Constellium’s Fundamental Issues Leave Little Room For Error

May 20, 2023

Trending News 🌧️

Constellium ($NYSE:CSTM) SE is a global provider of high-strength aluminum and aluminum-based products. The company, which has operations in Europe, North America and Asia, is listed on the Euronext Paris stock exchange. Despite its strength in the aluminum market, Constellium has recently come under pressure from fundamental issues such as a lack of margin of safety, a lagging stock price and macroeconomic headwinds. The lack of margin of safety is particularly concerning for investors, as this leaves little room for error in terms of market fluctuations. This means that investors must be aware of any news or events that could affect the company and act quickly to protect their investments.

In addition, the lagging stock price could indicate that the company is not performing as expected, which could be a red flag for potential investors. Furthermore, macroeconomic headwinds such as trade tensions, tariffs, and sluggish economic growth could also be weighing on the company’s performance. These factors could have an effect on the company’s profits and margins, making it difficult for investors to accurately predict the company’s prospects. Overall, Constellium’s fundamental issues leave little room for error, meaning that investors should be aware of all potential risks before deciding to invest in this company. While Constellium does have strong presence in the aluminum market, its stock could still be vulnerable to market fluctuations and macroeconomic forces. As such, it is important to conduct diligent research before making any decisions regarding investing in Constellium SE.

Stock Price

On Friday, CONSTELLIUM SE stock opened at $16.2 and closed at $15.8, down by 1.7% from prior closing price of 16.0. The stock’s slump further highlights the fundamental issues that the company is facing, leaving little room for error. With its share price already low, the margin of error for CONSTELLIUM SE to stabilize its performance has become increasingly slim. This potentially disastrous situation could be worrisome to investors, given that there is a high risk of the stock tanking further, with no chance of recovery in the foreseeable future.

Even if a brief upswing occurs, it is unlikely to be sustained in the long-term. Ultimately, this leaves little room for error for the company, as it must take every measure to ensure that its stock remains afloat. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Constellium Se. More…

| Total Revenues | Net Income | Net Margin |

| 8.1k | 144 | 2.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Constellium Se. More…

| Operations | Investing | Financing |

| 427 | -306 | -88 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Constellium Se. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.04k | 4.27k | 5.16 |

Key Ratios Snapshot

Some of the financial key ratios for Constellium Se are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.7% | -18.5% | 1.6% |

