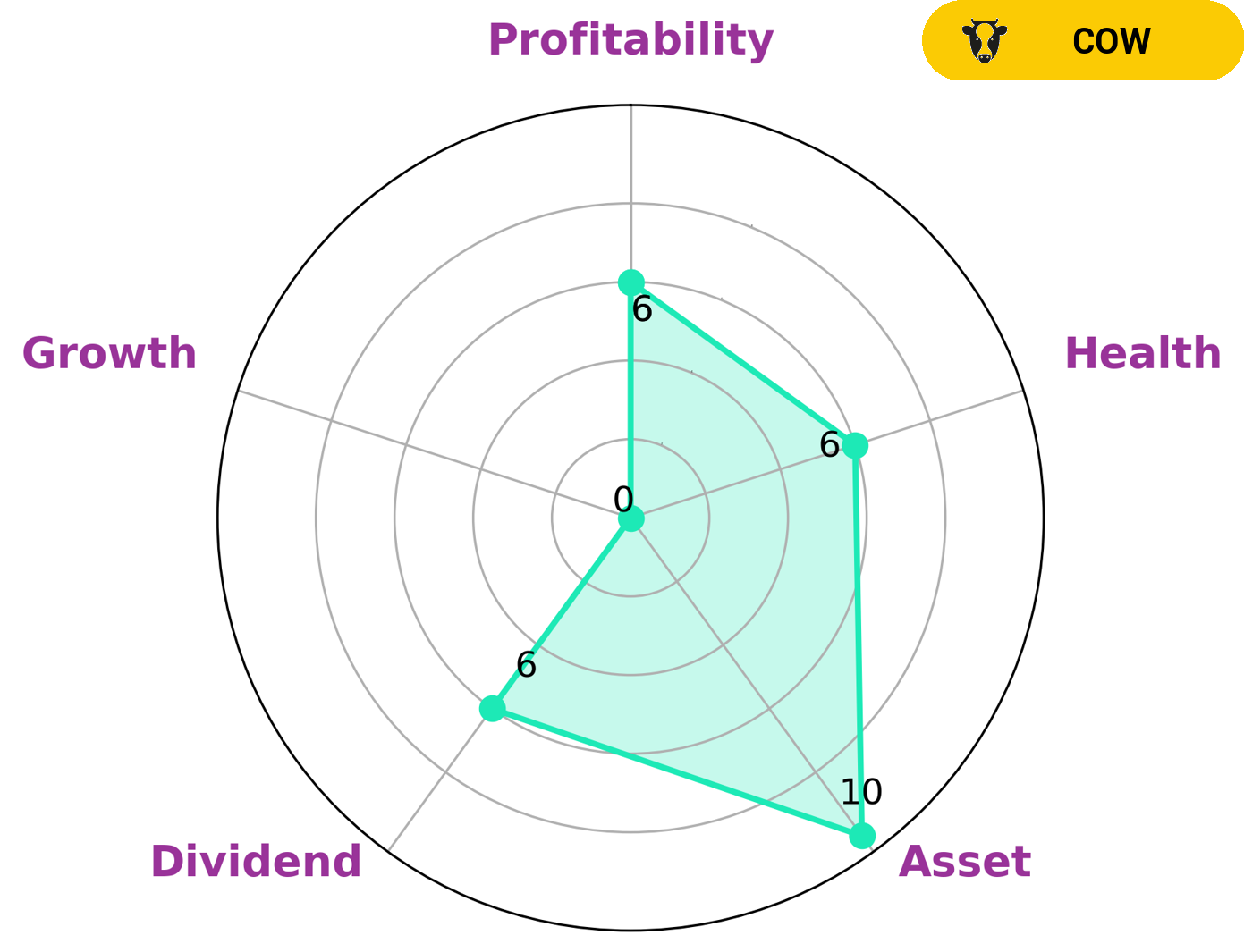

GoodWhale has conducted an analysis of GAP‘s fundamentals and found that GAP has a strong asset base and an intermediate health score of 6/10 considering its cashflows and debt. This indicates that it is likely to be able to pay off debt and fund future operations. According to our Star Chart, GAP is medium in dividend, profitability and weak in growth. On this basis, GAP is classified as a ‘cow’, a type of company we conclude that has the track record of paying out consistent and sustainable dividends. This type of company may be of interest to dividend investors, value investors, or those seeking to build a diversified portfolio. More…

Peers

Gap Inc. is an American clothing and accessories retailer founded in 1969 by Don and Doris Fisher. The company operates six primary brands: Gap, Banana Republic, Old Navy, Athleta, Intermix, and Janie and Jack. Gap Inc. is headquartered in San Francisco, California. As of February 2019, Gap Inc. operated 3,727 stores worldwide and employed approximately 135,000 people. Abercrombie & Fitch Co. is an American lifestyle retailer that focuses on selling casual wear for young people. The company was founded in 1892 by David T. Abercrombie and Ezra Fitch and is headquartered in New Albany, Ohio. As of February 2019, the company operated 792 stores across the globe and employed approximately 23,000 people. The Children’s Place Inc. is an American children’s clothing retailer founded in 1969. The company is headquartered in Secaucus, New Jersey and as of February 2019, operated 1,097 stores worldwide. The company employs approximately 19,000 people. World Co Ltd is a Japanese retail company founded in 1949. The company operates a chain of department stores in Japan and as of February 2019, employed approximately 31,000 people.

– Abercrombie & Fitch Co ($NYSE:ANF)

Abercrombie & Fitch Co, a leading retailer of casual apparel, has a market cap of 817.96M as of 2022. The company’s ROE is 14.85%. Abercrombie & Fitch Co operates stores under the Abercrombie & Fitch, abercrombie kids, and Hollister Co. banners in the United States and internationally. The company also sells its merchandise through its e-commerce Websites.

– Children’s Place Inc ($NASDAQ:PLCE)

The Children’s Place Inc is a publicly traded company with a market capitalization of $498.72 million as of 2022. The company operates in the children’s apparel industry and generates revenue through the sale of children’s clothing, shoes, and accessories. The Children’s Place Inc has a return on equity of 55.72%. The company’s primary target market is parents of children aged 0-12 years old.

– World Co Ltd ($TSE:3612)

Suntech Power Holdings Co., Ltd. is a solar company. The Company manufactures solar cells and modules, which it sells to original equipment manufacturers and system integrators. Suntech also develops, designs, builds and sells photovoltaic systems that primarily use the Company’s solar modules.

Summary

GAP reported their third quarter earnings for FY2024, ending October 31 2023, on November 16 2023. Total revenue decreased by 6.7%, coming in at USD 3767.0 million, while net income decreased by 22.7%, coming in at USD 218.0 million. This is a concerning result for investors, indicating a decrease in overall profitability from the same period last year. Analysts will need to further investigate the company’s financials to better understand what caused this decrease in revenue and income, and determine whether it is likely to continue in the future.

Recent Posts