The Mosaic Company: A Hot Stock for Investors in 2023, with 1.54 Beta and 0.9 Million Traded Shares.

March 28, 2023

Trending News ☀️

The Mosaic Company ($NYSE:MOS) is a hot stock to watch in 2023, as its traded shares in the last session totaled 0.9 million and its beta value was 1.54. The amount of shares traded also reflects the stock’s popularity in the market. This could be an indication that the stock may be worth watching in the coming days and weeks.

Additionally, this could be an indication of the potential for short-term gains if the stock continues to be actively traded. For those looking to invest in a volatile stock that has seen significant activity in the recent session, The Mosaic Company may be worth considering.

Market Price

On Monday, MOSAIC opened at $43.2 and closed at $43.3, which was up by 2.1% from its prior closing price of $42.4. The company offers a variety of products, including fertilizers and industrial products, making it an attractive option for those who are looking for diversified investments.

In addition, the company has a strong dividend yield, making it an appealing option for those who are looking for an income stream as well as capital appreciation. MOSAIC also has a strong balance sheet, with a solid track record of profitability and strong cash flows. Furthermore, the company has been able to successfully navigate the changing market conditions, making it a reliable and resilient stock to invest in. With its strong fundamentals, high growth potential, and low volatility, it is a great choice for any investor looking to add a valuable asset to their portfolio. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mosaic Company. More…

| Total Revenues | Net Income | Net Margin |

| 19.13k | 3.58k | 18.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mosaic Company. More…

| Operations | Investing | Financing |

| 3.94k | -1.26k | -2.68k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mosaic Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 23.39k | 11.19k | 35.55 |

Key Ratios Snapshot

Some of the financial key ratios for Mosaic Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 29.0% | 135.3% | 25.2% |

