Envestnet Asset Management Boosts Stock Holdings in Copa Holdings, S.A. by $1.33 Million

December 1, 2023

☀️Trending News

Envestnet Asset Management Inc. has recently boosted its stock holdings in Copa Holdings ($NYSE:CPA), S.A. by $1.33 million. Copa Holdings, S.A. is a full-service airline holding company, with its headquarters in Panama City, Panama. It is the parent company of Copa Airlines and Copa Airlines Colombia.

Stock Price

On Thursday, the price of COPA HOLDINGS stock opened at $92.6 and closed at the same amount, 0.5% higher than its closing price of 92.2 from the previous day. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Copa Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 3.43k | 414.69 | 16.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Copa Holdings. More…

| Operations | Investing | Financing |

| 979.66 | -438.98 | -481.19 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Copa Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.02k | 3.02k | 47.69 |

Key Ratios Snapshot

Some of the financial key ratios for Copa Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 37.4% | 1.1% | 19.5% |

| FCF Margin | ROE | ROA |

| 9.6% | 23.5% | 8.3% |

Analysis

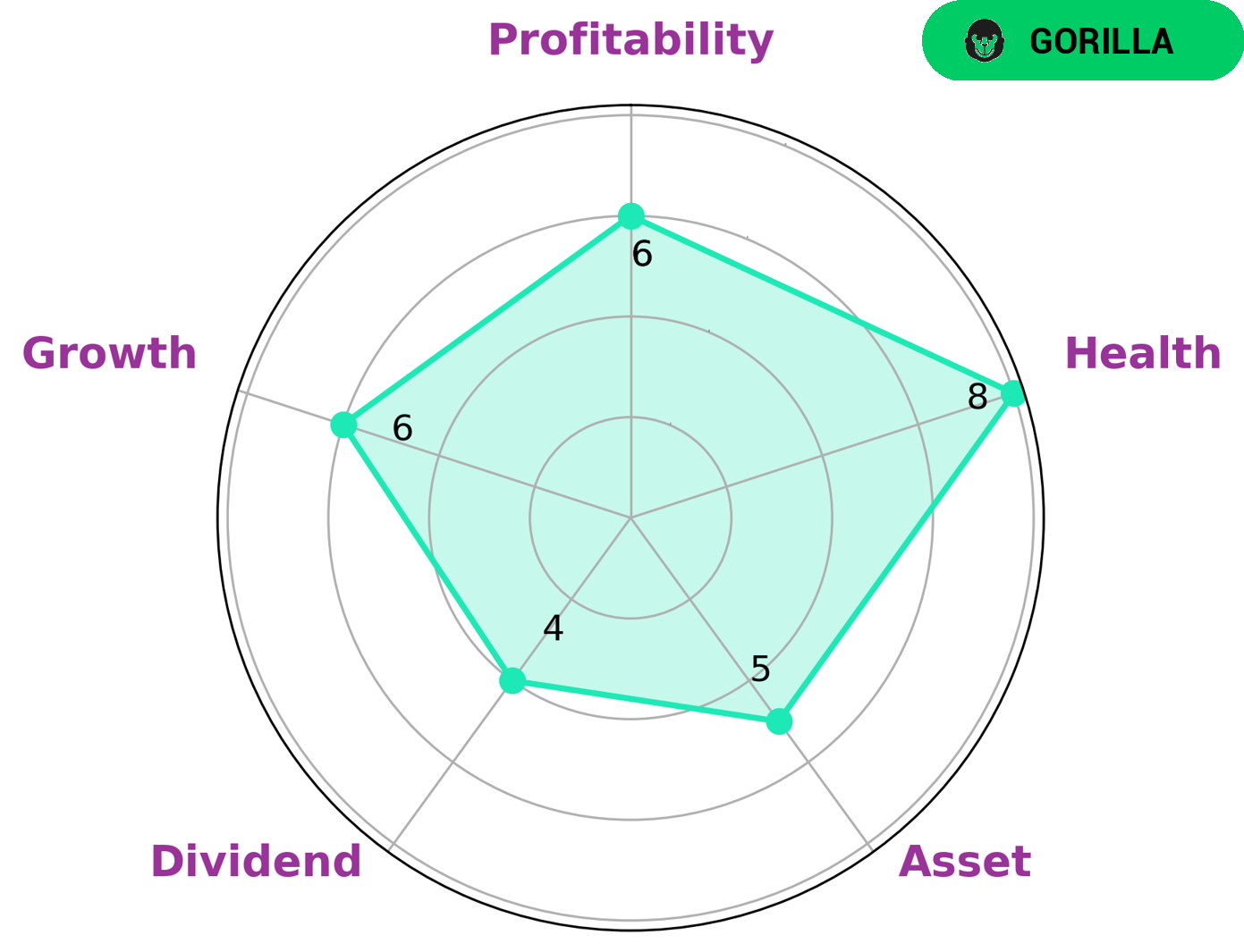

At GoodWhale, we have conducted a thorough analysis of COPA HOLDINGS‘s fundamentals. According to our Star Chart, COPA HOLDINGS is strong in asset, dividend, growth and profitability. Additionally, COPA HOLDINGS has a high health score of 8/10 which indicates that it is very capable in terms of cash flows and debt, able to pay off its debt and fund future operations. We have also classified COPA HOLDINGS as a ‘gorilla’, which is a type of company that we believe has achieved stable and high revenue or earning growth due to its strong competitive advantage. This makes COPA HOLDINGS an attractive pick for investors who are looking for a company with strong fundamentals and a competitive edge. More…

Peers

Through its operating companies, the Company provides passenger and cargo services. The Company operates approximately 80 daily flights to over 60 destinations in 30 countries in North, Central and South America and the Caribbean. The Company’s competitors include Grupo Aeromexico SAB de CV, Jin Air Co Ltd, ANA Holdings Inc.

– Grupo Aeromexico SAB de CV ($OTCPK:GRPAF)

Grupo Aeromexico SAB de CV is a Mexican airline company that provides scheduled air transportation services in Mexico and to various international destinations. It has a market cap of 1.23B as of 2022 and a Return on Equity of 67.02%. The company has a fleet of over 100 aircraft and operates over 600 daily flights.

– Jin Air Co Ltd ($KOSE:272450)

Founded in 1984, Jin Air Co Ltd is a South Korean airline company with a market cap of 618.4B as of 2022. The company has a Return on Equity of -79.32%. Jin Air operates scheduled and charter flights to domestic and international destinations and also offers cargo services.

– ANA Holdings Inc ($TSE:9202)

MGM Holdings Inc is a holding company that engages in the ownership and operation of resorts and casinos. The company has a market cap of 1.37T as of 2022 and a Return on Equity of -11.76%. The company operates resorts and casinos in the United States, China, and Macau.

Summary

Copa Holdings, S.A. is a company that holds stocks in the airline industry. Looking at the company’s competitive position, it holds a strong competitive edge in its market, and has been consistently improving its market share. The stock appears to be low risk and offers a moderate return on investment, making it attractive to investors.

Additionally, the stock’s P/E ratio is below industry average, further indicating a good value for potential investors. All in all, Copa Holdings appears to be an attractive stock for long-term investors looking for a moderate return.

Recent Posts