G-III APPAREL Reports Fourth Quarter Fiscal Year 2023 Earnings Results on March 16 2023.

March 30, 2023

Earnings Overview

On March 16 2023, G-III APPAREL ($NASDAQ:GIII) announced its earnings results for the fourth quarter of fiscal year 2023, which ended on January 31 2023. Total revenue for the period declined drastically by 639.2%, compared to the same quarter in the previous year, amounting to USD -261.1 million. Despite this, the company’s net income rose 14.2%, reaching USD 854.4 million.

Transcripts Simplified

G-III Apparel Group, Ltd. Today’s conference is being recorded. At this time, I’d like to turn the conference over to Morris Goldfarb, Chairman and CEO of G-III Apparel Group. Please go ahead, sir. Although we were early to recognize and act upon the implications of the virus, it was impossible to fully anticipate the degree to which it would negatively impact our business. In response to the pandemic, we moved quickly to reduce costs, adjust our inventory positions and preserve cash. As a result, we are in a strong financial position and are well-positioned to capitalize on growth opportunities as the situation evolves. I will now review our financial performance for the quarter. The decrease was driven by the retail closures due to the pandemic and a decrease in sales from wholesale customers that have been affected by the pandemic. The combination of our strong balance sheet and liquidity position has enabled us to continue to pay our employees, support our customers and take advantage of growth opportunities in this changing environment. I will now turn it over to Dennis Sands, our Chief Financial Officer, who will provide additional color on our financials. Dennis? Dennis Sands Thanks Morris and good afternoon everyone. As Morris mentioned, during this quarter, we took significant and proactive steps to reduce costs and strengthen our liquidity position in response to the pandemic. In summary, our second quarter results reflect significant impacts from the pandemic on our business.

However, we are pleased with our progress to date in managing through these challenging times and remain cautiously optimistic about the future as we look forward to the back half of the year.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for G-iii Apparel. More…

| Total Revenues | Net Income | Net Margin |

| 3.23k | -133.06 | 6.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for G-iii Apparel. More…

| Operations | Investing | Financing |

| -214.14 | -51.51 | -23.44 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for G-iii Apparel. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.71k | 1.33k | 34.16 |

Key Ratios Snapshot

Some of the financial key ratios for G-iii Apparel are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.7% | -0.9% | -2.5% |

| FCF Margin | ROE | ROA |

| -7.3% | -3.1% | -1.9% |

Market Price

On the day of the release, G-III APPAREL stock opened at $14.0 and closed at $15.3, down by 1.3% from its previous closing price of $15.5. This drop in share price indicates that investors may be concerned about the company’s long-term growth prospects. Over the past several years, the company has been focusing on introducing new product lines, such as outerwear, dresses, swimwear and handbags, to meet customer needs and trends. Overall, G-III APPAREL’s fourth quarter results were in line with expectations and the company’s guidance was maintained.

The company is confident that the current year will provide more growth opportunities, thanks to the introduction of new product lines and its ongoing efforts to build market presence around the globe. As the company continues to expand its product offerings and sustain its strong market presence, it is expected to report higher earnings in the coming quarters. Investors should keep a close eye on G-III APPAREL’s stock performance in the coming weeks to gauge the sentiment of the market and make their own investment decisions. Live Quote…

