Zacks Research Estimates Century Aluminum Corporation’s Q2 2023 Earnings Per Share

May 27, 2023

Trending News ☀️

Century Aluminum Corporation ($SHSE:601600) is one of the world’s leading producers of primary aluminum and aluminum products. It is an American corporation with global operations, and a major player in the aluminum industry. Recently, Zacks Research has released their estimated Q2 2023 earnings per share for Century Aluminum Corporation. According to their research, the company is expected to achieve high earnings in the second quarter of 2023.

They believe this strong performance is driven by increasing demand for aluminum products, continued cost-saving initiatives, and improved pricing across their product lines. Moreover, the company’s diversified portfolio of products will ensure long-term growth and financial sustainability even in the face of uncertain market conditions. Investors can therefore expect to benefit from Century Aluminum Corporation’s solid financial performance and long-term investment potential.

Market Price

On Thursday, ALUMINUM CORPORATION‘s stock opened at CNY5.3 and closed at CNY5.2, marking a 1.5% decrease from the previous closing price of 5.3. The estimation is based on the most recent available financial information of the company. ALUMINUM CORPORATION has seen a decline in its stock performance in recent months, likely due to lower investor confidence in the company’s potential future success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Aluminum Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 290.99k | 4.07k | 2.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Aluminum Corporation. More…

| Operations | Investing | Financing |

| 27.75k | -3.42k | -27.04k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Aluminum Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 212.35k | 124.59k | 3.17 |

Key Ratios Snapshot

Some of the financial key ratios for Aluminum Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.3% | 53.2% | 5.9% |

