CORPORACIÓN AMÉRICA AIRPORTS S.A Reports Record Breaking Q4 Earnings of USD 7.6 Million, Up 130.9% YOY.

March 25, 2023

Earnings Overview

On March 22, 2023, CORPORACIÓN AMÉRICA AIRPORTS S.A ($NYSE:CAAP) announced its FY2022 Q4 financial results, which revealed total revenue of USD 7.6 million, a 130.9% jump compared to the same period in the previous year. Net income also rose significantly, with a 51.1% year-over-year increase to USD 372.6 million.

Transcripts Simplified

Chief Financial Officer, Carlota Vázquez: Thank you, Gerardo. This was mainly driven by organic growth as well as our recent acquisitions in Argentina and Chile. In response to the coronavirus pandemic, we have implemented numerous operational changes to ensure the safety and well-being of our passengers, employees and partners. We continue to closely monitor the situation and its impact on our business.

Carlota: Given the uncertainty around the pandemic, we are taking a prudent approach to managing our balance sheet and liquidity position. We remain confident that our long-term growth strategy will allow us to weather this difficult period. Thank you for joining us today and we look forward to providing updates on our progress in the coming quarters.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CAAP. More…

| Total Revenues | Net Income | Net Margin |

| 1.38k | 168.17 | 5.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CAAP. More…

| Operations | Investing | Financing |

| 302.63 | -5.31 | -234.29 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CAAP. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.84k | 2.97k | 3 |

Key Ratios Snapshot

Some of the financial key ratios for CAAP are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.0% | 0.3% | 25.7% |

| FCF Margin | ROE | ROA |

| 21.2% | 31.0% | 5.8% |

Stock Price

This impressive result drove the company’s stock to open at $9.1 but it closed at $9.2, down by 2.4% from the prior closing price of 9.4. The company attributed the successful fourth quarter result to various strategic investments and initiatives, including the expansion of its fleet, the modernization of its airports, and the diversification of its revenue sources. In addition to these investments, CORPORACIÓN AMÉRICA AIRPORTS S.A has also implemented cost-cutting initiatives that have enabled the company to reduce operating costs while increasing profitability.

The strong fourth quarter performance of CORPORACIÓN AMÉRICA AIRPORTS S.A reaffirms the company’s commitment to delivering value for shareholders. The recent results demonstrate the potential of the company’s growth strategy and its ability to generate strong returns for investors. Live Quote…