| FCF Margin | ROE | ROA |

| 1.5% | 10.8% | 1.6% |

Analysis

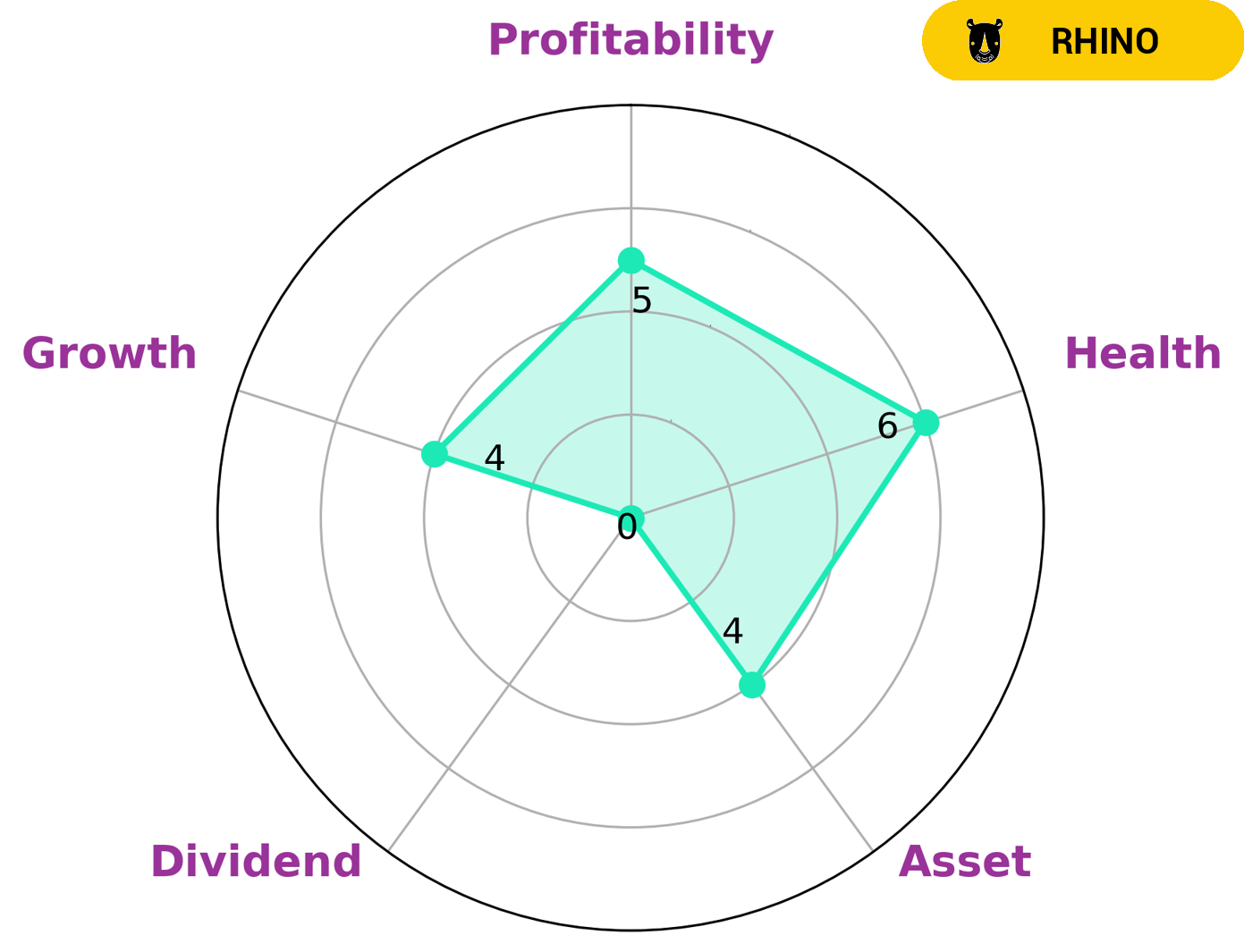

GoodWhale has conducted an analysis of CONSTELLIUM SE‘s financials and found that the company is strong in asset, growth, and profitability, and weak in dividend. Our Star Chart provides a comprehensive overview of how the company is currently performing across these key metrics. We have assigned CONSTELLIUM SE an intermediate health score of 6/10 with regard to its cashflows and debt, indicating that it is likely to safely ride out any crisis without the risk of bankruptcy. We classify CONSTELLIUM SE as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Based on our analysis, we believe that value, growth, and income investors may be interested in this company. Value investors may be attracted by the company’s strength in assets and profitability, while growth investors may be more interested in the company’s moderate growth potential. Similarly, income investors may be drawn to CONSTELLIUM SE by its potential for providing dividends over the coming years. More…

Peers

The company has over 10,000 employees in more than 30 countries. Constellium SE’s main competitors are AMAG Austria Metall AG, Nippon Light Metal Holdings Co Ltd, and Synthiko Foils Ltd.

– AMAG Austria Metall AG ($LTS:0Q7L)

The company’s market cap is 1.18B as of 2022 and its ROE is 15.65%. The company produces and sells metal products and services. It offers a range of aluminum products, including foil, sheets, plates, extrusions, and more. The company also provides metal processing services, such as sawing, punching, and bending. In addition, it offers metal recycling services.

– Nippon Light Metal Holdings Co Ltd ($TSE:5703)

Nippon Light Metal Holdings Co Ltd is a Japanese company that produces and sells light metal products. The company has a market cap of 93.71B as of 2022 and a Return on Equity of 4.87%. The company’s products include aluminum products, magnesium products, and other light metal products. The company also produces and sells aluminum alloys, magnesium alloys, and other light metal alloys.

– Synthiko Foils Ltd ($BSE:513307)

Synthiko Foils Ltd is a publicly traded company with a market capitalization of 619.79 million as of 2022. The company’s primary business is the manufacture and sale of aluminum foil products. Synthiko Foils Ltd has a return on equity of 13.86%.

Summary

Constellium SE is a metals and engineering company specializing in aluminium products and components for the automotive, aerospace, and packaging industries. As an investment, Constellium presents several fundamental issues that should be considered by potential investors. These include the company’s current debt structure, its lack of significant operating income, and a weak balance sheet with limited liquidity.

Additionally, despite the fact that Constellium is currently trading at a discounted price, there is very little margin of safety, creating a significant risk for investors. It is therefore important for investors to conduct thorough due diligence before deciding whether or not to invest in Constellium.

Recent Posts