Citi Trends Intrinsic Value – CITI TRENDS Reports Earnings Results for Fourth Quarter of FY2023

March 30, 2023

Earnings Overview

CITI TRENDS ($NASDAQ:CTRN) released the earnings results for their fourth quarter of FY2023 on March 21 2023. Revenue totaled USD 6.6 million, showing a decrease of 32.5% compared to the same quarter of the prior year. Net income dropped 13.1% year over year, amounting to USD 209.5 million.

Transcripts Simplified

CFO: Good morning everyone and welcome to the third quarter earnings call for Citi Trends. This was a result of our ongoing investments in technology and customer experience, including launching a new website earlier this year, which enabled customers to shop for products across multiple channels. Looking ahead, we remain focused on driving top line growth through innovative marketing strategies and targeted customer engagement. We believe these initiatives will continue to build on our success and position us for continued success in the fourth quarter and beyond.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Citi Trends. More…

| Total Revenues | Net Income | Net Margin |

| 795.01 | 58.89 | 1.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Citi Trends. More…

| Operations | Investing | Financing |

| -3.59 | -29.52 | -118.19 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Citi Trends. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 544.26 | 377.81 | 18.96 |

Key Ratios Snapshot

Some of the financial key ratios for Citi Trends are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.6% | -16.1% | 9.6% |

| FCF Margin | ROE | ROA |

| -4.0% | 30.1% | 8.8% |

Market Price

The stock opened at $20.4 and closed at $21.0, which was a 10.0% drop from the last closing price of 23.3. This marked a decrease in profitability for the company, as their earnings per share had previously been higher. This brings the company’s total losses for the year to $2 billion. Despite these troubling numbers, CITI TRENDS has still managed to remain profitable and keep its customer base loyal.

The company has also stated that it will be implementing strategies to increase its profitability in the upcoming quarters and will be looking at new ways to cut costs. With a few changes in their operations, it appears that CITI TRENDS is hoping to turn things around and get back to seeing higher profits in the near future. Live Quote…

