Innovation New Material dividend yield calculator – Innovation New Material Technology Co Ltd Announces 0.06 Cash Dividend

May 29, 2023

Dividends Yield

Innovation New Material ($SHSE:600361) Technology Co Ltd announced on May 25 2023, an annual cash dividend per share of 0.06 CNY. Over the last two years, INNOVATION NEW MATERIAL TECHNOLOGY has issued a dividend per share of 0.08 CNY and is expected to yield dividends of 2.18% in 2021 and 2023. This translates to an average dividend yield of 2.18%. If you are looking for stocks with attractive dividend yields, then INNOVATION NEW MATERIAL TECHNOLOGY could be an excellent option for you.

The ex-dividend date for this dividend is May 18 2023. Investors who purchase the stock before this date will be eligible to receive the dividend.

Share Price

On Thursday, the company’s stock opened at CNY5.1 and closed at CNY5.0, representing a 2.2% decrease from the last closing price of CNY5.1. The reduced closing rate was attributed to the news of the dividend announcement. Through its cutting edge technology and research, the company strives to create high-performance materials to meet the needs of modern industry. This dividend announcement marks the continued success and growth of INNOVATION NEW MATERIAL TECHNOLOGY Co Ltd.

The dividend payment is a sign of the company’s financial strength and commitment to rewarding its shareholders. As the company continues to innovate new material technologies, it is expected to remain a leader in the field. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Innovation New Material. More…

| Total Revenues | Net Income | Net Margin |

| 69.92k | 967.8 | 1.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Innovation New Material. More…

| Operations | Investing | Financing |

| -7.69 | -868.95 | 2.56k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Innovation New Material. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.94k | 9.75k | 1.98 |

Key Ratios Snapshot

Some of the financial key ratios for Innovation New Material are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 83.2% | 105.5% | 2.2% |

