Blade Air Mobility Reports Record-Breaking Earnings and Revenue Figures

May 12, 2023

Trending News 🌥️

According to the company, their GAAP earnings per share of -$0.14 exceeded expectations by $0.07, and their revenue of $45.27M was higher than predicted by $5.92M. Blade Air Mobility ($NASDAQ:BLDE) is a global leader in aviation technology, offering a variety of innovative solutions that are transforming the industry. The company’s focus is on creating safe, efficient, and sustainable flight operations through their proprietary software, hardware, and platforms. Blade Air Mobility’s technology suite provides a comprehensive suite of digital services for pilots, aircraft operators, and air traffic control systems, enabling them to make better decisions and maximize their efficiency.

They also offer a range of services that helps airlines increase their operational performance, reduce costs, and enhance customer experience. With their cutting-edge technology and strong financial performance, Blade Air Mobility is quickly becoming one of the industry’s most trusted companies.

Price History

The company’s stock opened at $3.3 and closed at $3.1, a 7.3% increase from its previous closing price of $2.9. This was the highest stock performance BLADE AIR MOBILITY had seen in recent years and reflects the company’s strong financial standing. The remarkable opening price of $3.3 marked a new record high for the company and showed investors’ confidence in the company’s future outlook.

This spectacular growth indicates a bright future for the company, especially considering the uncertain economic climate. This strong performance bodes well for the future of the company and its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BLDE. More…

| Total Revenues | Net Income | Net Margin |

| 146.12 | -27.26 | -33.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BLDE. More…

| Operations | Investing | Financing |

| -37.13 | 79.34 | -1.08 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BLDE. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 325.02 | 50.54 | 3.83 |

Key Ratios Snapshot

Some of the financial key ratios for BLDE are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 67.3% | – | -36.6% |

