AEO Stock Fair Value Calculation – American Eagle Outfitters AEO Flourishes with Cost-Reduction Efforts, Aerie Strength & Robust Online Show.

May 17, 2023

Trending News ☀️

The company’s success is backed by a number of cost-saving initiatives and the strength of the Aerie brand, as well as a robust online presence. The slogan “Real Power Real Growth” is the driving force behind the company’s success and will likely continue to contribute to their increasing profits. With the implementation of cost-saving measures, such as reducing inventory and optimizing processes, AEO has been able to significantly reduce their expenses. This has contributed to their financial success, enabling them to invest capital into their stores and Aerie brand. AEO has also been able to capitalize on their strong online presence.

With this powerful online platform, AEO has been able to expand their reach and attract more customers than ever before. Overall, American Eagle Outfitters ($NYSE:AEO) Inc. (AEO) has been experiencing a period of rapid growth due to its cost-saving initiatives, Aerie strength, and robust online presence. With the motto “Real Power Real Growth” driving its success, AEO looks forward to continuing its upward trajectory for many years to come.

Price History

American Eagle Outfitters Inc. (AEO) has been successful in their efforts to reduce costs and have seen a strong performance from their Aerie brand. This performance is bolstered by their robust online show. On Monday, AEO’s stock opened at $13.0 and closed at $12.9, down by 0.5% from the previous closing price of $13.0. Cost-reduction efforts have allowed the company to become more efficient in their operations and better manage expenses. This has allowed AEO to improve their bottom line and reinvest back into their business.

The Aerie brand has been a stellar performer for the company as customers are continuously responding to its cozy, comfortable and affordable apparel. Moreover, their online show has seen strong growth with a focus on e-commerce and digital capabilities. American Eagle Outfitters’ portfolio of brands have allowed them to reach their customers in different ways and in different markets around the world. The company continues to make investments into its infrastructure and digital capabilities to ensure that it remains successful in the ever-changing retail landscape. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AEO. More…

| Total Revenues | Net Income | Net Margin |

| 4.99k | 125.14 | 2.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AEO. More…

| Operations | Investing | Financing |

| 406.3 | -261.38 | -407.89 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AEO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.42k | 1.82k | 8.2 |

Key Ratios Snapshot

Some of the financial key ratios for AEO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.0% | -5.0% | 5.2% |

