AM8 dividend – AMAG Austria Metall AG Declares 1.5 Cash Dividend

April 5, 2023

Dividends Yield

On April 1 2023, AMAG Austria Metall AG declared a 1.5 cash dividend. If you’re looking for stocks that offer dividends, AMAG AUSTRIA METALL AG ($BER:AM8) could be a viable option. Over the past three years, they have issued a dividend of 1.5, 0.5 and 0.5 EUR respectively, providing dividend yields of 3.66%, 1.54% and 1.93%. This averages out to an impressive 2.38% dividend yield.

The ex-dividend date for their April 18 2023 dividend is April 18 2023. With consistent dividends and an average yield of 2.38%, it is a solid long-term investment choice for those seeking to benefit from steady returns.

Market Price

This announcement has been met with enthusiasm from shareholders, who have seen a steady increase in AMAG Austria Metall AG’s stock price over the past few months. The dividend is a sign that the company is continuing to perform well and is committed to rewarding its shareholders. This is further evidenced by its strong second quarter earnings report, which showed solid growth in both revenues and profits. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AM8. More…

| Total Revenues | Net Income | Net Margin |

| 1.57k | 108.04 | 6.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AM8. More…

| Operations | Investing | Financing |

| -88.73 | -73.69 | 125.27 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AM8. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.91k | 1.22k | 19.47 |

Key Ratios Snapshot

Some of the financial key ratios for AM8 are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.9% | 54.8% | 10.3% |

| FCF Margin | ROE | ROA |

| -10.5% | 15.6% | 5.3% |

Analysis

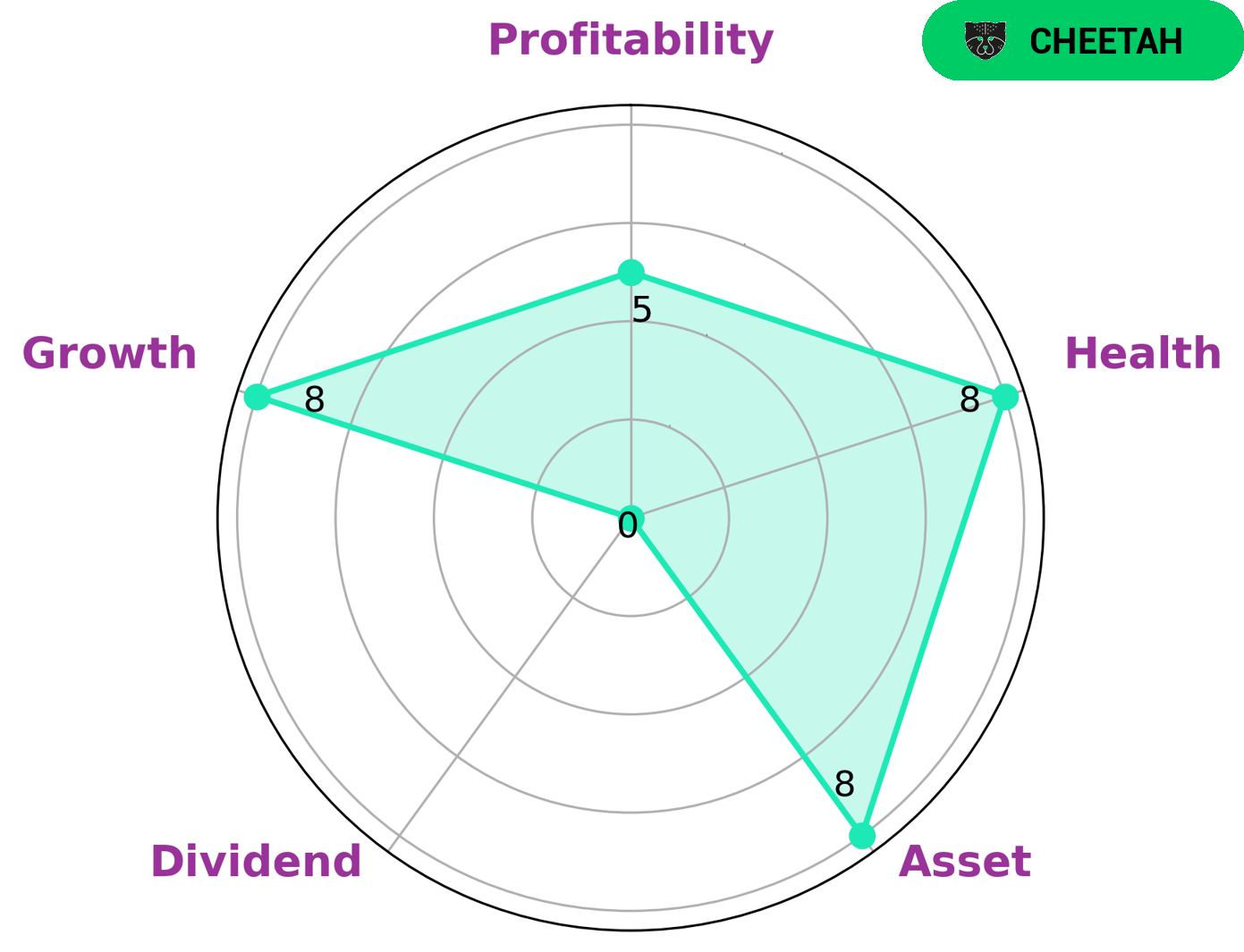

GoodWhale has conducted an analysis of AMAG AUSTRIA METALL AG’s financials. We noted that based on Star Chart, AMAG AUSTRIA METALL AG is strong in asset and growth, medium in profitability, and weak in dividend. After further analysis, we concluded that AMAG AUSTRIA METALL AG is classified as a ‘cheetah’. This type of company has achieved high revenue or earnings growth but is considered less stable due to lower profitability. What type of investors may be interested in such a company? Those looking for high-growth opportunities and willing to take on the risks associated with these businesses would be suitable for AMAG AUSTRIA METALL AG. Investors who have the appetite for risk and are willing to take on higher levels of volatility in return for higher potential returns may be interested in this type of firm. More…

Summary

AMAG AUSTRIA METALL AG is a good choice for investors seeking stocks with a reliable dividend income. Over the past three years, dividends per share have been quite consistent, averaging 1.5 EUR and yielding an average of 2.38%. This makes the company an attractive option for those seeking both steady returns and capital appreciation.

Recent Posts