G-III Apparel Group, Ltd. Achieves Earnings Growth Despite 49% Investor Loss Over Five Years.

February 3, 2023

Trending News ☀️

G-III ($NASDAQ:GIII) Apparel Group, Ltd. is a leading manufacturer and distributor of apparel and accessories. The company designs, manufactures, and markets a variety of products, including outerwear, dresses, sportswear, swimwear, and women’s suits. The company also markets accessories including handbags, footwear, small leather goods, cold weather accessories and lingerie. This is due largely to the company’s focus on expanding its product offerings and developing strong relationships with retailers and department stores.

In addition, the company has been able to capitalize on new trends in the fashion world by introducing new lines of apparel and accessories. G-III Apparel Group, Ltd. has also made a number of strategic acquisitions that have allowed it to expand into new markets and increase its presence in the global apparel market. This includes the acquisition of Andrew Marc, a designer of high-end clothing and accessories, and Vilebrequin, a luxury swimwear brand. These acquisitions have helped to diversify the company’s product portfolio and open up more opportunities for growth. This is due to the company’s focus on expanding its product offerings and developing strong relationships with retailers and department stores. Through strategic acquisitions and a commitment to staying ahead of trends in fashion, G-III Apparel Group, Ltd. continues to be a leader in the apparel industry.

Share Price

Despite this, news sentiment surrounding the company remains largely neutral. On Thursday, G-III APPAREL stock opened at $17.3 and closed at $17.0, down by 1.0% from the prior closing price of $17.2. Over the past five years, the company has reported steady growth in net sales and earnings. G-III Apparel Group has also seen success in its international operations. In light of these positive developments, G-III Apparel Group, Ltd. remains committed to delivering long-term value to its shareholders. The company has invested heavily in its online presence and increased its advertising spend to reach a larger audience.

Additionally, the company has focused on expanding its product portfolio to meet changing consumer demand. Overall, G-III Apparel Group, Ltd. has continued to deliver strong financial results despite some short-term losses in its stock price. The company’s long-term strategy of investing in its online presence and expanding its product portfolio will likely help it continue to grow and remain competitive in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for G-iii Apparel. More…

| Total Revenues | Net Income | Net Margin |

| 3.12k | 176.49 | 5.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for G-iii Apparel. More…

| Operations | Investing | Financing |

| -117.92 | -51.51 | -23.44 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for G-iii Apparel. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.29k | 1.67k | 33.36 |

Key Ratios Snapshot

Some of the financial key ratios for G-iii Apparel are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.6% | 1.6% | 9.0% |