| FCF Margin | ROE | ROA |

| 2.9% | 10.5% | 4.7% |

Analysis – AEO Stock Fair Value Calculation

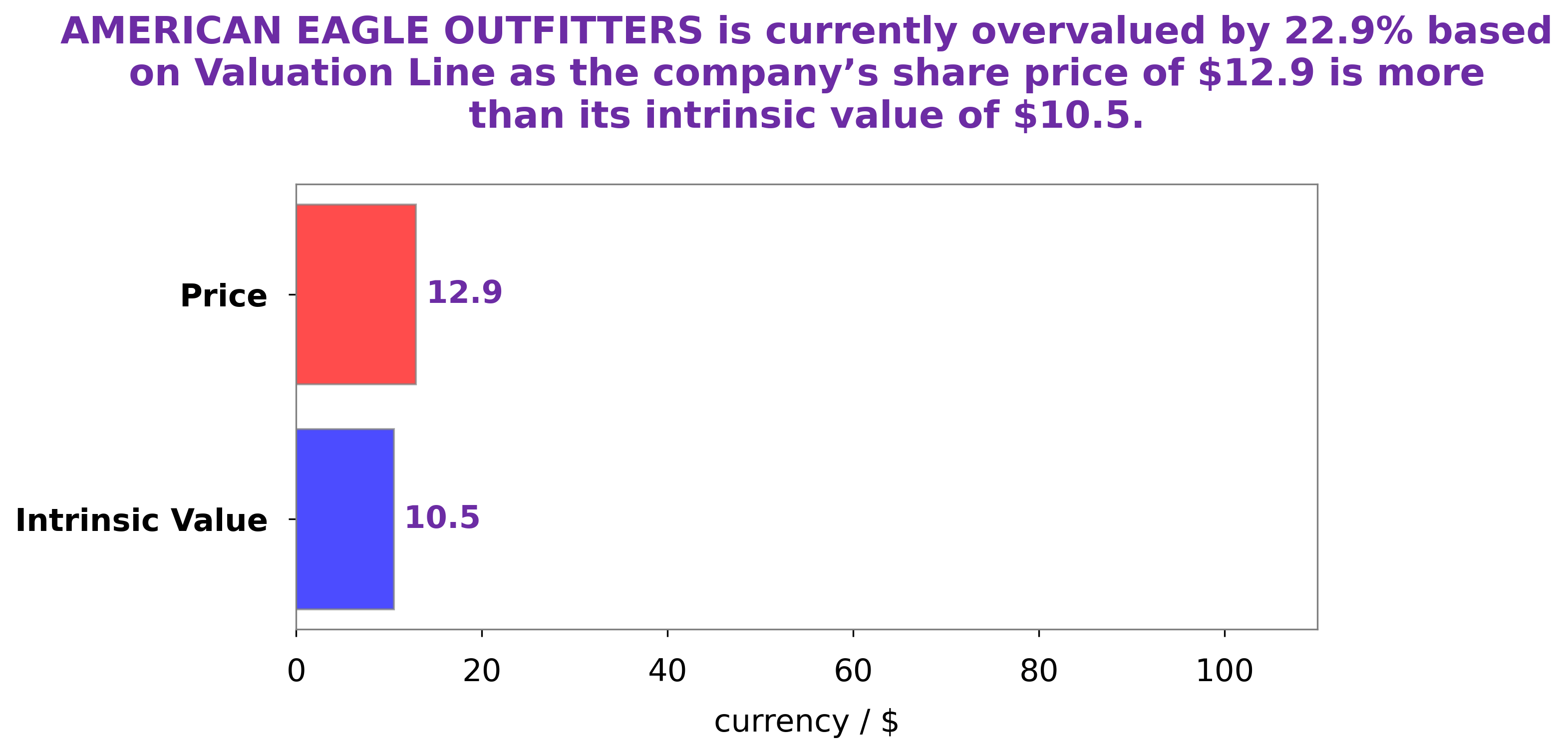

At GoodWhale, we analyze the wellbeing of AMERICAN EAGLE OUTFITTERS through our proprietary metrics. According to our findings, the intrinsic value of AMERICAN EAGLE OUTFITTERS share is estimated to be around $10.5. This value was calculated using our Valuation Line, which takes into account various factors such as the company’s financial performance, assets, liabilities, market trends, and more. Currently, AMERICAN EAGLE OUTFITTERS’ stock is being traded at $12.9, which is 23.4% higher than its intrinsic value. This makes it an overvalued security and may not be a good investment for the long term. More…

Peers

American Eagle Outfitters Inc competes with Roots Corp, Aritzia Inc, and Zumiez Inc. for market share in the clothing retail industry. All four companies offer a variety of clothing and accessories for men, women, and children, but American Eagle Outfitters Inc has a few key differentiators. First, American Eagle Outfitters Inc operates more than 1,000 stores in the United States, compared to Roots Corp’s 85 stores, Aritzia Inc’s 97 stores, and Zumiez Inc’s 741 stores. Second, American Eagle Outfitters Inc’s product mix includes a larger proportion of private label merchandise than its competitors, which allows the company to control cost and maintain higher profit margins.

– Roots Corp ($TSX:ROOT)

Roots Corp is a Canadian retailer that specializes in selling outdoor lifestyle clothing and accessories. The company was founded in 1973 and today operates more than 120 stores across Canada. In addition to its retail stores, Roots also operates an online store and sells its products through wholesale channels.

Roots Corp has a market cap of 115.97M as of 2022. The company’s ROE for the same year is 12.62%.

– Aritzia Inc ($TSX:ATZ)

Aritzia Inc. is a Canadian women’s fashion retailer founded in 1984. The company operates over 80 stores across Canada and the United States under eight different banners. Aritzia offers a wide range of women’s clothing, accessories, and beauty products. The company has a market cap of 5.72B as of 2022 and a return on equity of 31.82%.

– Zumiez Inc ($NASDAQ:ZUMZ)

Zumiez Inc is a publicly traded company with a market capitalization of 407.32M as of 2022. The company has a strong return on equity of 16.06% and is involved in the retail industry. Zumiez Inc operates stores that sell apparel, footwear, and accessories for young men and women. The company’s focus is on action sports, such as skateboarding, snowboarding, and motocross.

Summary

American Eagle Outfitters’ (AEO) investment prospects look promising due to their effective cost-reduction and expansion efforts. The company has seen notable success in its Aerie brand and online sales, giving investors reason for optimism. AEO is looking to capitalize on the long-term investments made in its digital platform, which should lead to increased profitability as the platform continues to mature. Additionally, the company’s strong balance sheet, combined with its well-positioned portfolio of brands and strategic investments, provides a solid foundation for growth.

Recent Posts