| FCF Margin | ROE | ROA |

| 14.1% | 25.4% | 12.9% |

Analysis

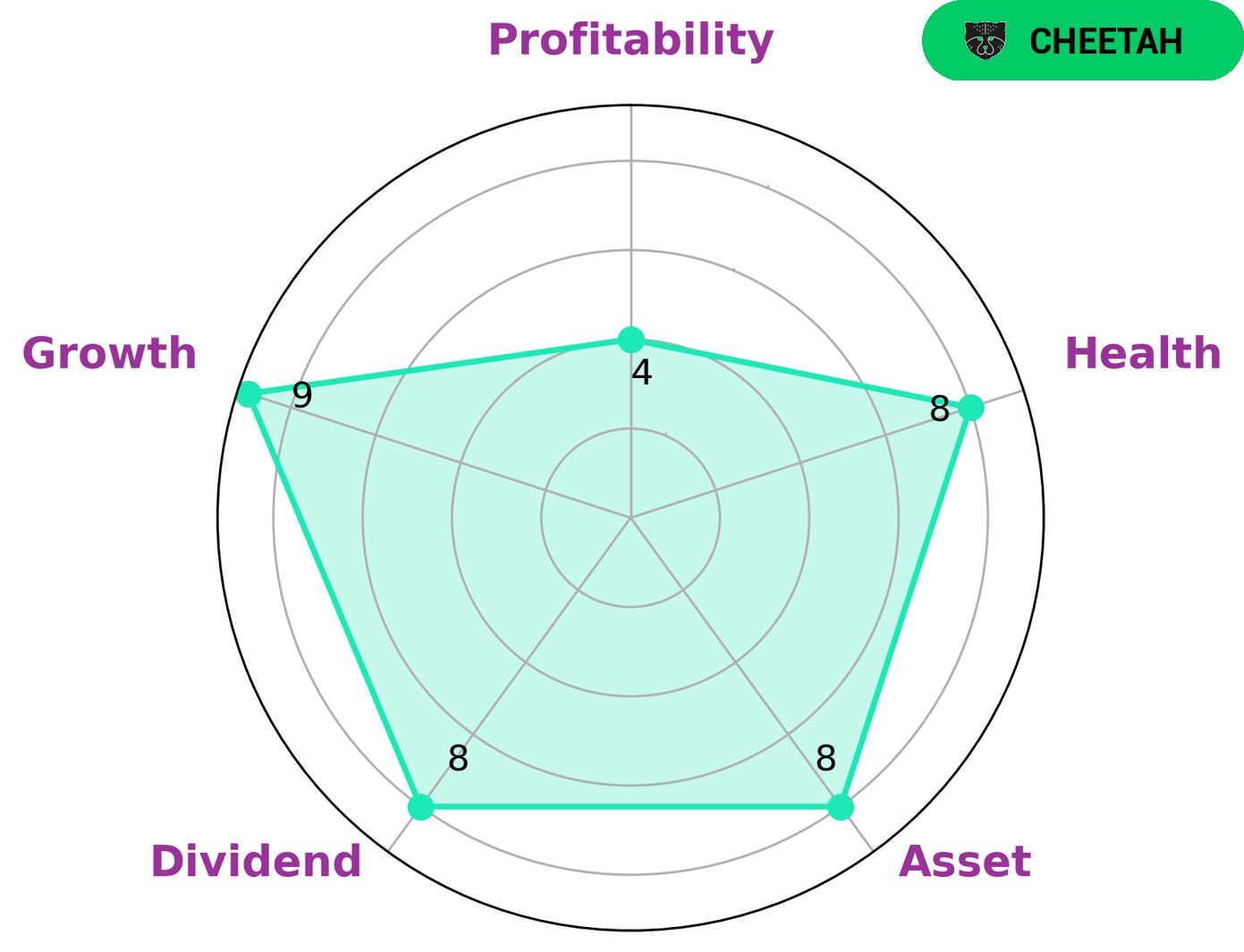

As GoodWhale conducted an analysis of MOSAIC COMPANY‘s wellbeing, we used the Star Chart classification system to categorize them as a ‘cheetah’ type company. These companies are known for achieving high revenue or earnings growth but are considered less stable due to lower profitability. Investors interested in companies of this type may be looking for high returns or growth opportunities. Upon further examination, MOSAIC COMPANY is strong in asset, dividend, and growth, and medium in profitability. Overall, MOSAIC COMPANY has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable to safely ride out any crisis without the risk of bankruptcy. This makes it a promising investment for those looking for high returns and potential growth opportunities. More…

Peers

The company operates mines, production facilities, and distribution centers in the United States, Canada, and South America. The Mosaic Co’s competitors include CF Industries Holdings Inc, Nutrien Ltd, Corteva Inc.

– CF Industries Holdings Inc ($NYSE:CF)

CF Industries Holdings, Inc. is a holding company. The Company, through its subsidiaries, is engaged in the manufacture and distribution of nitrogen fertilizers. It operates through two segments: Nitrogen Fertilizers and Nitrogen Fertilizer Intermediates. The Company’s nitrogen fertilizers include ammonia, granular urea, urea ammonium nitrate and ammonium nitrate. The Company produces nitrogen fertilizer intermediates, including nitric acid and soda ash. It also owns and operates a natural gas liquids (NGL) business, which consists of its equity investment in Grande Prairie Pipelines Limited Partnership (GPP), which owns and operates a 1,912-mile pipeline system that transports NGLs from western Canada to the United States Gulf Coast.

– Nutrien Ltd ($TSX:NTR)

Nutrien Ltd is a Canadian agricultural company that produces and distributes crop nutrients. It is the largest fertilizer company in the world with a market cap of 60.94B as of 2022. The company has a strong focus on sustainable agriculture and has a return on equity of 23.76%.

– Corteva Inc ($NYSE:CTVA)

Corteva Inc is a publicly traded company with a market capitalization of $45.19 billion as of 2022. The company has a return on equity of 5.63%. Corteva Inc is a leading provider of crop protection and seed products. The company’s products are used by farmers to improve crop yields and protect against pests and diseases. Corteva’s products are sold in more than 130 countries around the world.

Summary

Its past performance suggests that it is a relatively stable stock with a record of consistent returns. Fundamental analysis indicates that the company has strong financials and low debt levels, allowing for potential profitability. Technical analysis reveals that the stock is trading at a reasonable price with positive trends in the near future. The overall outlook for Mosaic Company is positive, making it an attractive pick for those looking to make investments.

Recent Posts