Union Gives Green Light to Alcoa Smelter Deals in Indiana and New York

May 19, 2023

Trending News 🌥️

Alcoa Corporation ($NYSE:AA), the world’s leading producer of aluminum, is celebrating a major victory. The United Steelworkers Union has approved deals for the corporation’s smelters in both Indiana and New York. This marks a crucial step forward in Alcoa’s business plan. The new deals will bring more jobs and opportunities to local communities, while also providing economic stability and security for Alcoa’s workers.

This agreement marks a major milestone for Alcoa Corporation and for its workers, as it provides a platform for the company to continue its success in the global aluminum market. As the world transitions to electric vehicles and greater demand for lightweight materials, Alcoa’s smelters are sure to be in high demand.

Stock Price

On Thursday, ALCOA CORPORATION saw a slight increase in its stock with the opening price of $36.3 and closing at $36.8, which is 0.2% higher than the closing price of $36.7 the previous day. The two smelters in question are located in Warrick County and Oswego County, both located in the states of Indiana and New York respectively. The union approval of the deals comes after a long negotiation process between ALCOA CORPORATION and representatives of the United Steelworkers union.

The union approval of the deals is seen as a major win for ALCOA CORPORATION as it allows the company to expand its business activities in the states of Indiana and New York. The company is expected to benefit from the resulting revenues and job creation, as well as from the improved public image that comes with providing employment opportunities to its workers. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Alcoa Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 11.83k | -823 | -4.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Alcoa Corporation. More…

| Operations | Investing | Financing |

| 625 | -504 | -519 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Alcoa Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.37k | 8.07k | 26.3 |

Key Ratios Snapshot

Some of the financial key ratios for Alcoa Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.4% | -5.8% | -1.1% |

