G-III Apparel Group Ltd. Experiences Upward Trend Despite 2023 Market Volatility

March 31, 2023

Trending News 🌥️

G-III ($NASDAQ:GIII) Apparel Group Ltd. (GIII) is a leading designer and supplier of apparel, outerwear, and accessories. Its products are sold through department stores, specialty stores, and e-commerce retailers across the United States, Canada, Europe, Asia, and Latin America. Despite recent market volatility, GIII shares have experienced an upward trend. The company has seen a steady increase in sales and revenue over the past few years and has expanded its product offerings to include more fashionable items.

These offices allow GIII to access new markets, strengthen partnerships with existing customers, and identify potential opportunities for growth. G-III Apparel Group also continues to expand its product offerings to include athleisure wear and lifestyle apparel for both men and women. The company is also looking to differentiate itself from its competitors by introducing innovative designs and technologies. These initiatives have led to increased brand awareness, customer loyalty, and sales growth. This trend is likely to continue as the company expands its product offerings, strengthens its international presence, and introduces innovative designs and technologies that appeal to customers around the world.

Stock Price

The stock opened at $15.0 and closed at $15.3, a 3.3% increase from the prior closing price of 14.8. This marked a promising sign of resilience and stability for G-III Apparel Group Ltd. during a time of market uncertainty. Investors were encouraged with the strong performance of the company and the confidence in its ability to withstand market fluctuations. This provided a sense of assurance in the strength of the company’s financials and offered a positive outlook for future performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for G-iii Apparel. More…

| Total Revenues | Net Income | Net Margin |

| 3.23k | -133.06 | 6.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for G-iii Apparel. More…

| Operations | Investing | Financing |

| -214.14 | -51.51 | -23.44 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for G-iii Apparel. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.71k | 1.33k | 34.16 |

Key Ratios Snapshot

Some of the financial key ratios for G-iii Apparel are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.7% | -0.9% | -2.5% |

