Foot Locker stock dividend – Foot Locker Inc Announces 0.4 Cash Dividend

April 9, 2023

Dividends Yield

On April 1 2023, Foot Locker ($NYSE:FL) Inc announced a 0.4 cash dividend of 1.6 US dollars per share. This marks the third time in three years that FOOT LOCKER has issued dividends. For investors interested in dividend stocks, FOOT LOCKER could be an attractive option. This dividend will provide investors with a good way to earn passive income from their investments.

Share Price

On Monday, Foot Locker Inc, a American footwear and apparel retailer, announced a quarterly cash dividend of $0.4 per share. This news sent the stock soaring, with the opening price of $40.0 and closing at $41.4, up 4.4% from the previous closing price of $39.7. This spike in share price reflects investor optimism in Foot Locker’s growth prospects and its potential to return shareholder capital through dividends. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Foot Locker. More…

| Total Revenues | Net Income | Net Margin |

| 8.76k | 342 | 4.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Foot Locker. More…

| Operations | Investing | Financing |

| 136 | -1.38k | -152 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Foot Locker. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.91k | 4.61k | 34.85 |

Key Ratios Snapshot

Some of the financial key ratios for Foot Locker are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.0% | -0.8% | 6.2% |

| FCF Margin | ROE | ROA |

| -1.8% | 10.4% | 4.3% |

Analysis

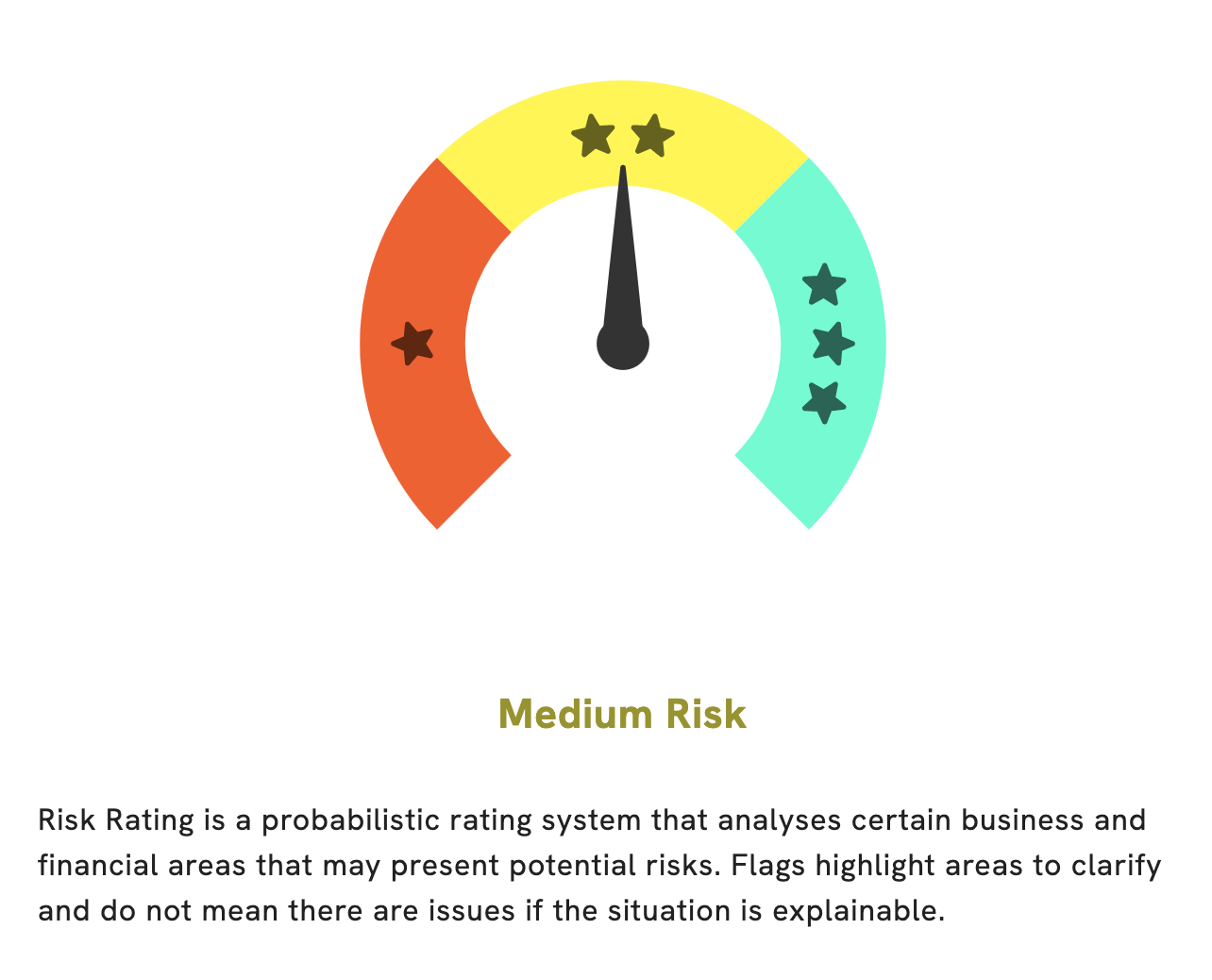

At GoodWhale, we have conducted a thorough analysis of FOOT LOCKER‘s financials and have determined that it is a medium risk investment, especially in terms of financial and business aspects. We have also identified two risk warning signals in their balance sheet and cash flow statement, and would encourage potential investors to register with us to review the signals in detail. Our detailed risk assessment provides a comprehensive overview of FOOT LOCKER’s financial performance and helps investors make informed decisions. More…

Peers

The company operates in more than 20 countries and has over 3,500 stores. Its main competitors are Zumiez Inc, Abercrombie & Fitch Co, and TJX Companies Inc.

– Zumiez Inc ($NASDAQ:ZUMZ)

Zumiez is a publicly traded company with a market capitalization of 398.36 million as of 2022. The company has a return on equity of 16.06%. Zumiez is a specialty retailer of apparel, footwear, and accessories for young men and women. The company operates over 800 stores in the United States, Canada, and Europe.

– Abercrombie & Fitch Co ($NYSE:ANF)

Abercrombie & Fitch Co is an American lifestyle retailer that focuses on casual wear for young consumers. The company operates through three segments: Domestic, International, and Direct-to-Consumer. As of 2022, Abercrombie & Fitch Co had a market capitalization of 816.97 million and a return on equity of 14.85%. The company’s domestic segment includes stores in the United States and Puerto Rico. The international segment consists of stores in Europe, Asia, Canada, Mexico, and the Middle East. The Direct-to-Consumer segment includes e-commerce operations in the United States and international markets.

– TJX Companies Inc ($NYSE:TJX)

The TJX Companies, Inc. is an American multinational off-price department store chain, based in Framingham, Massachusetts. It operates TJ Maxx, Marshalls, HomeGoods, Sierra Trading Post, and HomeSense stores in the United States; Winners, HomeSense, and Marshalls stores in Canada; T.K. Maxx stores in the United Kingdom, Ireland, Germany, Poland, Austria, and the Netherlands; and Trade Secret stores in Australia.

Summary

Foot Locker has proven to be an attractive investment opportunity, with a steady dividend yield of 5.16% over the last two years. This yield is above the historical average and provides investors with a reliable source of income. Foot Locker’s dividend history is backed by strong sales performance, as evidenced by its positive earnings per share and rising share price.

In addition, Foot Locker’s financials remain strong, with strong cash flow and balance sheet metrics. Investors can therefore expect Foot Locker to continue to be a reliable long-term investment, providing steady returns and dividend income.

Recent Posts