Uacj Corp dividend yield – UACJ Corp Declares 85.0 Cash Dividend

March 17, 2023

Dividends Yield

On March 1 2023, UACJ Corp declared a cash dividend of 85.0 JPY per share for the 2023 financial year. This dividend is the same as the one issued in the last two years, resulting in a dividend yield of 2.98% from 2022 to 2023. This average dividend yield is quite competitive, making UACJ CORP ($BER:F4M) a great option for those looking to reinvest their profits into stocks which pay dividends. March 30 2023 is the ex-dividend date, so investors should be sure to stay up to date with the latest information with regards to this dividend.

UACJ Corp’s cash dividend is an attractive option for those looking for more out of their investments. With the same dividend yield being issued over the past two years, investors can rest assured that the company is dedicated to providing consistent returns on their investments. Its competitive average dividend yield makes it a great choice for those looking for long-term growth and stability in their portfolios.

Share Price

The stock opened at 18.7 and closed at the same price, representing a successful day of trading for investors. This dividend is likely to be welcomed by investors and could lead to further increases in the company’s stock price in the coming days. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Uacj Corp. More…

| Total Revenues | Net Income | Net Margin |

| 948.59k | 16.15k | 2.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Uacj Corp. More…

| Operations | Investing | Financing |

| -8.18k | -21.04k | -652 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Uacj Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 901.08k | 627.19k | 5.61k |

Key Ratios Snapshot

Some of the financial key ratios for Uacj Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.8% | 69.7% | 3.1% |

| FCF Margin | ROE | ROA |

| -3.4% | 7.0% | 2.0% |

Analysis

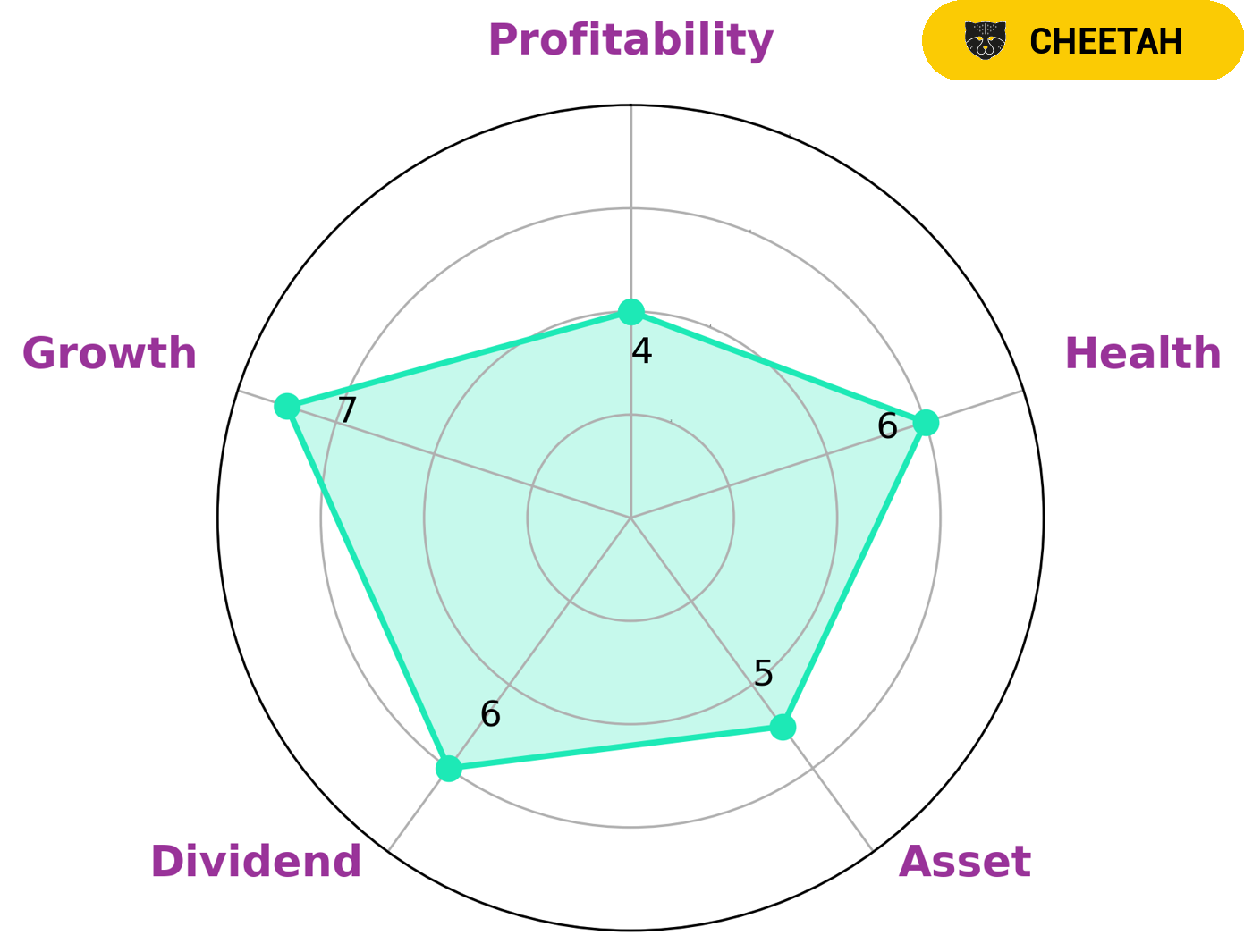

GoodWhale recently analyzed the financials of UACJ CORP and our assessment revealed that UACJ CORP is a “cheetah” company, meaning that it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Our Star Chart shows that UACJ CORP is strong in growth and medium in asset, dividend, and profitability. In terms of health score, UACJ CORP has an intermediate health score of 6/10. This indicates that UACJ CORP might be able to pay off debt and fund future operations. This type of company might be attractive to investors that are looking for short-term gains or want to diversify their portfolio with higher risk investments. In addition, UACJ CORP has potential to deliver long-term returns, however investors should be aware of the risks associated with investing in a less stable company. More…

Summary

Investing in UACJ CORP can be a good way to benefit from a reliable stream of income. With an annual dividend per share of 85.0 JPY for the last two years, the dividend yield of 2.98% provides a steady return on investment. This yield is also attractive given the market conditions, being slightly above average compared to similar companies. For investors who seek reliable returns, UACJ CORP is a reliable option that offers regular income.

Recent Posts