Under Armour Intrinsic Value – Raymond James Financial Services Advisors Cuts Stake in Under Armour, by 12842 Shares

November 7, 2023

🌥️Trending News

Under Armour ($NYSE:UAA), Inc. recently saw a large decrease in its amount of shares held by Raymond James Financial Services Advisors Inc. The investment firm sold off 12842 of Under Armour’s shares, leaving the company with fewer assets than before. It is best known for its performance apparel, footwear, and accessories, including its signature moisture-wicking fabric that helps athletes stay dry and comfortable while performing. The company has continued to expand its product lines and distribution channels, resulting in an impressive global presence. In addition to its core product lines, Under Armour has become a leader in the development of digital fitness products, services, and experiences.

With its suite of digital offerings, the company is striving to inspire athletes and provide them with the tools they need to reach their performance goals. Through its innovative products and marketing campaigns, Under Armour continues to be a leader in the athletic apparel space.

Market Price

This marks a 2.2% decrease in the company’s ownership stake. Following the announcement, Under Armour’s stock opened at $7.3 and closed at $7.1, a drop from its prior closing price of $7.3. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Under Armour. More…

| Total Revenues | Net Income | Net Margin |

| 5.87k | 387.64 | 6.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Under Armour. More…

| Operations | Investing | Financing |

| -96.38 | -146.64 | -103.25 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Under Armour. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.87k | 2.86k | 4.51 |

Key Ratios Snapshot

Some of the financial key ratios for Under Armour are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.9% | 6.5% | 4.6% |

