Hanesbrands Inc Stock Intrinsic Value – Citigroup Cuts Stake in Hanesbrands as Analysts Await Earnings Results

June 12, 2023

🌧️Trending News

The company designs, manufactures, sources, and sells apparel and intimate apparel products under renowned brands such as Hanes, Champion, and Playtex. Its products are sold through major retailers, department stores, national chains, catalogs, mass merchants, and e-commerce sites. In an unprecedented move, Citigroup Inc. recently cut its stake in Hanesbrands Inc ($NYSE:HBI). by 31.8% during the fourth quarter. This move has raised several questions from analysts who are now awaiting the company’s earnings results to determine the actual impact of Citigroup’s withdrawal from the stock.

However, the recent decline in Citigroup’s stake could lead to a decline in investor confidence and a lower stock price for the company. Analysts will be keenly monitoring Hanesbrands Inc.’s upcoming earnings results to gage the impact of this move by Citigroup Inc. If the earnings report fails to meet market expectations, it could result in further drops in the stock price of Hanesbrands Inc., potentially jeopardizing investors’ returns. On the other hand, if the company posts strong earnings results, then it could offset the impact of Citigroup’s recent withdrawal. It remains to be seen how the market will react to the company’s earnings release and what impact it will have on Hanesbrands Inc.’s share prices.

Earnings

Citigroup Inc. recently announced that it had cut its stake in HANESBRANDS INC, leaving analysts to await the company’s earnings results of Q1 2021. The results of the report, dated March 31 2021, showed that HANESBRANDS INC earned a total revenue of 1508.03M USD and lost 263.26M USD in net income. This marked a 4.3% decrease in total revenue and a 321.8% decrease in net income compared to the previous year.

Over the last three years, HANESBRANDS INC’s total revenue has declined from 1508.03M USD to 1389.41M USD. The company’s financial performance for the quarter is sure to be closely monitored by investors as they determine the future of the stock.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hanesbrands Inc. More…

| Total Revenues | Net Income | Net Margin |

| 6.05k | -280.31 | -4.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hanesbrands Inc. More…

| Operations | Investing | Financing |

| -83.08 | -192.14 | 164.08 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hanesbrands Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.43k | 6.09k | 0.97 |

Key Ratios Snapshot

Some of the financial key ratios for Hanesbrands Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.3% | -19.3% | 6.3% |

