ALLEGIANT TRAVEL Reports Q4 Earnings Results for Period Ending December 31, 2022

March 31, 2023

Earnings Overview

For the fourth quarter of fiscal year 2022, ALLEGIANT TRAVEL ($NASDAQ:ALGT) reported total revenue of USD 52.5 million, a remarkable 390.4% increase from the same period in the previous year. Net income for the quarter also rose 23.1% to USD 611.5 million year-over-year. The figures were released on February 1 2023.

Transcripts Simplified

Allegiant Travel reported fourth quarter net income of $52.5 million. Excluding the 2022 employee recognition bonus and special charges related to Sunseeker, earnings per share was $3.17 in the quarter. Factors that drove the strong performance included strong demand, operational improvements, and a favorable fuel cost.

For 2023, Allegiant Travel expects full year airline only earnings per share of approximately $7, total CapEx of roughly $700 million, and induction of 7 A320 aircraft into the operating fleet throughout the year. The company plans to debt finance the bulk of its CapEx spend during 2023.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Allegiant Travel. More…

| Total Revenues | Net Income | Net Margin |

| 2.3k | 2.46 | 1.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Allegiant Travel. More…

| Operations | Investing | Financing |

| 303.05 | -491.42 | 33.12 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Allegiant Travel. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.51k | 3.29k | 67.34 |

Key Ratios Snapshot

Some of the financial key ratios for Allegiant Travel are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.7% | -29.7% | 4.7% |

| FCF Margin | ROE | ROA |

| -5.7% | 5.6% | 1.5% |

Share Price

ALLEGIANT TRAVEL reported its earnings results for the quarter ending December 31, 2022 on Wednesday. At the start of trading, the company’s stock opened at $85.1 and closed at $84.4, representing a 1.9% decrease from the previous closing price of 86.0. Although the earnings results fell short of analysts’ expectations, ALLEGIANT TRAVEL’s revenue was still up from the same period last year, indicating that the company is still performing well overall. The quarterly report also showed that the company had increased its cash reserves by approximately $1.5 billion, giving it greater financial flexibility to expand its operations and pursue new opportunities.

ALLEGIANT TRAVEL also announced that it had entered into an agreement with a major online travel platform to increase its market share in the travel industry. Overall, ALLEGIANT TRAVEL’s earnings report was somewhat disappointing, but the company’s long-term future appears to be bright. Management believes that the company’s strategic initiatives and investments in technology are setting it up for success in the coming years and will help it remain competitive in an ever-changing industry. Live Quote…