Analysis

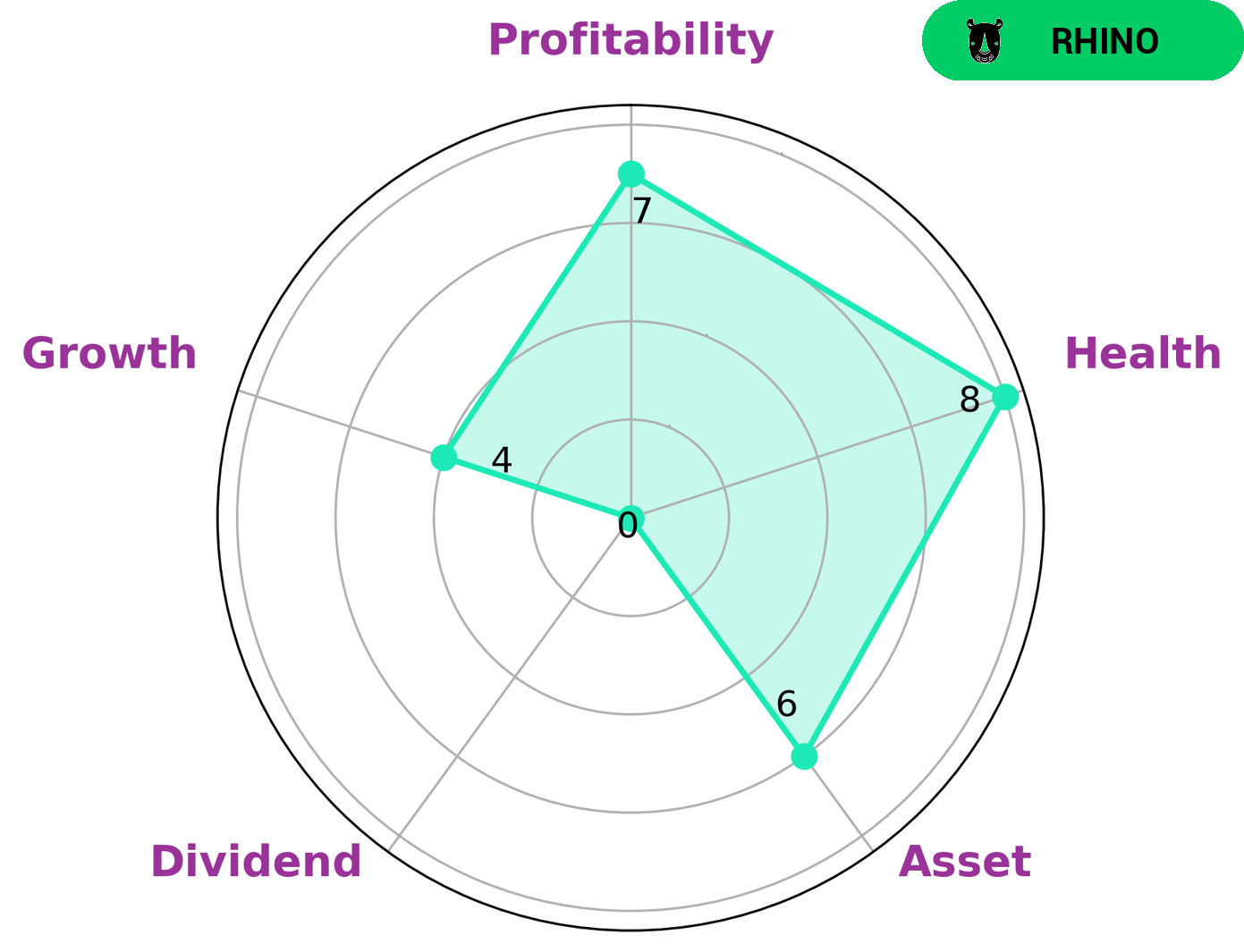

GoodWhale conducted an analysis of G-III APPAREL‘s wellbeing and found that the company has a high health score of 8/10 based on its Star Chart, indicating that it is capable of paying off debt and funding future operations. We found that G-III APPAREL is strong in profitability, medium in asset, growth and weak in dividend. Based on these findings, we classified G-III APPAREL as a ‘rhino’ which is a type of company with moderate revenue or earnings growth. Investors who are looking for companies with high health, strong profitability and moderate growth may be interested in investing in G-III APPAREL. The company provides a safe and secure investment opportunity due to its ability to pay off debt and fund future operations. Furthermore, the moderate growth potential makes it an attractive investment for investors who are looking for a more balanced return. More…

Peers

It is a publicly traded company that competes with other fashion companies such as Genesco Inc, AS Silvano Fashion Group, and Rocky Brands Inc. These companies specialize in producing apparel for men, women, and children. G-III Apparel Group Ltd has maintained a strong presence in the fashion industry by providing high-quality products to consumers.

– Genesco Inc ($NYSE:GCO)

Genesco Inc is a Nashville-based company that specializes in footwear, apparel, and accessories. As of 2022, the company had a market cap of 556.98 million dollars and a Return on Equity of 14.06%. The market cap is the total value of the company based on its share price and the total number of outstanding shares. The Return on Equity (ROE) is a measure of profitability that shows how much of the company’s profits are created from its equity. Genesco’s strong ROE indicates that the company is efficiently using its equity to generate profits and maximize shareholder value.

– AS Silvano Fashion Group ($LTS:0FZD)

Silvano Fashion Group is an Italian clothing company that specializes in the design and production of high-end fashion apparel. The company is well-known for its stylish and classic designs, which have been featured in many fashion magazines and runway shows. As of 2022, the company has a market cap of 39.53M, with a Return on Equity of 22.76%. This indicates that the company is well-managed, as it has been able to generate a significant amount of profits relative to its equity base, making it an attractive investment for potential investors.

– Rocky Brands Inc ($NASDAQ:RCKY)

Rocky Brands Inc is an Ohio-based footwear and apparel company that specializes in outdoor, work, and military footwear, as well as western and athletic footwear. As of 2022, the company has a market cap of 176.13M and a Return on Equity (ROE) of 14.69%. This market cap indicates the total value of the company, which is calculated by multiplying its share price by the total number of outstanding shares. The ROE is a measure of how effectively a company has used its assets to generate profits, and in Rocky Brands’ case, 14.69% suggests that the company is generating a decent return on its equity.

Summary

G-III Apparel reported lower revenues for the fourth quarter of fiscal year 2023, but was able to generate net income growth despite this. Revenues were down 639.2% year-on-year, while net income grew 14.2% to USD 854.4 million. This suggests that the company has managed to maintain strong margins in spite of the challenging macroeconomic conditions, making it an attractive investment option. With this in mind, investors should consider G-III Apparel’s financials carefully before deciding whether or not to invest in the company.

Recent Posts