| FCF Margin | ROE | ROA |

| -1.3% | 11.8% | 5.3% |

Analysis

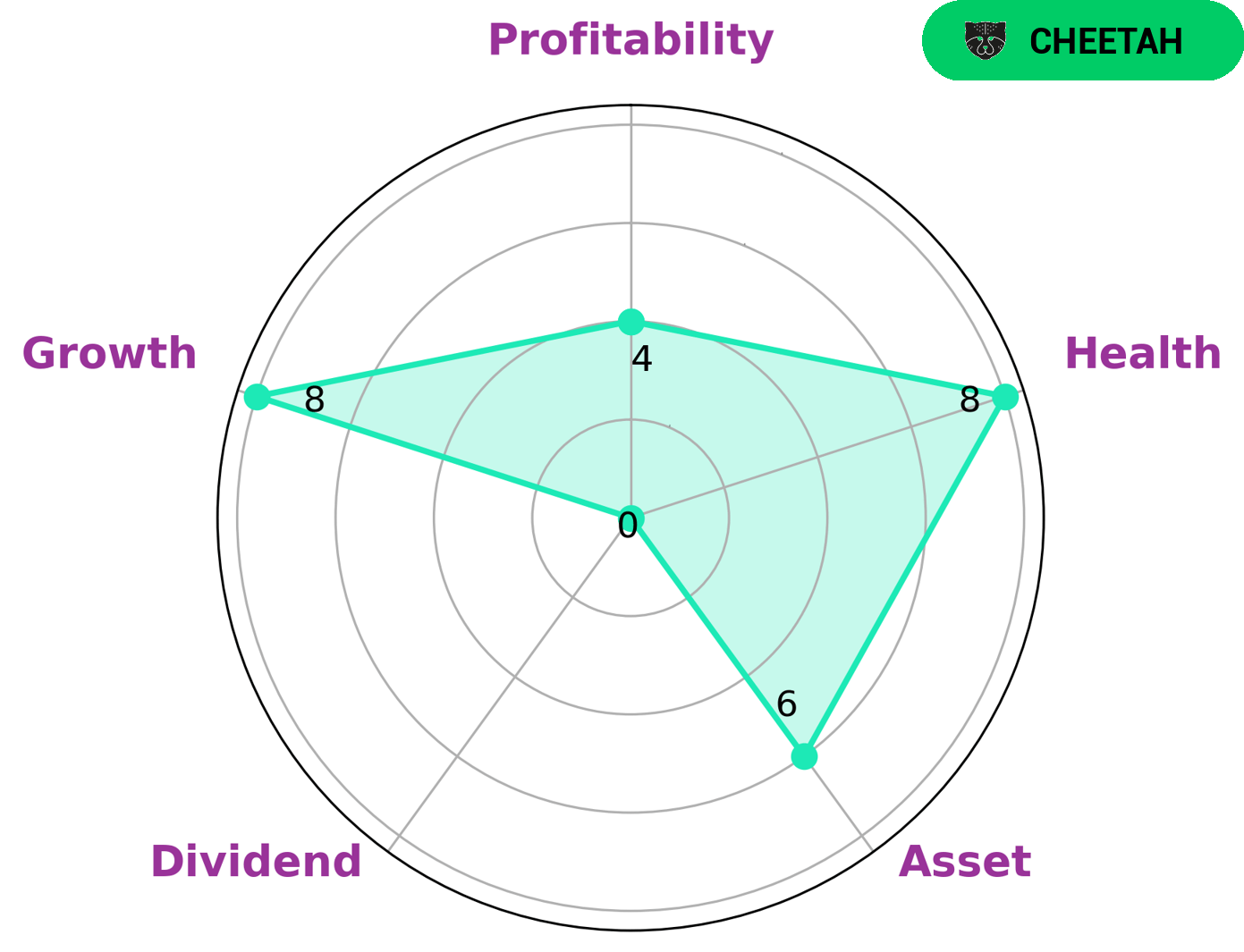

GoodWhale is pleased to analyze the fundamentals of INNOVATION NEW MATERIAL TECHNOLOGY. According to our Star Chart, INNOVATION NEW MATERIAL TECHNOLOGY is strong in growth, medium in asset, profitability and weak in dividend. Furthermore, it has a high health score of 8/10 considering its cashflows and debt, and is therefore capable to pay off debt and fund future operations. As such, we classify INNOVATION NEW MATERIAL TECHNOLOGY as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are looking for high growth companies, but are willing to take on some risk, may be interested in such a company. As such, investors who are looking for high potential returns may be attracted to INNOVATION NEW MATERIAL TECHNOLOGY. Moreover, those investors who are comfortable with a higher degree of risk may also be interested in such a company. More…

Peers

It is one of the few companies operating in this field, and is competing with ZYF Lopsking Material Technology Co Ltd, Liaoning Xinde New Material Technology Co Ltd and Yinbang Clad Material Co Ltd. All four companies are committed to providing innovative products that are of the highest quality.

– ZYF Lopsking Material Technology Co Ltd ($SZSE:002333)

Lopsking Material Technology Co Ltd is a leading Chinese manufacturing and technology company specializing in the production of advanced materials and components for a wide range of industries. The company has a market cap of 4.04 billion as of 2023, making it one of the largest public companies in China. It also has a return on equity of -0.37%, indicating that Lopsking is not generating enough value for its investors. Despite this, the company is well-positioned to continue growing its market presence and capitalize on new opportunities in the years to come.

– Liaoning Xinde New Material Technology Co Ltd ($SZSE:301349)

Liaoning Xinde New Material Technology Co Ltd is a Chinese company that specializes in the production of high-tech materials. The company has a market capitalization of 5.46 billion as of 2023, making it one of the larger companies in the sector. The company also has a strong Return on Equity (ROE) of 3.77%, which indicates its ability to generate profits relative to its shareholders’ equity. This is a sign of the company’s positive performance and helps to attract investors. The company focuses on producing and developing new materials for various industries, which has helped it to remain competitive in the market.

– Yinbang Clad Material Co Ltd ($SZSE:300337)

Yinbang Clad Material Co Ltd is a world-leading Chinese clad materials company that specializes in producing high-quality clad materials for various applications. With a market cap of 5.55B as of 2023, the company is well-positioned to continue its growth and provide high-quality products to its customers. Furthermore, the company boasts an impressive Return on Equity (ROE) of 5.52%, which is significantly higher than the industry average. The company’s strong financial performance has allowed it to reinvest in its operations and expand its customer base. As the demand for clad materials continues to increase, Yinbang Clad Material Co Ltd is well-positioned to remain competitive in the future.

Summary

INNOVATION NEW MATERIAL TECHNOLOGY is a great option for dividend investors, boasting a 2.18% dividend yield for its last two years. This is higher than the average dividend yield across the market, making it an attractive investment for those looking to generate a steady income. In addition, the company is expected to pay a dividend of 0.08 CNY per share in 2021 and 2023, giving investors a good return on their investment.

Recent Posts