Analysis

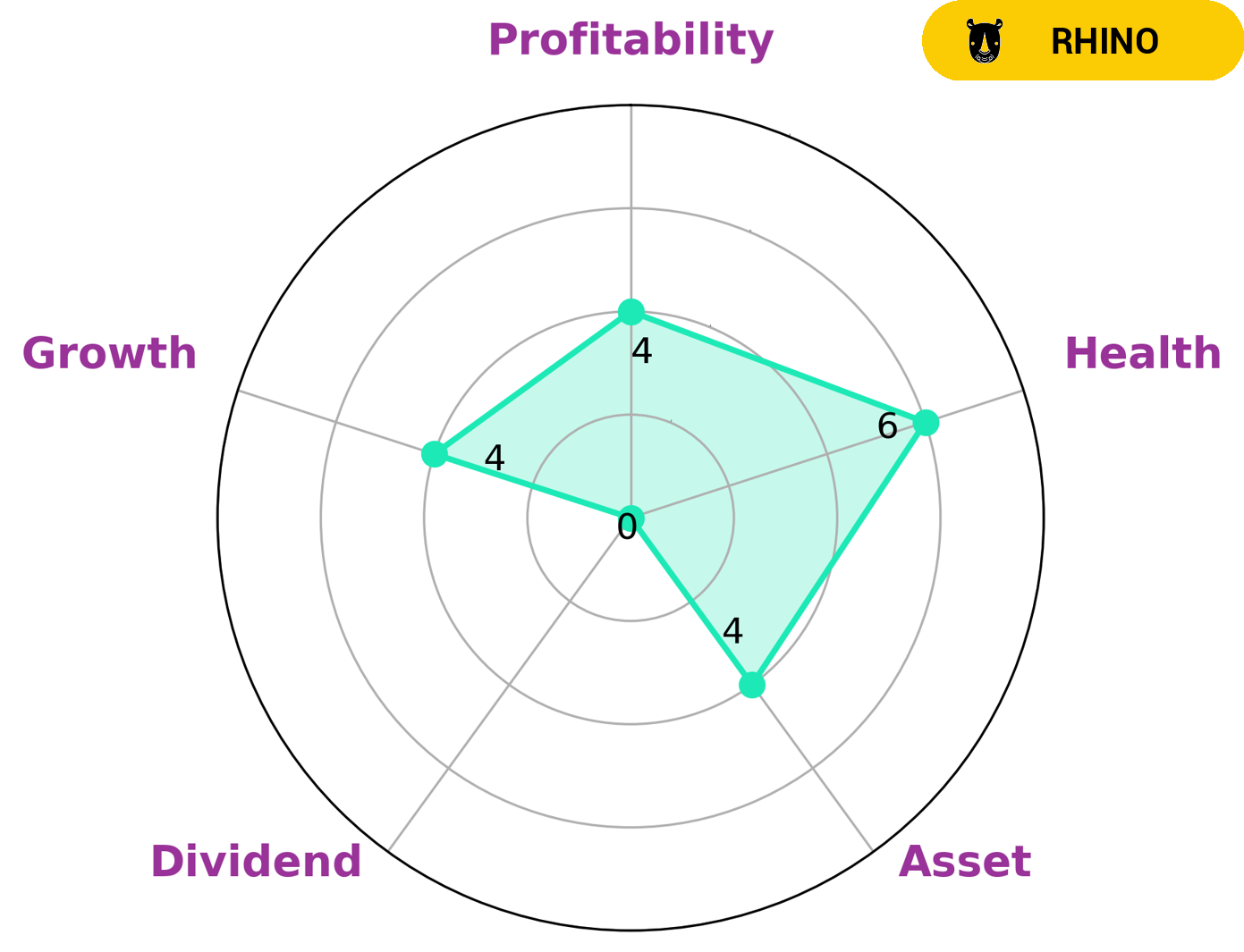

GoodWhale performed an analysis of ALLEGIANT TRAVEL‘s wellbeing and concluded that the company is classified as a ‘rhino’ – a type of company with moderate revenue or earnings growth. It is likely that investors interested in a moderate growth potential would be interested in ALLEGIANT TRAVEL. The company has an intermediate health score of 6/10 with regard to its cashflows and debt, indicating that it might be able to sustain future operations in times of crisis. In terms of its strengths, ALLEGIANT TRAVEL is strong in asset, medium in growth, profitability and weak in dividend. More…

Peers

The competition among Allegiant Travel Co, Korean Air Lines Co Ltd, Cebu Air Inc, and InterGlobe Aviation Ltd is fierce. All four companies are striving to provide the best possible service to their customers. Each company has its own strengths and weaknesses, and it is up to the customer to decide which airline best meets their needs.

– Korean Air Lines Co Ltd ($KOSE:003490)

Korean Air Lines Co Ltd is a major airline company headquartered in Seoul, South Korea. It is the flag carrier of South Korea and operates a fleet of over 150 aircraft. The company has a market cap of 7.89T as of 2022 and a Return on Equity of 20.57%. Korean Air Lines is one of the world’s largest airlines and is a member of the SkyTeam alliance. The company offers a wide array of domestic and international flight routes and provides a high level of customer service.

– Cebu Air Inc ($PSE:CEB)

Cebu Air Inc is a leading low-cost carrier in the Philippines. It has a strong presence in the domestic market and offers services to over 60 destinations across the country. The company has a market cap of 22.34B as of 2022 and a Return on Equity of -580.13%. Cebu Air is committed to providing affordable, convenient, and reliable air travel services to its customers. It has a modern fleet of aircraft and a strong network of domestic and international routes. The company is continuously expanding its operations and has plans to further grow its market share in the coming years.

– InterGlobe Aviation Ltd ($BSE:539448)

InterGlobe Aviation Ltd, the owner of India’s largest airline by market share, IndiGo, has a market cap of 672.27B as of 2022. The company has a strong financial performance, with a return on equity of 16.73%. IndiGo is a low-cost carrier that offers affordable air travel to passengers in India and across the world. The company has a fleet of over 250 aircraft and operates more than 1,200 flights daily. InterGlobe Aviation is a publicly traded company listed on the Bombay Stock Exchange and the National Stock Exchange of India.

Summary

Investors should take note of Allegiant Travel‘s impressive fourth quarter results. Total revenue increased significantly by 390.4% year-over-year while net income increased 23.1%. This represents an increase of 611.5 million USD in net income year-over-year.

The company’s performance suggests it is well-positioned for continued success in fiscal 2023. As such, investors interested in the travel industry should consider investing in Allegiant Travel due to its strong financials and potential for further growth.

Recent Posts