Frontier Group Stock Fair Value – Citi Opens Positive Catalyst Watch on Frontier Group, Stock Rallies in Response

June 4, 2023

☀️Trending News

The Frontier Group ($NASDAQ:ULCC), a major airline based in North America, experienced a surge in stock prices after Citi initiated a positive catalyst watch on the company. Citi’s assessment of Frontier’s stock was that it held potential for long-term growth and success. With hubs in Denver, Las Vegas, and Philadelphia, Frontier is one of the top 10 largest airlines in the country.

This reflects investor confidence in the airline and is likely to encourage further investment in the company. With Citi’s optimistic outlook and the surge in stock prices, Frontier Group appears to be on a successful trajectory and is well-positioned for continued growth.

Share Price

The stock opened at $8.5 and closed at $9.1, soar by 10.5% from its previous closing price of 8.3. This single day increase in the stock price was due to the positive catalyst watch set by Citi, which highlighted the potential for further upside in the company’s stock. The news of Citi’s watch created a buzz among investors and traders, leading to a rally in FRONTIER GROUP‘s stock prices. It is safe to assume that the increased attention given by Citi has given FRONTIER GROUP’s stock the much-needed visibility and momentum that it needs in order to continue climbing in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Frontier Group. More…

| Total Revenues | Net Income | Net Margin |

| 3.57k | 71 | 2.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Frontier Group. More…

| Operations | Investing | Financing |

| -16 | -111 | 190 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Frontier Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.67k | 4.18k | 2.23 |

Key Ratios Snapshot

Some of the financial key ratios for Frontier Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.9% | -0.8% | 2.8% |