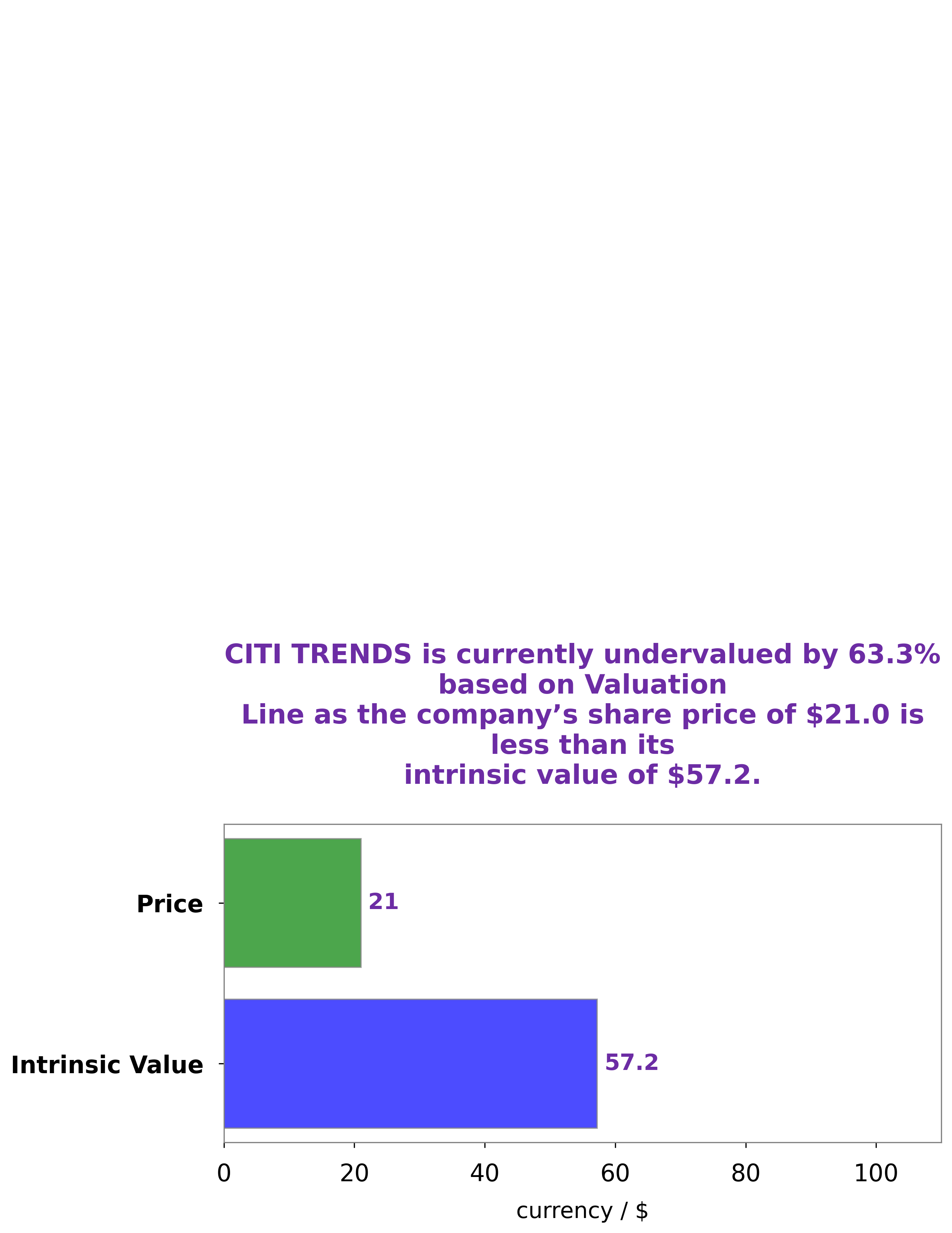

Analysis – Citi Trends Intrinsic Value

At GoodWhale, we recently conducted an analysis of CITI TRENDS‘s wellbeing. By using our proprietary Valuation Line, we were able to determine the intrinsic value of CITI TRENDS share to be around $57.2. Currently, the stock is being traded at $21.0, which is substantially lower than its true worth, making it a prime opportunity for investors who are looking to capitalize on an undervalued stock. This means that the stock is currently undervalued by 63.3%, making it an attractive option for potential investors. More…

Peers

There is stiff competition among Citi Trends Inc and its competitors PreVu Inc, Buckle Inc, and Vedant Fashions Ltd. All four companies are vying for a share of the market for affordable trendy clothing. Citi Trends Inc has an advantage in that it has over 500 stores in 31 states, while its competitors have fewer stores. However, all four companies are comparable in terms of the quality of their clothing and the prices they charge.

– PreVu Inc ($OTCPK:PRVU)

PreVu Inc is a provider of marketing solutions. The company has a market cap of 159.57k as of 2022 and a return on equity of 20.12%. The company offers a variety of marketing services, including content marketing, social media marketing, and email marketing. The company also provides a variety of tools and resources to help businesses with their marketing needs.

– Buckle Inc ($NYSE:BKE)

Buckle Inc is a leading retailer of apparel and accessories for young men and women in the United States. The company has a market capitalization of 1.77 billion as of 2022 and a return on equity of 55.65%. Buckle Inc operates over 450 stores in 44 states under the Buckle, BKE, and MKL brand names. The company offers a wide variety of clothing, footwear, and accessories for both men and women. Buckle Inc has a strong online presence and offers free shipping on orders over $100. The company is headquartered in Kearney, Nebraska.

– Vedant Fashions Ltd ($BSE:543463)

Vedant Fashions Ltd is an Indian fashion retailer that is based in Mumbai. The company has a market cap of 340.01B as of 2022 and a Return on Equity of 38.43%. The company was founded in 1984 and operates a chain of stores across India. It offers a wide range of products such as clothing, accessories, and home furnishings. The company also has an online store that ships to various international locations.

Summary

Investors were disappointed by CITI TRENDS‘ FY2023 fourth quarter earnings results, which reported a 32.5% decrease in revenue and a 13.1% decline in net income compared to the same quarter in the previous year. Consequently, the stock price dropped on the same day. In light of this news, investors should assess the company’s current financial position and future outlook before deciding whether to invest in this firm. Furthermore, they should also compare CITI TRENDS against its competitors and consider economic factors that may affect the company’s performance in the future.

Recent Posts