| FCF Margin | ROE | ROA |

| -4.9% | 8.4% | 3.5% |

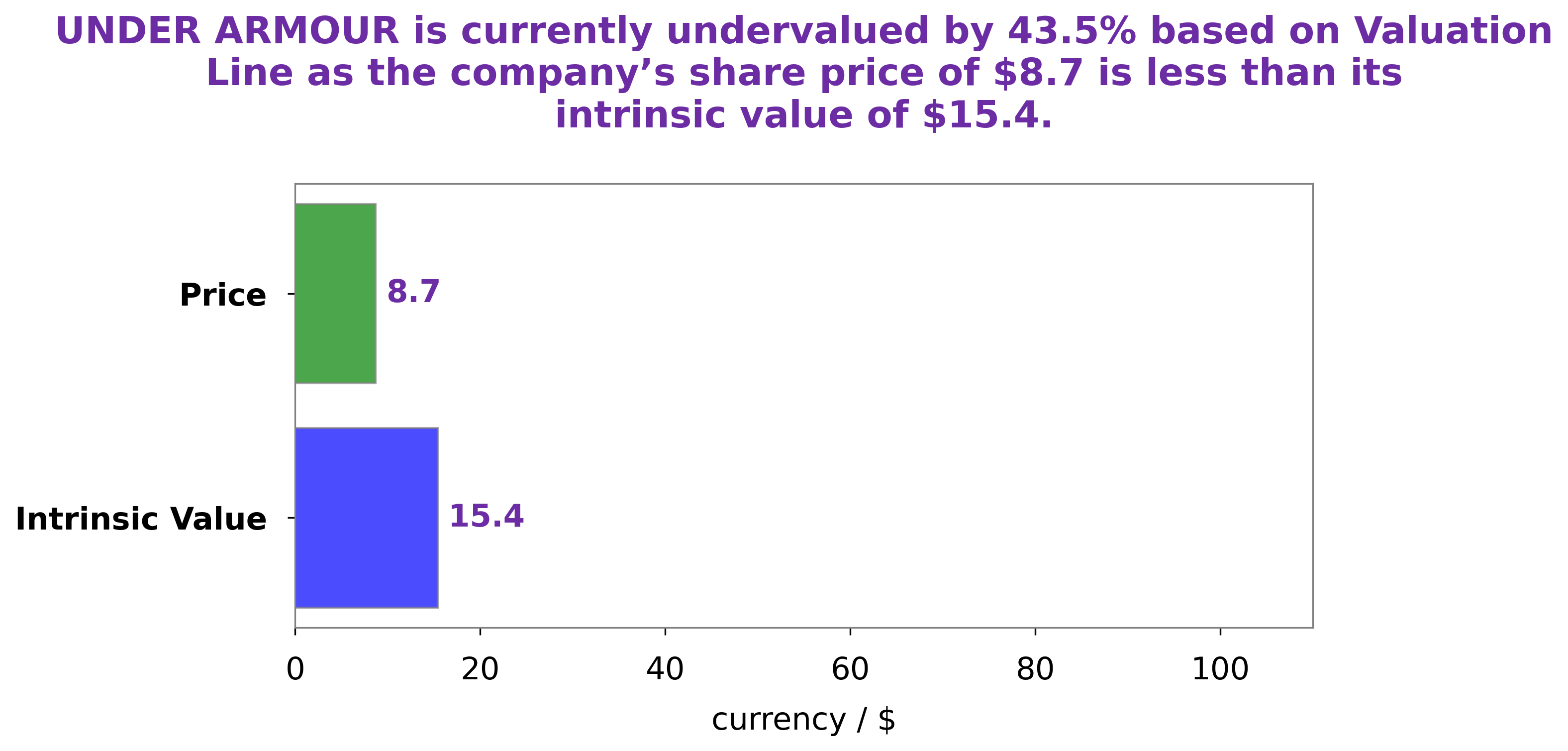

Analysis – Under Armour Intrinsic Value

At GoodWhale, we recently conducted an analysis of Under Armour’s fundamentals. We found that the intrinsic value of Under Armour’s share is around $15.6, which was calculated using our proprietary Valuation Line. As of now, Under Armour stock is traded at $7.1, which implies that it is significantly undervalued by 54.5%. This provides a great opportunity for savvy investors to buy Under Armour’s stock at a good price. More…

Peers

Under Armour, Inc. is an American company that manufactures footwear, sports, and casual apparel. Founded in 1996 by Kevin Plank, a former University of Maryland football player, Under Armour is the second-largest sportswear manufacturer in the United States. UA’s competitors include Nike, Lululemon Athletica, and Capri Holdings.

– Nike Inc ($NYSE:NKE)

Nike Inc is a publicly traded company with a market capitalization of 137.7 billion as of 2022. The company has a return on equity of 25.1%. Nike is a designer, manufacturer, and marketer of athletic footwear, apparel, equipment, and accessories. The company’s products are sold in over 190 countries worldwide. Nike has endorsement deals with some of the world’s most popular athletes, including LeBron James, Cristiano Ronaldo, and Tiger Woods.

– Lululemon Athletica Inc ($NASDAQ:LULU)

Lululemon Athletica Inc. is a Canadian athletic apparel retailer. The company was founded in 1998 by Chip Wilson and is headquartered in Vancouver, British Columbia. Lululemon Athletica Inc. designs, manufactures and markets athletic apparel and accessories for women, men and girls. The company’s product line includes pants, shorts, tops, jackets, hoodies, and accessories such as bags, socks, and headwear. Lululemon Athletica Inc. also operates a website and provides online shopping services. As of 2022, the company’s market cap is $37.96 billion and its ROE is 34.51%.

– Capri Holdings Ltd ($NYSE:CPRI)

Capri Holdings Ltd is a fashion company with a market cap of 5.96B as of 2022. The company has a Return on Equity of 25.1%. Capri Holdings Ltd is a luxury fashion company that owns and operates a portfolio of iconic fashion brands, including Michael Kors, Versace, and Jimmy Choo. The company’s brands are available in more than 100 countries through a network of company-operated stores, licensed stores, and e-commerce sites.

Summary

Under Armour, Inc. is a popular sportswear and equipment company, and it has been the subject of recent investment analysis. Raymond James Financial Services Advisors Inc. recently sold 12842 shares of Under Armour, Inc., suggesting a potential shift in opinion on the company. Analysts point to the long-term growth potential of the company as an attractive option for investors. Its innovative products and successful marketing campaigns have resulted in increased sales, and its presence in international markets has provided great opportunities for expansion.

However, analysts are cautious about Under Armour’s high marketing expenses and brand concentration, which have the potential to reduce profitability. Nevertheless, with a strong portfolio of brands and a focus on long-term growth, there’s potential for investors interested in Under Armour to make gains.

Recent Posts