| FCF Margin | ROE | ROA |

| -4.4% | 11.0% | 5.3% |

Analysis

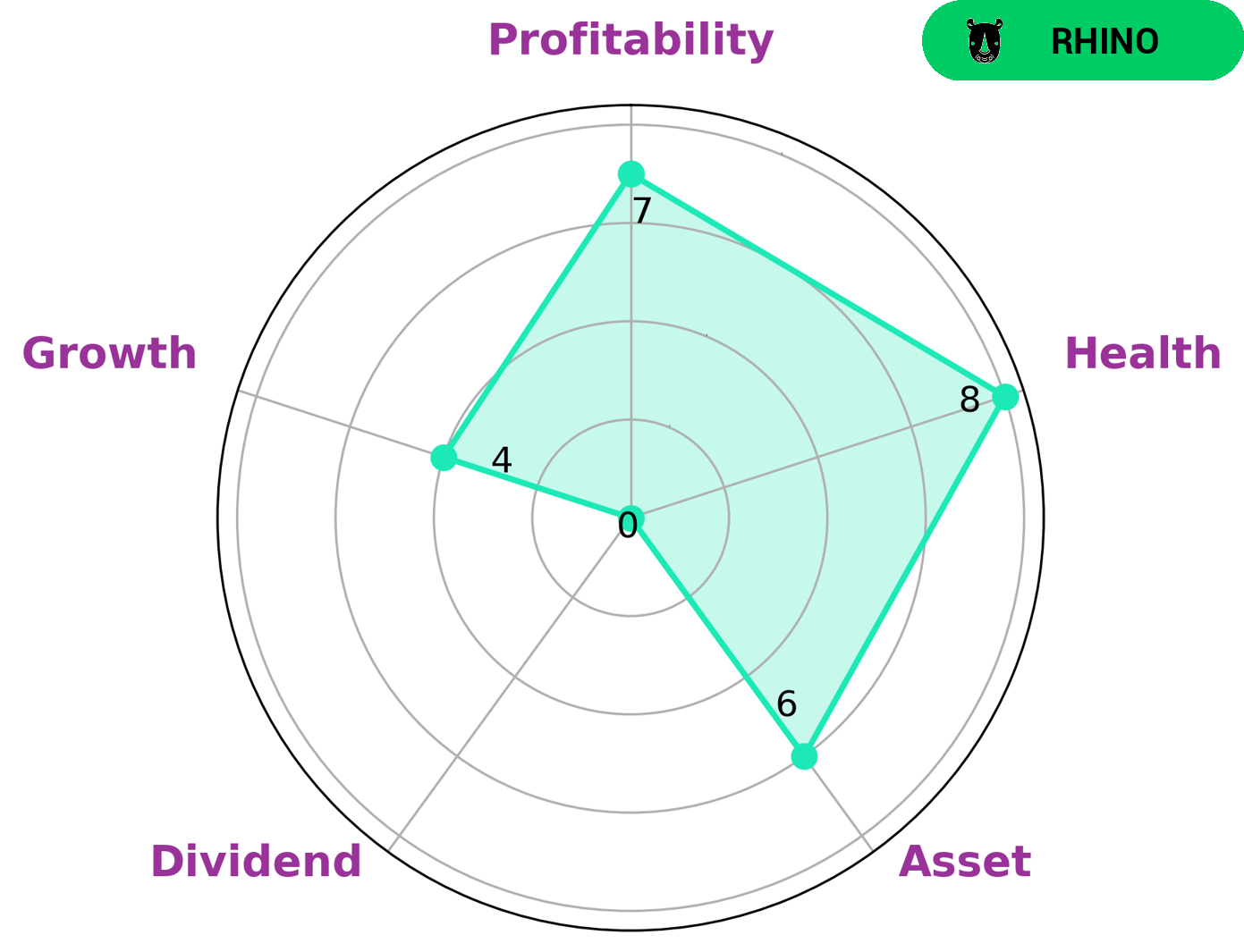

G-III Apparel is a company that has been analyzed using GoodWhale’s Star Chart system. The Star Chart shows that G-III Apparel has a strong profitability score, a medium score for asset growth, and a weak score for dividend. The company is classified as a ‘rhino’, which means that it has achieved moderate revenue or earnings growth. Investors who are interested in companies like G-III Apparel may be looking for an established company that has already achieved moderate success and is capable of continuing to grow. These investors may also look for companies with a high health score, which G-III Apparel has with a score of 8/10 for its cashflows and debt. This health score indicates that the company is capable of paying off debt and funding future operations. Overall, G-III Apparel is an established company that has achieved moderate success and is capable of continuing to grow. It has a high health score, indicating that it is capable of paying off debt and funding future operations. These qualities make G-III Apparel an attractive option for investors who are looking for steady growth and a secure financial future. More…

Peers

It is a publicly traded company that competes with other fashion companies such as Genesco Inc, AS Silvano Fashion Group, and Rocky Brands Inc. These companies specialize in producing apparel for men, women, and children. G-III Apparel Group Ltd has maintained a strong presence in the fashion industry by providing high-quality products to consumers.

– Genesco Inc ($NYSE:GCO)

Genesco Inc is a Nashville-based company that specializes in footwear, apparel, and accessories. As of 2022, the company had a market cap of 556.98 million dollars and a Return on Equity of 14.06%. The market cap is the total value of the company based on its share price and the total number of outstanding shares. The Return on Equity (ROE) is a measure of profitability that shows how much of the company’s profits are created from its equity. Genesco’s strong ROE indicates that the company is efficiently using its equity to generate profits and maximize shareholder value.

– AS Silvano Fashion Group ($LTS:0FZD)

Silvano Fashion Group is an Italian clothing company that specializes in the design and production of high-end fashion apparel. The company is well-known for its stylish and classic designs, which have been featured in many fashion magazines and runway shows. As of 2022, the company has a market cap of 39.53M, with a Return on Equity of 22.76%. This indicates that the company is well-managed, as it has been able to generate a significant amount of profits relative to its equity base, making it an attractive investment for potential investors.

– Rocky Brands Inc ($NASDAQ:RCKY)

Rocky Brands Inc is an Ohio-based footwear and apparel company that specializes in outdoor, work, and military footwear, as well as western and athletic footwear. As of 2022, the company has a market cap of 176.13M and a Return on Equity (ROE) of 14.69%. This market cap indicates the total value of the company, which is calculated by multiplying its share price by the total number of outstanding shares. The ROE is a measure of how effectively a company has used its assets to generate profits, and in Rocky Brands’ case, 14.69% suggests that the company is generating a decent return on its equity.

Summary

G-III Apparel Group, Ltd. has experienced a 49% loss of investor value over the last five years, despite achieving positive earnings growth in the same period. Despite this decline, investors are still interested in the company and its potential for future growth. Analysts are examining G-III’s financial performance, market conditions, and competitive landscape to determine if it is a good long-term investment.

They are also analyzing the company’s balance sheet, cash flow, and other financial metrics to gauge its financial health. With its fundamentals in check, G-III may be an attractive investment option for those looking to take advantage of a potentially undervalued stock.

Recent Posts