Analysis

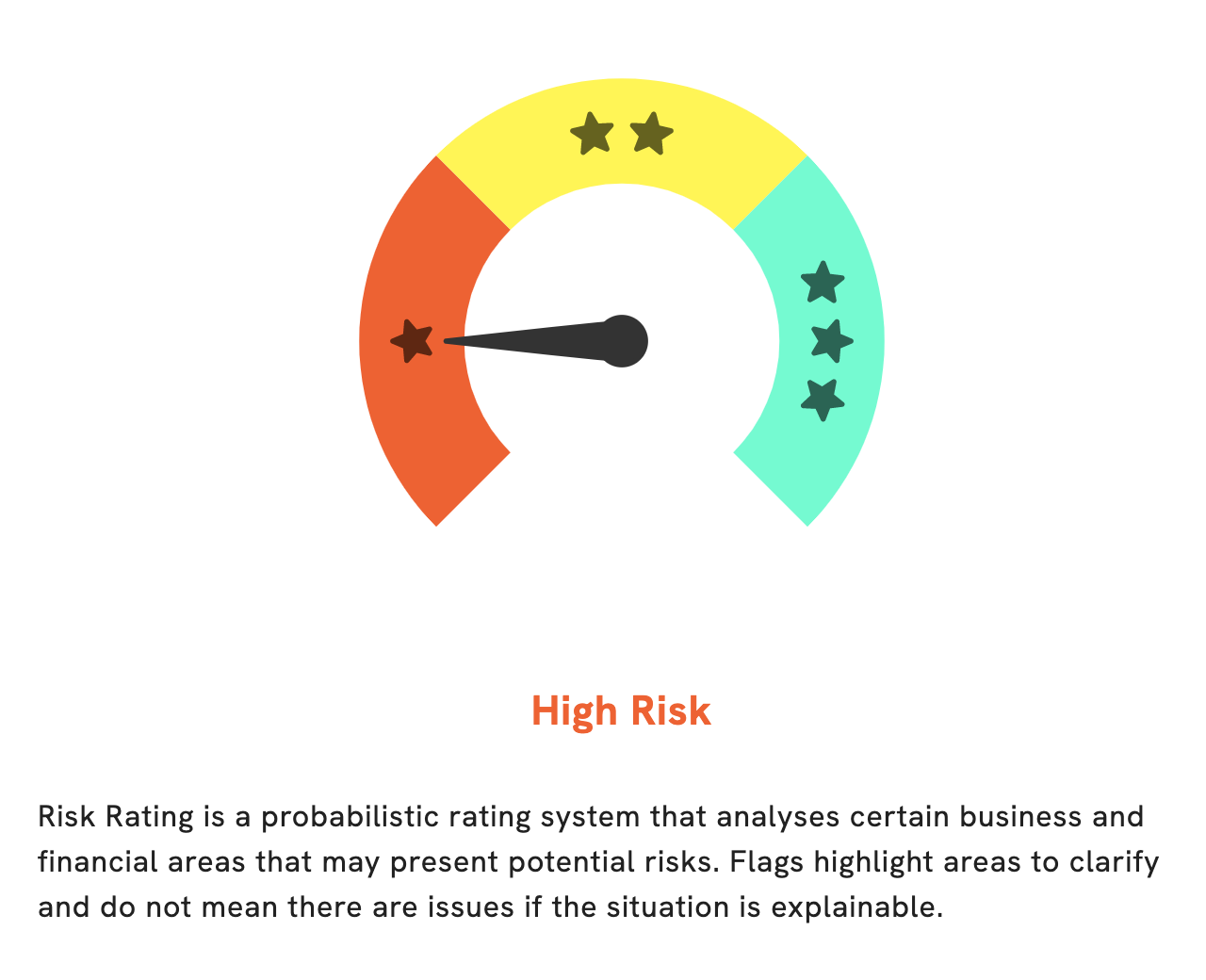

At GoodWhale, we recently ran an analysis on the wellbeing of CORPORACIÓN AMÉRICA AIRPORTS S.A. and based on our Risk Rating, this is a high risk investment in terms of financial and business aspects. After extensive research, we have uncovered two risk warnings in their income sheet and balance sheet. To see the full details on these warnings, become a registered user of GoodWhale. Our platform provides detailed information on the financial health of various companies in order to help you make informed decisions about where to invest. Sign up today and get access to the latest insights into CORPORACIÓN AMÉRICA AIRPORTS S.A. and more. More…

Peers

Its main competitors in the sector are easyJet PLC, ENAV SpA, and Grupo Aeroportuario del Sureste SAB de CV. All four of these companies strive to deliver the highest quality of services to passengers and cargo customers, with a commitment to meeting the needs of their customers.

– easyJet PLC ($LSE:EZJ)

easyJet PLC is a British low-cost airline carrier operating both domestic and international flights. The company is known for its competitive fares and efficient services, as well as its commitment to sustainability and green initiatives. easyJet PLC has a market capitalization of 3.62 billion GBP as of 2023, reflecting a year-on-year increase of almost 10%. In addition, the company’s Return on Equity (ROE) has been negative, at -1.63%, indicating that the company is underperforming its peers in terms of profitability. Despite this, easyJet remains one of the leading low-cost airlines in Europe and is well positioned to capitalize on increased air travel in the future.

– ENAV SpA ($BER:ENV)

TENAV SpA is an Italian company with a market capitalization of 2.11 billion as of 2023. The company specializes in the design, manufacturing, and installation of electrical instrumentation and automation systems for the oil, gas, and automotive industries. Its Return on Equity is 9.85%, which indicates that the company has managed to generate solid returns for its investors. The company is well-positioned in the industry and should continue to generate strong financial performance going forward.

– Grupo Aeroportuario del Sureste SAB de CV ($OTCPK:ASRMF)

Grupo Aeroportuario del Sureste SAB de CV is a Mexican airport operator based in Cancun, Mexico. As of 2023, the company has achieved a market capitalization of 8.8 billion dollars and a return on equity of 23.0%. The company’s primary business is the management and operation of 13 airports in the southeastern region of Mexico. Notable airports include Cancun International Airport, Cozumel International Airport, and Huatulco International Airport. The company also provides services such as air transportation, passenger service, cargo handling, and related activities at those airports.

Summary

CORPORACIÓN AMÉRICA AIRPORTS S.A had a strong fourth quarter in FY2022, reporting total revenue of USD 7.6 million, a 130.9% year-over-year increase. Net income increased 51.1% to USD 372.6 million, indicating increased efficiency and cost savings. This is a sign of potential long-term success and suggests that CORPORACIÓN AMÉRICA AIRPORTS S.A is poised for continued growth in the coming years. Investors should consider investing in CORPORACIÓN AMÉRICA AIRPORTS S.A as they will be able to benefit from its strong financial numbers and future growth potential.

Recent Posts