| FCF Margin | ROE | ROA |

| 1.1% | -1.7% | -0.6% |

Analysis

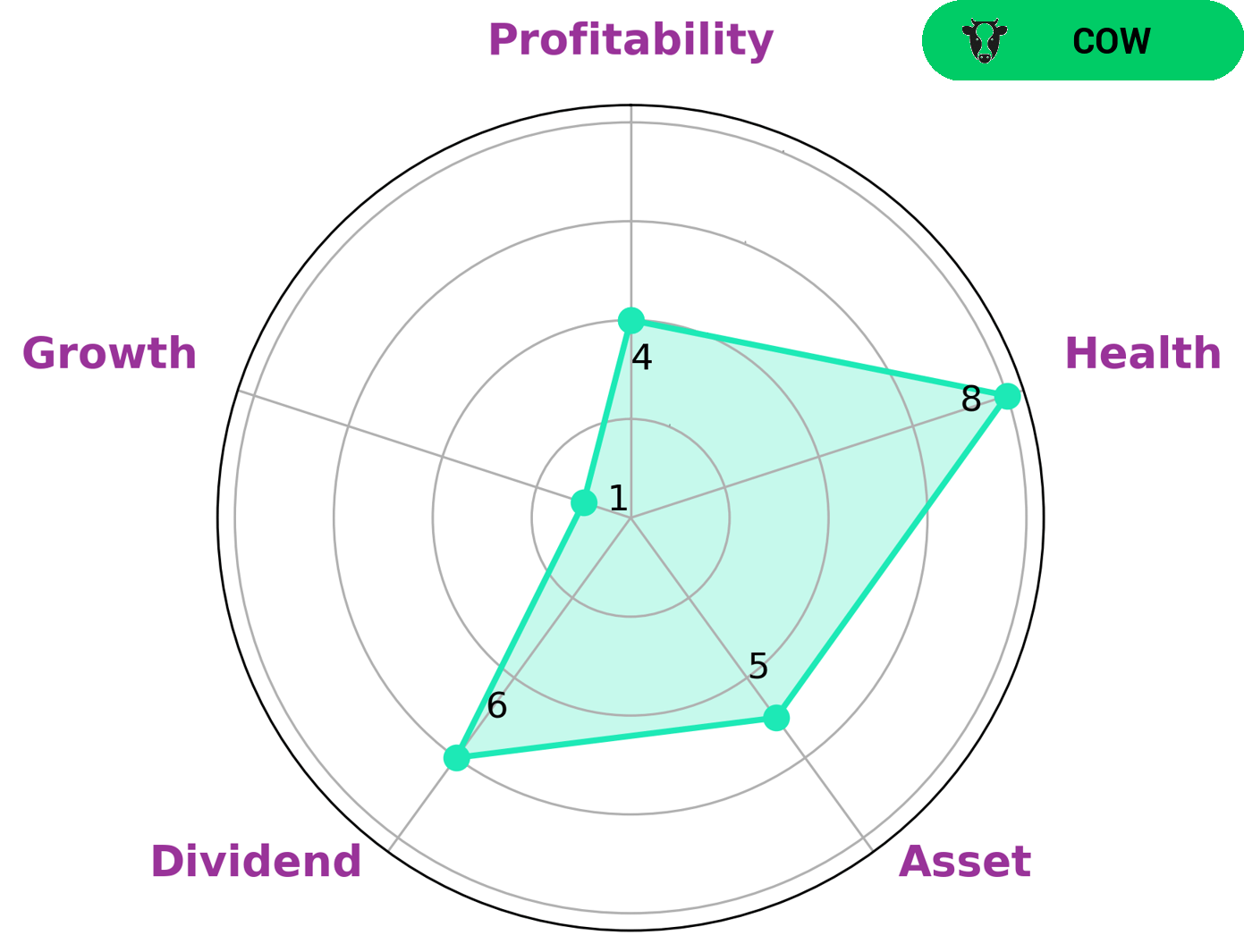

At GoodWhale, we have been analyzing ALCOA CORPORATION‘s financials and we are pleased to present our findings. Our Star Chart gives ALCOA CORPORATION a health score of 8/10 with regard to its cashflows and debt, suggesting that the company is able to pay off debt and fund future operations. Additionally, ALCOA CORPORATION is strong in medium in asset, dividend, profitability and weak in growth. After considering all the data, we classify ALCOA CORPORATION as a ‘cow’, which is a type of company that typically has a track record of paying out consistent and sustainable dividends. Therefore, we believe that investors looking for steady income and returns may be interested in such a company. More…

Peers

Alcoa Corp, one of the world’s largest aluminum producers, competes with a number of other companies in the industry, including Norsk Hydro ASA, MLG Oz Ltd, and Anglo American PLC. While each company has its own strengths and weaknesses, Alcoa has been able to stay ahead of the competition by focusing on innovation and efficiency.

– Norsk Hydro ASA ($OTCPK:NHYDY)

Norsk Hydro ASA is a Norwegian aluminum and renewable energy company. It has a market capitalization of 12.63 billion as of 2022 and a return on equity of 23.31%. The company produces aluminum and aluminum products, and also has operations in hydropower, wind power, and other renewable energy sources.

– MLG Oz Ltd ($ASX:MLG)

Anglo American PLC is a British multinational mining company with headquarters in London, United Kingdom. It is the world’s largest producer of platinum, with around 40% of world output, as well as being a major producer of diamonds, copper, nickel, iron ore and metallurgical and thermal coal. The company has operations in Africa, Asia, Australia, Europe, North America and South America.

Summary

ALCOA Corporation is a global leader in the aluminum industry and a major producer of value-added products. As of late, the company has been investing heavily in its operations and has just recently approved a labor deal for its smelters in Indiana and New York. This agreement is expected to reduce costs while enhancing ALCOA’s competitive position in the sector.

Analysts are bullish on the stock, citing the company’s strong fundamentals, diversified portfolio, and robust balance sheet. With a wide range of products and an outlook for continued growth, ALCOA looks to be a solid choice for investors.

Recent Posts