Century Aluminum Stock Fair Value – Century Aluminum Exceeds Expectations with Non-GAAP EPS of -$0.11 and Revenue of $552.4M

May 9, 2023

Trending News 🌥️

Century Aluminum ($NASDAQ:CENX), a leader in the aluminum industry, recently reported Non-GAAP Earnings Per Share of -$0.11, surpassing expectations by $0.04. Total revenue was $552.4M, exceeding forecasts by $28.9M. This is a strong showing for the company, which has seen its stock prices rally over the past several months. The company is a leading producer of primary aluminum and provides products to a variety of industries, from automotive and beverage cans to transportation, construction and packaging. Century Aluminum’s products are used worldwide and are essential for the production of a variety of goods.

Despite a challenging macroeconomic environment, Century Aluminum was able to exceed expectations and report positive financial results. The company’s focus on cost control and efficiency have helped it remain resilient to external factors, as well as making strategic investments in order to capitalize on opportunities as they arise. Century Aluminum’s success is a testament to its commitment to strategic growth and financial discipline. The company will continue to focus on its long term goals, while keeping an eye on short term opportunities and challenges in the market.

Earnings

In its earning report of FY2022 Q4 as of December 31 2022, CENTURY ALUMINUM exceeded expectations with non-GAAP EPS of -$0.11 and revenue of $552.4M. Despite the increase in revenue, the company reported a 19.6% decrease in total revenue and a 287.9% decrease in net income compared to the same period last year. Over the last three years, CENTURY ALUMINUM has seen an impressive increase in revenue, going from 389.1M USD to 529.9M USD. This indicates that despite the decrease in net income reported in the current quarter, the company is still in a strong position and is expected to continue its upward trajectory in the future.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Century Aluminum. More…

| Total Revenues | Net Income | Net Margin |

| 2.78k | -14.1 | -1.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Century Aluminum. More…

| Operations | Investing | Financing |

| 25.9 | -85.5 | 74.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Century Aluminum. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.47k | 1.07k | 4.32 |

Key Ratios Snapshot

Some of the financial key ratios for Century Aluminum are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.8% | -16.8% | 2.3% |

| FCF Margin | ROE | ROA |

| -2.2% | 8.6% | 2.7% |

Price History

On Monday, CENTURY ALUMINUM stock opened at $8.6 and closed at $8.5, up by 2.1% from last closing price of 8.3. This positive reaction from the stock market indicates the potential growth the company has ahead of itself. Live Quote…

