Alumetal Sa stock dividend – ALUMETAL SA Declares 10.52 Cash Dividend

April 5, 2023

Dividends Yield

As a result, the dividend yield for the 2021-2023 period is 21.21%, and the average dividend yield is also 21.21%. This makes ALUMETAL SA ($LTS:0QWL) an attractive option for investors searching for quality dividend stocks in their portfolio. Furthermore, the ex-dividend date is set for April 26 2023.

ALUMETAL SA’s dividend is a reliable source of income over time and represents the company’s commitment to reward its shareholders. As such, investors should consider adding ALUMETAL SA to their list of choices when looking for dividend stocks.

Price History

The news of the dividend announcement caused ALUMETAL SA‘s stock to open at €42.0 on Monday and closed at €42.0 at the end of the day. This amount remains unchanged from the previous day’s closing price. This dividend payout is seen as a positive move by the company, indicating a healthy financial standing and potential growth opportunities. With this announcement, ALUMETAL SA reinforces its position as a reliable investment for shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Alumetal Sa. More…

| Total Revenues | Net Income | Net Margin |

| 3.27k | 245.34 | 7.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Alumetal Sa. More…

| Operations | Investing | Financing |

| 165.13 | -73.14 | -166.19 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Alumetal Sa. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.37k | 600.69 | 49.47 |

Key Ratios Snapshot

Some of the financial key ratios for Alumetal Sa are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 33.1% | 59.5% | 8.2% |