| FCF Margin | ROE | ROA |

| -25.9% | -11.8% | -10.3% |

Analysis

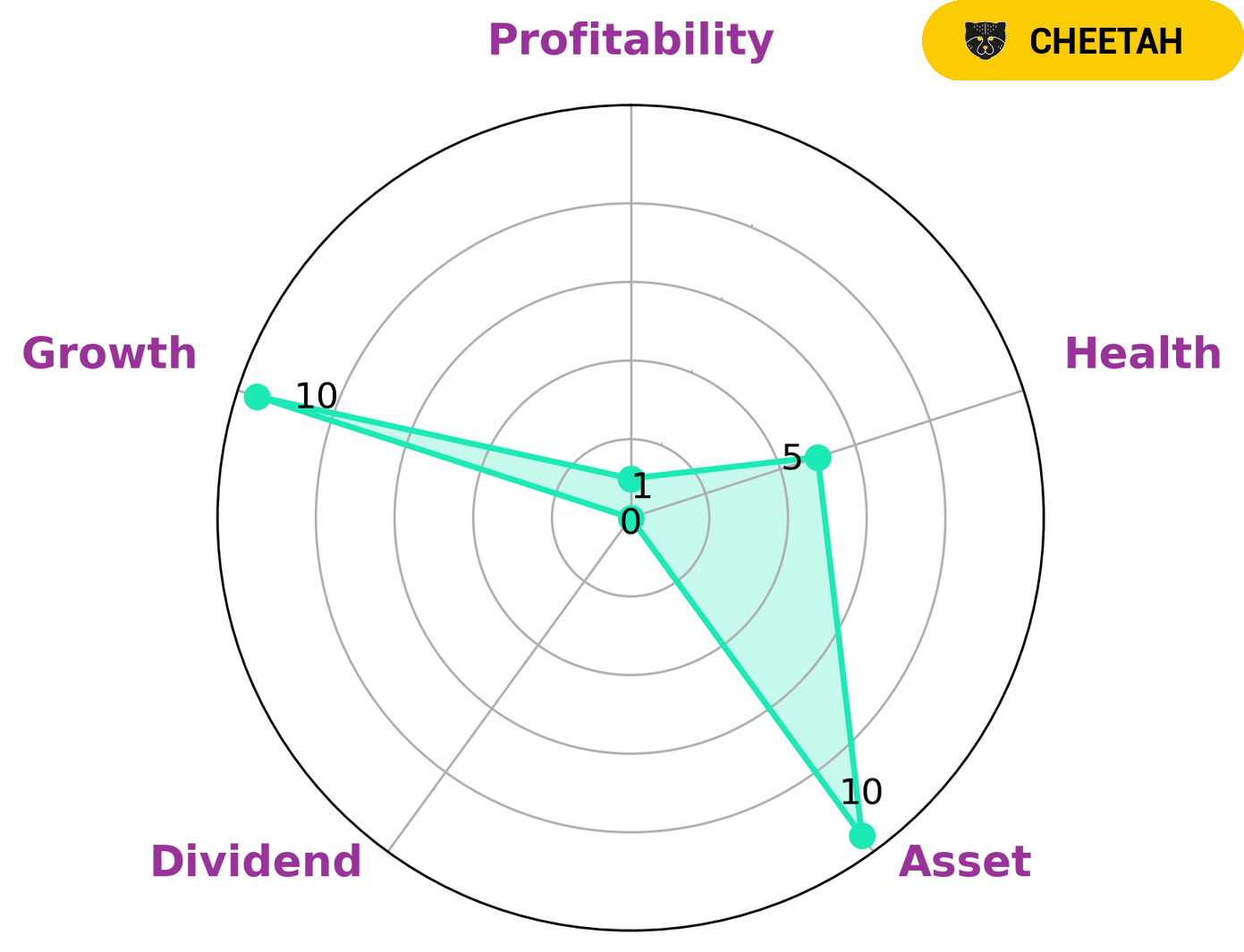

As part of our fundamental analysis of BLADE AIR MOBILITY, we used the GoodWhale Star Chart to measure the company’s health. Our analysis found that BLADE AIR MOBILITY has an intermediate health score of 5/10 with regard to its cashflows and debt, indicating that the company might be able to pay off debt and fund future operations. In terms of specific factors, BLADE AIR MOBILITY is strong in asset and growth, but weak in dividend and profitability. Based on these results, we classify BLADE AIR MOBILITY as a “cheetah” type of company; one that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. In light of these results, investors who are comfortable taking on a bit more risk may be interested in investing in BLADE AIR MOBILITY. Those investors who are looking for more stability may want to look elsewhere for their investments. More…

Peers

The competitive landscape in the commercial aviation industry is heating up, with a number of new entrants looking to grab a piece of the pie. One of the most aggressive players is Blade Air Mobility Inc, which is taking on established players such as Sun Country Airlines Holdings Inc, VietJet Aviation JSC, and Norwegian Air Shuttle ASA.

– Sun Country Airlines Holdings Inc ($NASDAQ:SNCY)

Sun Country Airlines Holdings Inc is a holding company for Sun Country Airlines, Inc., a Minnesota corporation. As of 2022, Sun Country Airlines operated scheduled passenger service on approximately 40 routes to destinations in the United States, Mexico, and the Caribbean. The Company’s average aircraft age is approximately 9.5 years old. The Company’s fleet consists of Boeing 737-700, 737-800, and 757-200 aircraft.

– VietJet Aviation JSC ($HOSE:VJC)

Norwegian Air Shuttle ASA is a Norwegian low-cost airline. The company is the third largest airline in Scandinavia. It offers a high quality, low-cost product to its passengers. The company has a strong financial position with a market cap of 6.89B and a ROE of 22.92%. Norwegian Air Shuttle ASA is a well-run company that is committed to providing its passengers with a safe, reliable, and comfortable travel experience.

Summary

Blade Air Mobility is an aviation company that specializes in on-demand air transportation services. Their recent earnings report revealed a surprising GAAP EPS of -$0.14, beating estimates by $0.07, and revenue of $45.27M, beating estimates by $5.92M. This news caused the stock price to move up the same day, making it an attractive option for investors.

The company has seen steady growth in the past year, with their innovative strategies and commitment to customer satisfaction. With a focus on safety and convenience at competitive prices, Blade Air Mobility is clearly a viable option for investors looking for an airline stock that has potential for substantial growth.

Recent Posts