Scotts Miracle-gro Stock Fair Value – Advisor Group Holdings Invests $2.48 Million in The Scotts Miracle-Gro Company

June 8, 2023

🌥️Trending News

Advisor Group Holdings Inc. has made a major investment in The Scotts ($NYSE:SMG) Miracle-Gro Company. This is an exciting development in the world of business and finance. The Scotts Miracle-Gro Company is a leading global producer of lawn and garden products. The company is composed of four primary divisions: Global Consumer, U.S. Consumer, Hawthorne Gardening Company and Scotts LawnService. The Scotts Miracle-Gro Company is listed on the New York Stock Exchange (NYSE) under the ticker symbol “SMG”.

The company has an impressive portfolio of products within the lawn and garden industry, including soil, potting mix, grow mediums, fertilizers, grass seed, plant food, pest control products, outdoor cleaners, and other items. Moreover, the company has gained a lot of attention due to its innovative technology and products such as its Gro-Smart App and Gro-Tech Sensor, which helps customers maintain their yards and gardens with ease. The Scotts Miracle-Gro Company has become a popular investment among institutional investors due to its strong financials and its potential for growth. With the new investment from Advisor Group Holdings Inc., the company’s stock price should continue to rise as investors become more confident in the strength of the business.

Price History

The investment is expected to benefit both companies, as well as their shareholders, through increased visibility and access to new markets. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Scotts Miracle-gro. More…

| Total Revenues | Net Income | Net Margin |

| 3.74k | -619.2 | -1.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Scotts Miracle-gro. More…

| Operations | Investing | Financing |

| 446.7 | -48 | -390.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Scotts Miracle-gro. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.99k | 4.85k | 2.46 |

Key Ratios Snapshot

Some of the financial key ratios for Scotts Miracle-gro are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.0% | -41.5% | -17.0% |