| FCF Margin | ROE | ROA |

| -4.1% | 12.7% | 1.4% |

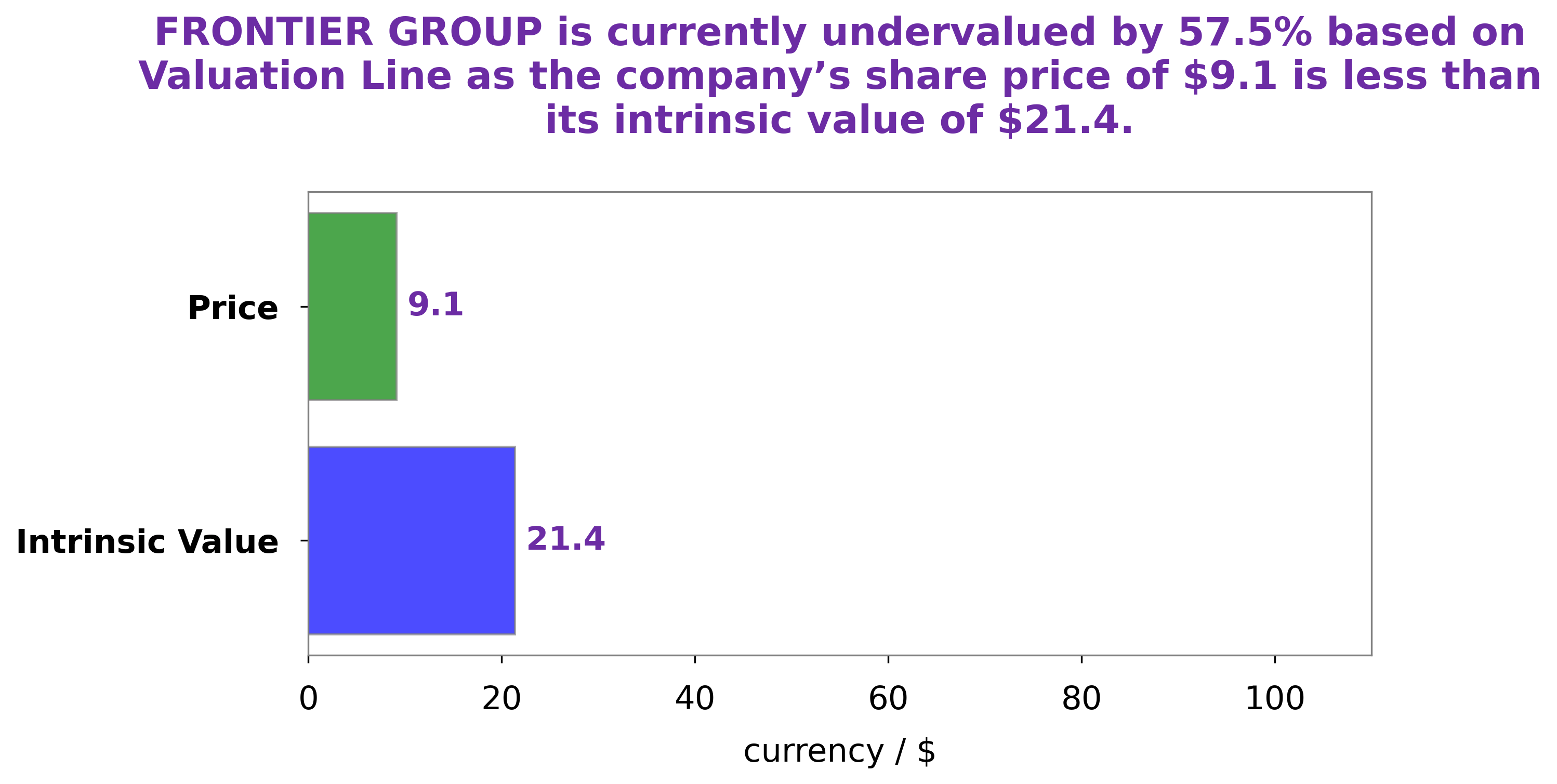

Analysis – Frontier Group Stock Fair Value

At GoodWhale, we have performed an analysis of FRONTIER GROUP‘s financials and our proprietary Valuation Line has calculated the fair value of a FRONTIER GROUP share at around $21.4. By comparison, the stock is currently trading at $9.1, which represents a 57.4% discount to its fair value. This strongly suggests that FRONTIER GROUP’s stock is significantly undervalued and presents an attractive long-term investment opportunity. More…

Peers

Frontier Group Holdings Inc is an airline holding company that owns and operates Frontier Airlines. The company was founded in 1994 and is headquartered in Denver, Colorado. Frontier Group Holdings Inc’s competitors include Spirit Airlines Inc, JetBlue Airways Corp, and Southwest Airlines Co.

– Spirit Airlines Inc ($NYSE:SAVE)

In 2022, Spirit Airlines had a market cap of 2.38 billion and a return on equity of -10.47%. The company is an American ultra-low-cost carrier, headquartered in Miramar, Florida. Spirit operates scheduled flights throughout the United States and in the Caribbean, Mexico, Latin America, and South America.

– JetBlue Airways Corp ($NASDAQ:JBLU)

As of 2022, JetBlue Airways Corp has a market cap of 2.42B and a Return on Equity of -8.81%. JetBlue Airways Corp is an airline company that operates in the United States. The company was founded in 1999 and is headquartered in New York, New York. JetBlue Airways Corp offers scheduled air service in the United States and the Caribbean. The company also provides cargo transportation services.

– Southwest Airlines Co ($NYSE:LUV)

Southwest Airlines Co is a publicly traded company with a market capitalization of $20.39 billion as of 2022. The company has a return on equity of 10.01%. Southwest Airlines Co is a low-cost carrier that operates in the United States. The company was founded in 1967 and is headquartered in Dallas, Texas.

Summary

Frontier Group is an airline stocks that has seen positive performance in the stock market recently. This performance was catalyzed by a positive watch from Citi, leading to an immediate rally in the stock price. Investment analysis has indicated that Frontier Group is a stock with potential for medium-term growth, with the airline industry showing signs of recovery. Investors should consider Frontier Group as a long-term investment, as it is expected to increase in price over time.

Recent Posts