| FCF Margin | ROE | ROA |

| -5.0% | 64.9% | 3.7% |

Stock Price

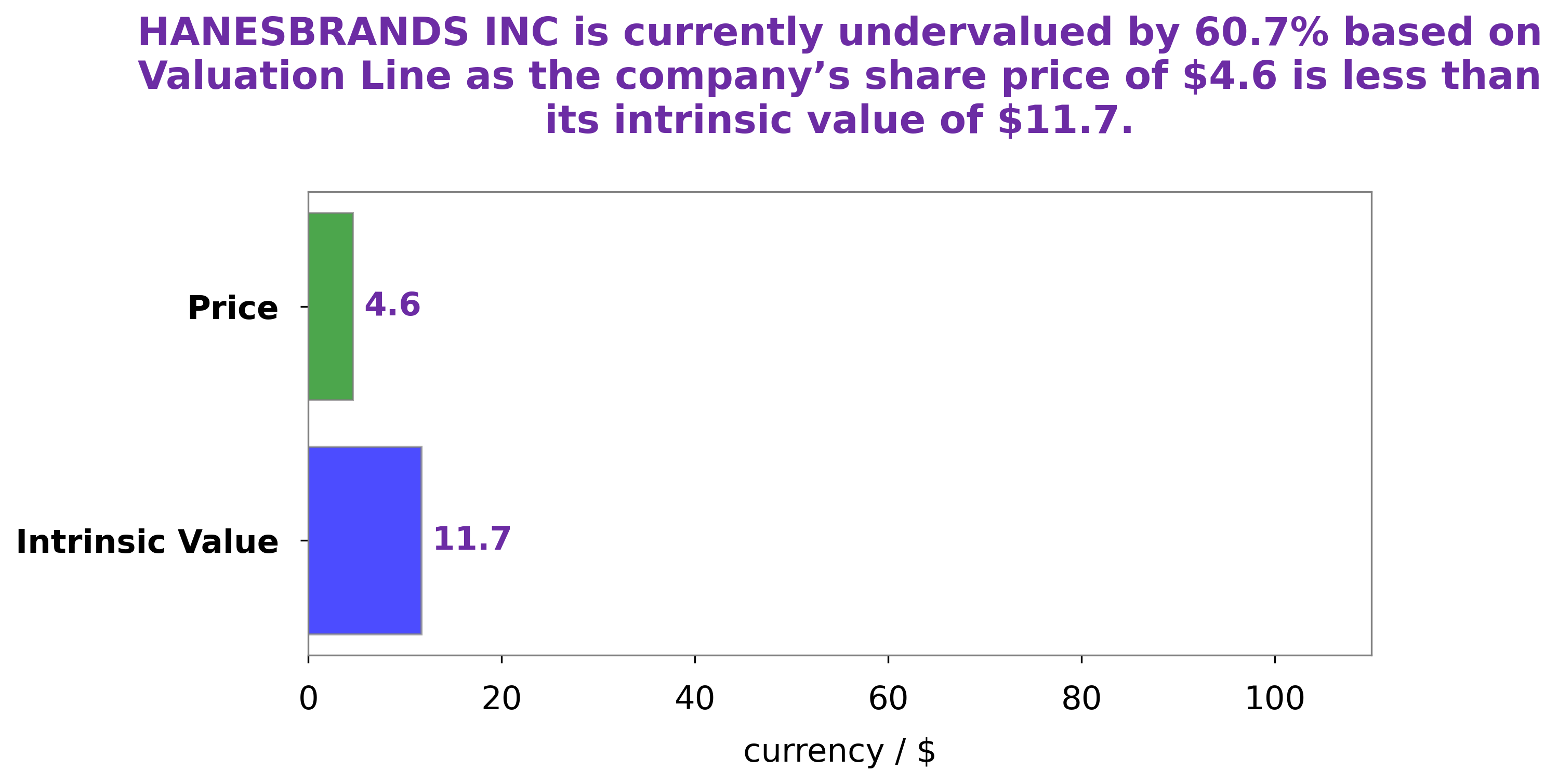

The stock of HANESBRANDS INC opened at $4.6 and closed at the same price on Thursday. It remains to be seen how HANESBRANDS INC will fare in the upcoming earnings report. Analysts remain optimistic about the company’s performance, given its wide portfolio of products and strong market presence. Any positive news from the earnings results would undoubtedly be welcomed by investors and shareholders alike. Live Quote…

Analysis – Hanesbrands Inc Stock Intrinsic Value

At GoodWhale, we use our proprietary Valuation Line to provide an in-depth analysis of the fundamentals of HANESBRANDS INC. Through our analysis, we calculated the intrinsic value of the HANESBRANDS INC share to be around $11.7. This means that the stock is currently undervalued by 60.8%, as it is traded at $4.6. If you are looking to make a good investment, HANESBRANDS INC is a good option as you can benefit from its strong potential for growth. More…

Peers

Hanesbrands Inc is an American clothing company with a range of clothing products including underwear, socks, and t-shirts. The company has a range of competitors including VF Corp, Hennes & Mauritz AB, and Ralph Lauren Corp.

– VF Corp ($NYSE:VFC)

VF Corporation is an American multinational clothing and footwear company founded in 1899 and headquartered in Greensboro, North Carolina. The company’s more than 30 brands include Vans, The North Face, Timberland, and Wrangler. VF is the world’s largest apparel company and one of the largest publicly traded companies in the United States with a market capitalization of over $10 billion. The company’s return on equity is 22.53%.

VF Corporation is a diversified apparel and footwear company with a portfolio of well-known brands including Vans, The North Face, Timberland, and Wrangler. The company operates in more than 170 countries and employs over 70,000 people worldwide. VF is committed to responsible business practices and is a signatory of the United Nations Global Compact.

– Hennes & Mauritz AB ($OTCPK:HNNMY)

H&M is a leading global fashion company with around 52,000 employees. The company’s business concept is to offer fashion and quality at the best price in a sustainable way. H&M has been listed on Nasdaq Stockholm since 1974.

– Ralph Lauren Corp ($NYSE:RL)

Ralph Lauren Corp is a company that focuses on the design and production of high-quality clothing and accessories. The company has a market cap of 6.28B as of 2022 and a return on equity of 19.37%. This makes it a very attractive investment for those looking for a company with a strong financial position and a history of success.

Summary

Investors are watching Hanesbrands Inc closely as Citigroup Inc. recently decreased its stake in the company by 31.8% in the fourth quarter. Analysts are anticipating when the company will release their upcoming earnings results, which could guide future investing decisions. As of now, investors are keeping an eye on Hanesbrands Inc and making decisions to minimize risks and maximize profits. With the latest news of Citigroup Inc. reducing its stake, it is uncertain how this will affect the stock in the near future.

Recent Posts