| FCF Margin | ROE | ROA |

| 9.3% | -403.5% | -8.0% |

Analysis – Scotts Miracle-gro Stock Fair Value

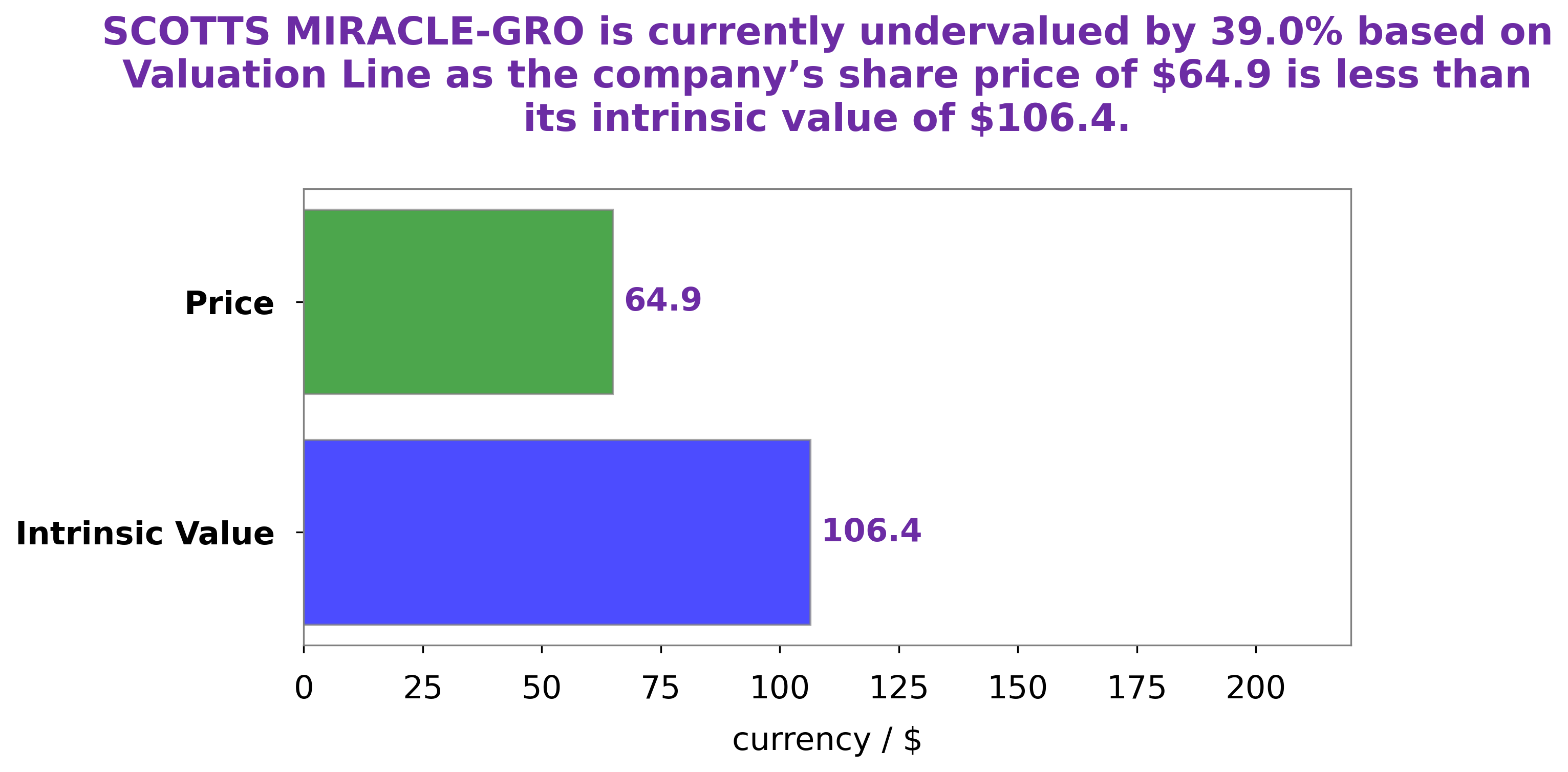

At GoodWhale, we analyzed SCOTTS MIRACLE-GRO‘s financials to determine the intrinsic value of its stock. After taking into account the company’s fundamentals, we calculated that the intrinsic value of each share of SCOTTS MIRACLE-GRO is around $106.4 using our proprietary Valuation Line. As of today, SCOTTS MIRACLE-GRO’s stock is trading at $64.9, representing a 39.0% discount to the intrinsic value of its stock. This indicates that SCOTTS MIRACLE-GRO’s stock is currently undervalued and presents an attractive opportunity for investors. More…

Peers

The Scotts Miracle Gro Co. is a leading manufacturer and marketer of consumer products for do-it-yourself lawn and garden care. The company’s products are sold under the brand names Scotts, Miracle-Gro and Ortho. Nutrien Ltd., Potash America Inc., and CF Industries Holdings Inc. are all major competitors in the lawn and garden care industry.

– Nutrien Ltd ($TSX:NTR)

Nutrien Ltd. is a Canadian retail and wholesale fertilizer company with operations in North and South America, Australia, and Asia. The company is the largest provider of crop inputs and services in the world. Nutrien Ltd. has a market cap of 58.31B as of 2022, a Return on Equity of 23.76%. The company’s retail operations include more than 1,700 retail locations across North America, South America, and Australia. The company’s wholesale operations include a network of distribution facilities in North America, South America, Asia, and Australia. Nutrien Ltd. also has a joint venture with Sinochem Group, one of the largest chemical companies in China.

– Potash America Inc ($OTCPK:PTAM)

Potash America Inc is a fertilizer company that produces and sells potash, a key ingredient in many fertilizers. The company has a market cap of 297.25k as of 2022 and a return on equity of 144.09%. Potash America Inc is a publicly traded company on the OTC markets.

– CF Industries Holdings Inc ($NYSE:CF)

CF Industries Holdings, Inc., through its subsidiaries, engages in the manufacture and distribution of nitrogen fertilizers, and other nitrogen products in North America. It operates through Ammonia, Granular Urea, UAN, AN, Other, and Phosphates segments. The company offers ammonia, granular urea, urea ammonium nitrate, and nitric acid products. It also produces phosphate-based fertilizers, including diammonium phosphate, monoammonium phosphate, and nitrogen phosphates. The company sells its products directly to retailers, farmers, and cooperatives, as well as through dealers and distributors. CF Industries Holdings, Inc. was incorporated in 1946 and is headquartered in Deerfield, Illinois.

Summary

Advisor Group Holdings Inc. recently revealed a stake worth $2.48 million in The Scotts Miracle-Gro Company, an American manufacturer and marketer of consumer lawn and garden products. This is a positive sign for investors looking to diversify into the lawn and garden industry. The company’s strategic acquisition of brands, such as Hawthorne Gardening and other smaller companies, has enabled them to expand their product offerings and boost sales. With their strong financial performance and a diversified portfolio of products, investors may find this company to be a good addition to their portfolios.

Recent Posts