| FCF Margin | ROE | ROA |

| 2.5% | 21.9% | 12.2% |

Analysis

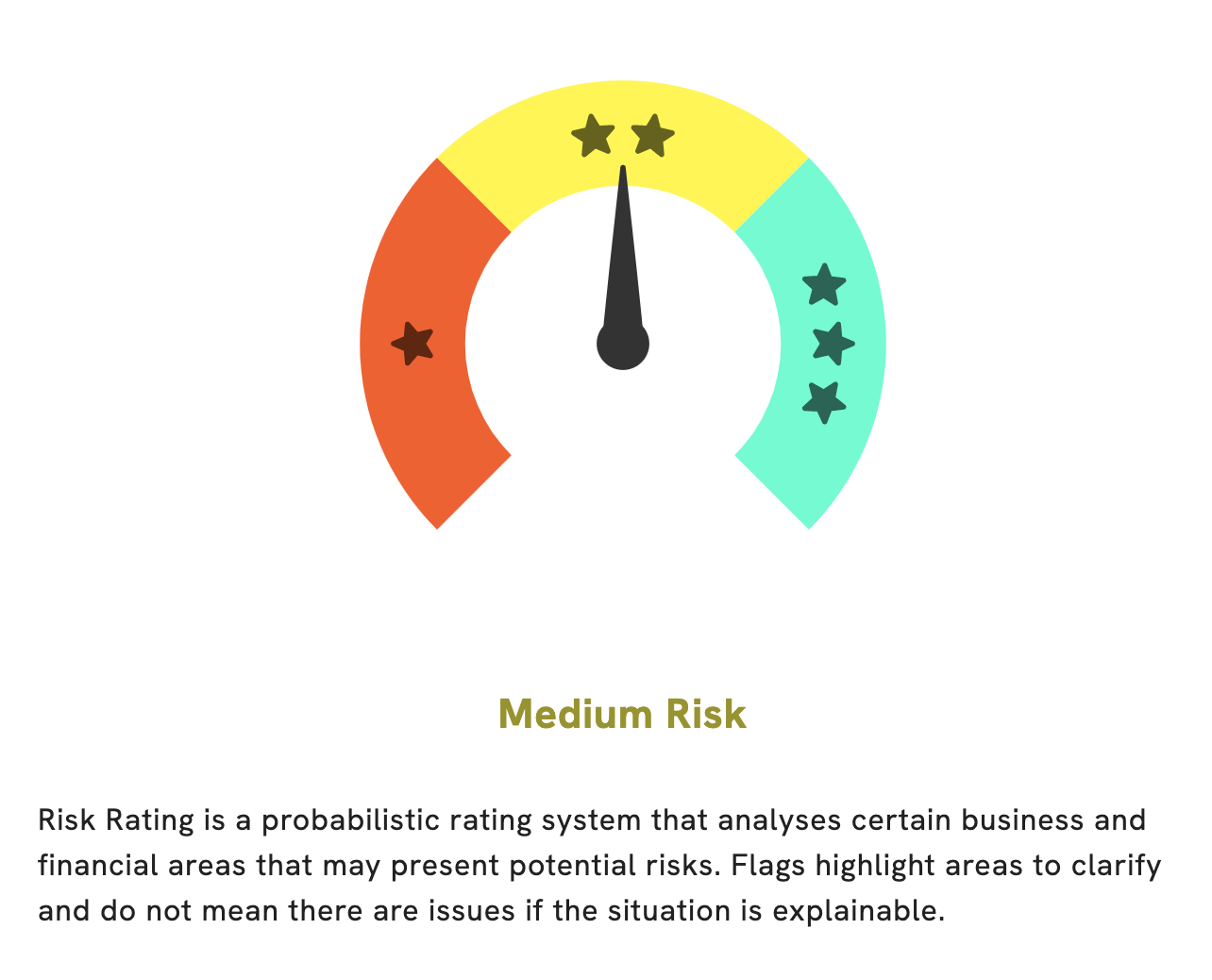

GoodWhale’s analysis of ALUMETAL SA‘s financials shows that it is a medium risk investment in terms of financial and business aspects. In order to provide an accurate risk rating for ALUMETAL SA, we carefully reviewed the income sheet and balance sheet. While we did not find any major red flags, we did identify two risk warnings that investors should be aware of. To view this information in more detail, we encourage potential investors to become registered users with GoodWhale. By doing so, they can access the full report and make an informed decision about whether ALUMETAL SA is the right investment for them. More…

Peers

Alumetal SA is competing in a highly competitive market against several other major players, including Kaiser Aluminum Corp, PT Alumindo Light Metal Industry Tbk, and Fujian Minfa Aluminium Co Ltd. All of these companies have strong footholds in the industry and are vying to be the market leader in aluminium production. In this dynamic and challenging landscape, Alumetal SA is striving to remain at the forefront of the industry through innovative strategies and high-quality products.

– Kaiser Aluminum Corp ($NASDAQ:KALU)

Kaiser Aluminum Corporation is a leading producer and distributor of semi-fabricated specialty aluminum mill products. With a market capitalization of $1.15 billion as of 2023, the company has established itself as a major player in the aluminum industry. Its Return on Equity (ROE) is 0.8%, which is an indication of its profitability and ability to generate returns for its shareholders. Kaiser also operates in five strategic business units: Aerospace & High Strength, Automotive & Commercial Transportation, Building & Construction, Industrial & Consumer, and Rolled Products. The company produces some of the highest quality aluminum products for a wide range of consumer and industrial applications.

– PT Alumindo Light Metal Industry Tbk ($IDX:ALMI)

Alumindo Light Metal Industry Tbk has a market cap of 938.74B as of 2023. Market capitalization is a measure of a company’s size and is calculated by multiplying the number of outstanding shares by the current price per share. Alumindo is a leading Indonesian producer and distributor of aluminium products, with operations that span across Indonesia, Thailand, and Myanmar. The company specializes in the production of primary aluminium ingots, foil and semi-finished products, as well as secondary aluminium products, including extrusion, sheet, and plate products. Alumindo also provides cutting, slitting and stamping services for aluminium products.

– Fujian Minfa Aluminium Co Ltd ($SZSE:002578)

Fujian Minfa Aluminium Co Ltd is a Chinese manufacturer and supplier of aluminum products and components. The company has a market cap of 3.83B as of 2023, indicating its size and market presence. Its Return on Equity of 2.48% is a measure of its management’s ability to generate profits from every dollar invested in the company. Fujian Minfa Aluminium Co Ltd produces a wide range of products including aluminum sheets, plates, coils, foils, tubes, and rods, as well as extruded parts, building profiles, industrial profiles, and heat sinks. The company primarily services the construction, automotive, and aviation industries.

Summary

ALUMETAL SA is a great choice for investors looking for dividend stocks. Over the past three years, the company has seen impressive annual dividends of 10.1 PLN per share, resulting in a dividend yield of 21.21%. This yield is above the average for the market and can provide investors with a steady stream of income. With a strong dividend record and the potential for further growth, ALUMETAL SA is an attractive choice for any investor looking for a reliable source of passive income.

Recent Posts