| FCF Margin | ROE | ROA |

| 7.9% | 18.5% | 5.0% |

Analysis

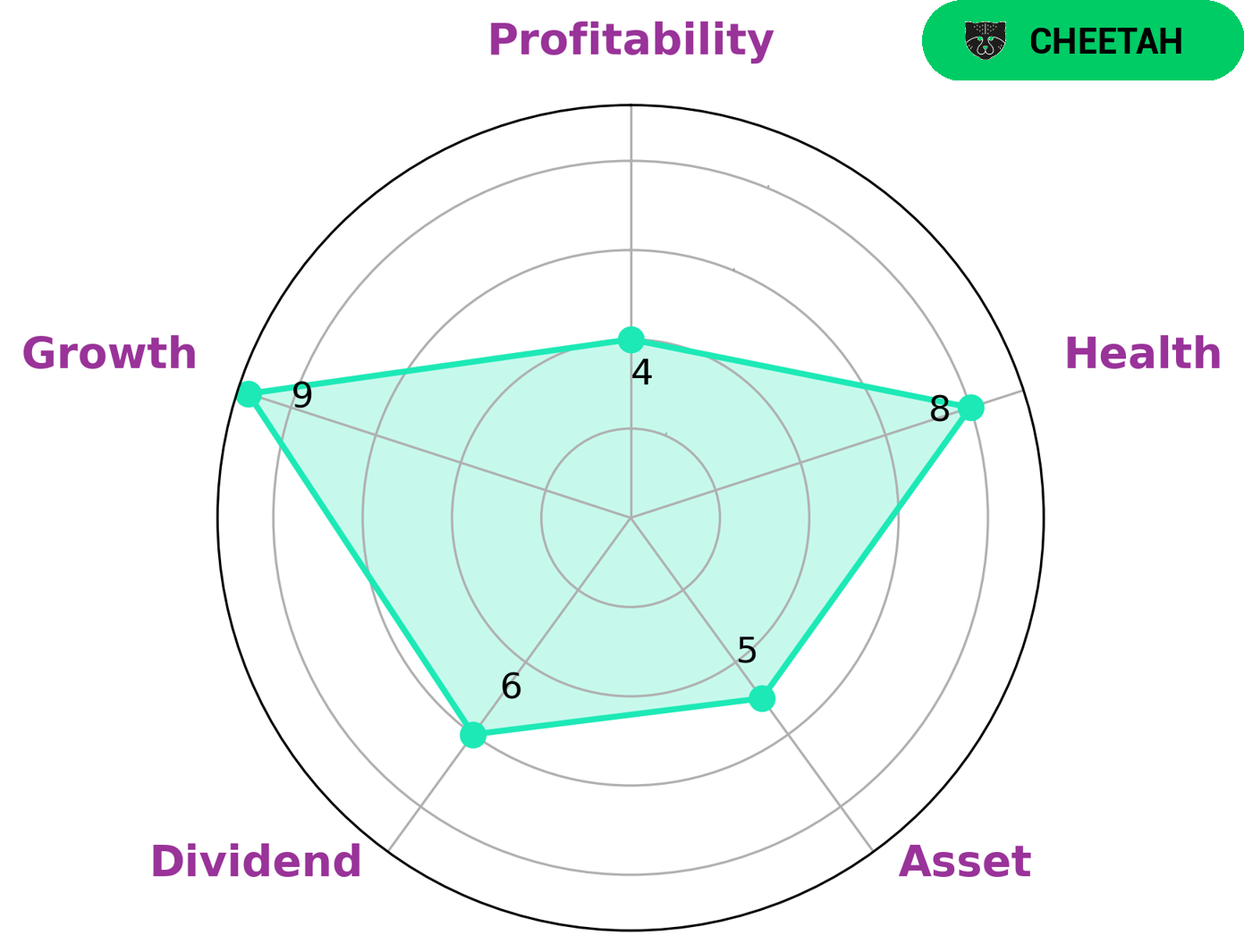

GoodWhale has analyzed the fundamentals of ALUMINUM CORPORATION and determined that it has a high health score of 8/10 with regard to its cashflows and debt. This means that the company is on solid ground and is able to safely ride out any crisis without the risk of bankruptcy. After further analysis, we have concluded that ALUMINUM CORPORATION is classified as ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given this analysis, we believe that ALUMINUM CORPORATION may be attractive to investors looking for a high growth stock. The company is strong in terms of growth, and medium in terms of asset, dividend, and profitability. Thus, it may appeal to those looking for a higher risk and higher reward investment. More…

Peers

The competition between Aluminum Corp of China Ltd and its competitors, PT Alakasa Industrindo Tbk, Renaissance Asia Silk Road Group Ltd, and South Manganese Investment Ltd, has been intense and multifaceted. Each company has its own unique strengths and weaknesses, creating a dynamic and ever-changing competitive landscape. As the competition intensifies, all four companies must strive to find ways to outpace their rivals and gain an edge in the market.

– PT Alakasa Industrindo Tbk ($IDX:ALKA)

PT Alakasa Industrindo Tbk is a publicly traded company on the Indonesia Stock Exchange (IDX). As of 2023, the company has a market capitalization of 186.82 billion Indonesian rupiah (IDR). The company is engaged in the manufacture, distribution and sale of polyvinyl chloride (PVC) products and related services. The company’s main products include PVC pipes and fittings, PVC sheets, and other PVC related products. The products are sold to customers throughout Indonesia and also exported to other countries in the Asia-Pacific region. PT Alakasa Industrindo Tbk is a leading player in the PVC market in Indonesia and continues to focus on expanding its presence in the region.

– Renaissance Asia Silk Road Group Ltd ($SEHK:00274)

Renaissance Asia Silk Road Group Ltd is a Hong Kong-based company that specializes in the development of investment and financial services. The company has a market capitalization of 370.09M as of 2023 and a Return on Equity of -24.47%. This indicates that the company’s performance is not providing a return to its shareholders, which could indicate that the company is not making the most effective use of its capital. The company offers a wide range of services, such as investment banking, fund management, project finance and risk management. In addition, the company provides advisory services and asset management services to its clients.

– South Manganese Investment Ltd ($SEHK:01091)

South Manganese Investment Ltd is a leading investment company in the manganese industry. It is a publicly traded company on the Johannesburg Stock Exchange and has a market capitalization of 2.19 billion as of 2023. The company’s Return on Equity (ROE) stands at 23.93%, indicating it has been successful in generating returns from its investments. South Manganese Investment Ltd is engaged in the exploration and development of manganese ore and related products, which it supplies to the global market for use in various industrial applications. It is one of the largest manganese producers in South Africa and owns several mining projects in the area.

Summary

Investment analysis of the Aluminum Corporation (Century Aluminum) for the second quarter of 2023 reveals favorable reports from Zacks Research. Analysts expect earnings per share to increase, and the company appears to be on a solid financial footing. Furthermore, industry experts believe that demand for aluminum products will continue in the foreseeable future, making Century a promising investment opportunity. It is important for investors to research current market trends and assess the competitive landscape before making any decisions.

Additionally, risk management strategies should be employed to minimize potential losses. Overall, Century Aluminum is a great option for those looking to invest in the aluminum industry.

Recent Posts