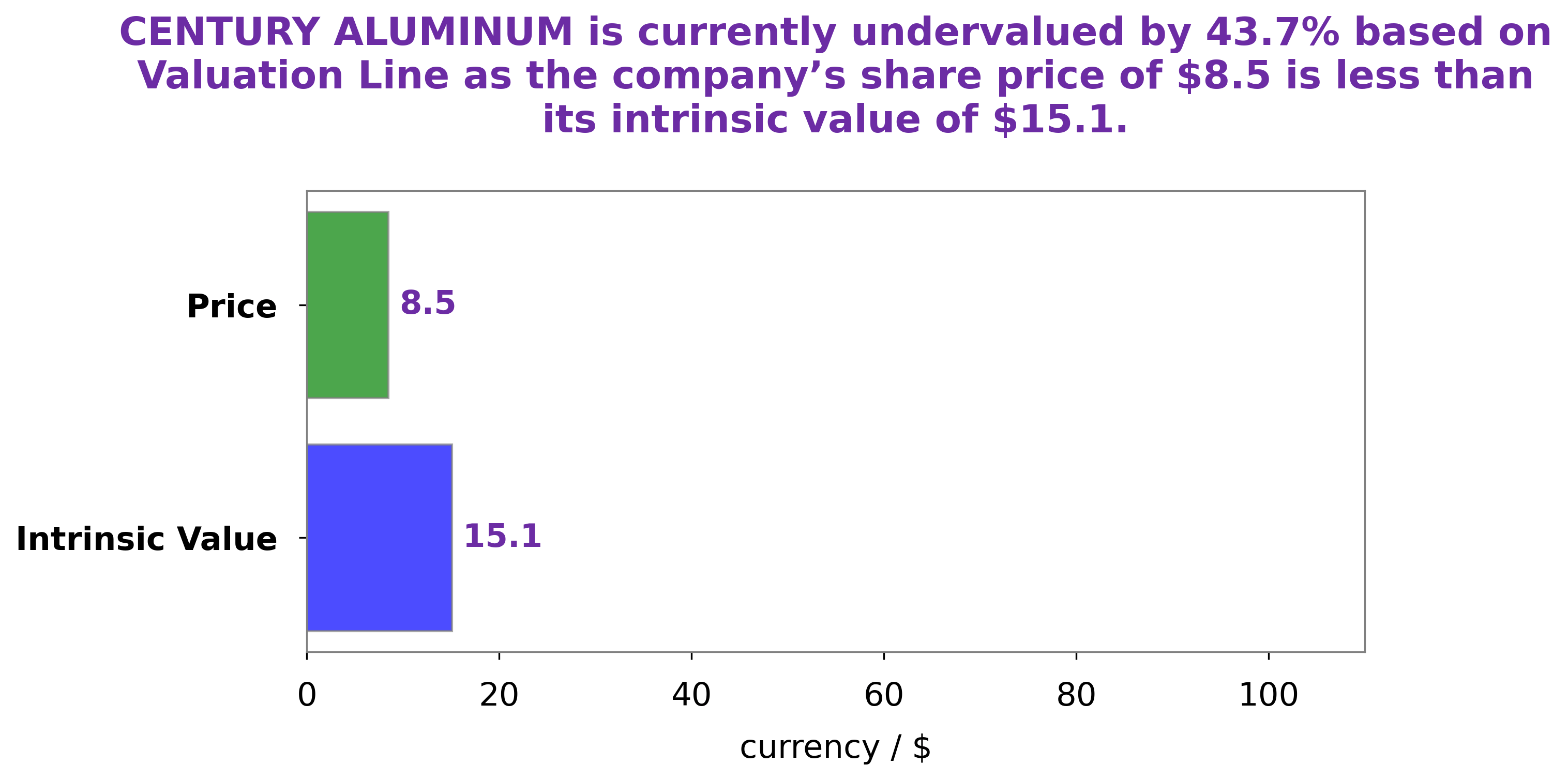

Analysis – Century Aluminum Stock Fair Value

GoodWhale has conducted an in-depth analysis of CENTURY ALUMINUM‘s wellbeing. Through our proprietary Valuation Line, we have determined that the intrinsic value of CENTURY ALUMINUM’s share is around $15.1. This means that the current price, which is trading at $8.5, is undervalued by 43.6%. We believe this presents a great opportunity for investors to capitalize on the potentially profitable trading opportunity. More…

Peers

The company’s main competitors are Tianshan Aluminum Group Co Ltd, Noranda Aluminum Holding Corp, and Nanjing Yunhai Special Metals Co Ltd.

– Tianshan Aluminum Group Co Ltd ($SZSE:002532)

Tianshan Aluminum Group Co Ltd is a Chinese aluminum producer. The company has a market cap of 30.98B as of 2022 and a Return on Equity of 16.7%. Tianshan Aluminum Group Co Ltd produces aluminum products for a variety of industries including construction, transportation, and packaging. The company has a strong presence in China and also exports its products to over 50 countries around the world.

– Noranda Aluminum Holding Corp ($OTCPK:NORNQ)

Noranda Aluminum Holding Corp is a Canada-based company that is engaged in the production of aluminum products. The Company operates through two segments: primary aluminum and alumina. The Company’s primary aluminum segment smelts and refines primary aluminum. The Company’s alumina segment mines, refines and markets alumina. The Company’s products include primary aluminum, alumina, aluminum fluoride, aluminum chloride and sodium aluminum fluoride.

– Nanjing Yunhai Special Metals Co Ltd ($SZSE:002182)

Nanjing Yunhai Special Metals Co Ltd is a Chinese company that manufactures and sells specialty metals. It has a market capitalization of 14.83 billion as of 2022 and a return on equity of 18.83%. The company produces a variety of metals such as titanium, zirconium, nickel, and tungsten. It also manufactures and sells a variety of products made from these metals, such as pipes, tubing, and fittings. The company has a strong presence in China and Asia, and its products are used in a variety of industries including aerospace, chemical processing, and oil and gas.

Summary

This was a positive indication for investors as the company was able to exceed expectations and show significant improvement compared to the same time last year. The company will continue to strive to increase its earnings and revenue in the upcoming quarters.

Recent Posts