| FCF Margin | ROE | ROA |

| -7.3% | -3.1% | -1.9% |

Analysis

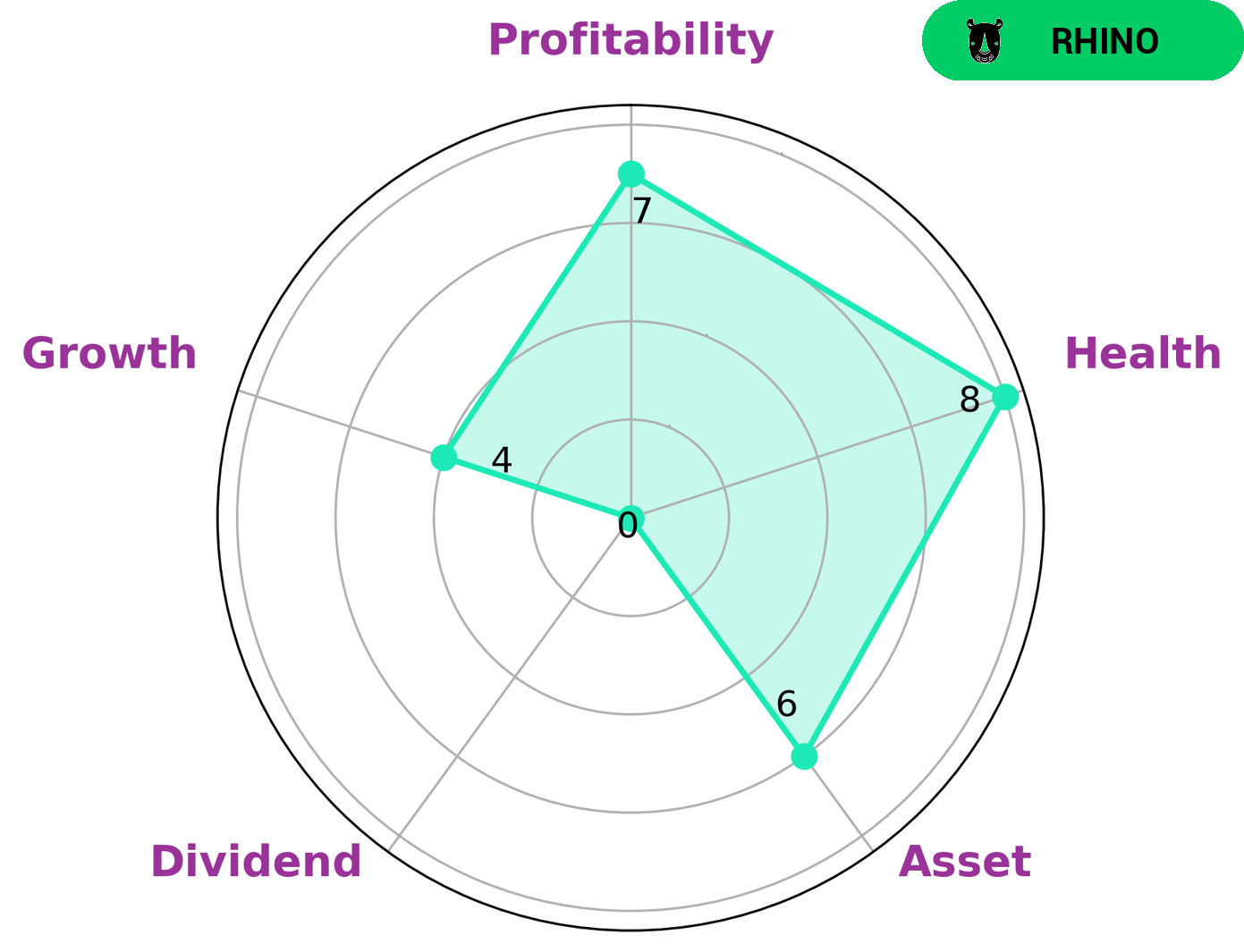

At GoodWhale, we performed an analysis of G-III APPAREL’s wellbeing and found that it is classified as ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. This makes it an attractive prospect for investors who are looking for companies that have potential for growth, but with a low to moderate risk profile. G-III APPAREL’s Star Chart showed that it is strong in profitability, medium in asset, growth and weak in dividend. This suggests that investors should approach the company with caution, as it may not be the most reliable option for dividend income. In addition to this, G-III APPAREL scored an impressive 8/10 for health. This indicates that it is capable of paying off debt and funding future operations from its cashflows and debt. Overall, G-III APPAREL has certain attractive qualities that could make it an appealing option for investors who are looking for moderate growth with low to moderate risk. More…

Peers

It is a publicly traded company that competes with other fashion companies such as Genesco Inc, AS Silvano Fashion Group, and Rocky Brands Inc. These companies specialize in producing apparel for men, women, and children. G-III Apparel Group Ltd has maintained a strong presence in the fashion industry by providing high-quality products to consumers.

– Genesco Inc ($NYSE:GCO)

Genesco Inc is a Nashville-based company that specializes in footwear, apparel, and accessories. As of 2022, the company had a market cap of 556.98 million dollars and a Return on Equity of 14.06%. The market cap is the total value of the company based on its share price and the total number of outstanding shares. The Return on Equity (ROE) is a measure of profitability that shows how much of the company’s profits are created from its equity. Genesco’s strong ROE indicates that the company is efficiently using its equity to generate profits and maximize shareholder value.

– AS Silvano Fashion Group ($LTS:0FZD)

Silvano Fashion Group is an Italian clothing company that specializes in the design and production of high-end fashion apparel. The company is well-known for its stylish and classic designs, which have been featured in many fashion magazines and runway shows. As of 2022, the company has a market cap of 39.53M, with a Return on Equity of 22.76%. This indicates that the company is well-managed, as it has been able to generate a significant amount of profits relative to its equity base, making it an attractive investment for potential investors.

– Rocky Brands Inc ($NASDAQ:RCKY)

Rocky Brands Inc is an Ohio-based footwear and apparel company that specializes in outdoor, work, and military footwear, as well as western and athletic footwear. As of 2022, the company has a market cap of 176.13M and a Return on Equity (ROE) of 14.69%. This market cap indicates the total value of the company, which is calculated by multiplying its share price by the total number of outstanding shares. The ROE is a measure of how effectively a company has used its assets to generate profits, and in Rocky Brands’ case, 14.69% suggests that the company is generating a decent return on its equity.

Summary

Investors have been pleased with the performance of G-III Apparel Group Ltd., despite the volatility of the market in 2023. On the same day, the company’s stock price rose, indicating that investors are feeling confident about their position in the apparel market. Analysts have praised G-III’s ability to create a compelling value proposition with its product offering, which is helping to drive sales and profit growth in this difficult economic climate.

The company has managed to stay competitive by consistently innovating and expanding into new markets. Investors should continue to monitor G-III’s performance in the near-term, as further changes in the market may impact the stock price.

Recent Posts