Russell Investments Group Ltd. Increases Stake in Intrepid Potash,

February 14, 2023

Trending News 🌥️

Russell Investments Group Ltd., a global asset manager, has recently increased their stake in Intrepid Potash ($NYSE:IPI), Inc. Intrepid Potash is a premier producer and marketer of potash and langbeinite products in the United States. The company’s products are used in a variety of industries, including agriculture, chemical manufacturing, and oil and gas. As a result, Intrepid Potash has become a leader in the fertilizer industry. Intrepid Potash’s stock has been steadily rising since the announcement by Russell Investments Group Ltd. that they have increased their stake in the company. This news has been well-received among shareholders and analysts alike, as it shows that the company is growing and has strong potential for further growth in the future. Intrepid’s stock is expected to remain strong, as it has consistently outperformed the broader market. The company has also made significant investments in innovation, which has enabled them to produce high-quality potash products that are being used across various industries. This has resulted in increased demand for their products, as customers now have access to a wider range of options when it comes to potash products.

The company also has a strong focus on sustainability. Intrepid Potash has implemented a number of measures to improve the efficiency of their operations, reduce waste, and protect the environment. These efforts have been widely praised by stakeholders and have helped to further strengthen the company’s reputation in the industry. Overall, the news that Russell Investments Group Ltd. has increased their stake in Intrepid Potash is very positive for the company and its shareholders. The company’s products have been gaining in popularity and demand, and the company has been investing heavily in innovation and sustainability. With this news, investors can expect to see continued growth in the company’s stock price in the coming months.

Share Price

On Monday, news broke that Russell Investments Group Ltd. has increased their stake in Intrepid Potash, Inc., a leading US-based producer and marketer of potash and langbeinite products. At the time of writing, the market sentiment surrounding the news was mostly positive. When markets opened on Monday, Intrepid Potash stock opened at $33.0, but closed at $32.2 at the end of the day. This represented a 2.1% drop from their previous closing price of $32.9. The decrease in the stock price was likely due to the overall market sentiment of sell-offs across the industry. Despite the slight drop in stock price, Intrepid Potash’s long-term outlook is still largely positive due to their superior production capabilities and strategic partnerships with many leading companies in the potash and langbeinite industry.

Recent reports from the company suggest that their sales and earnings are expected to remain high in the upcoming quarters. The increased stake from Russell Investments Group Ltd. could be seen as a vote of confidence in Intrepid Potash’s potential future performance. If they continue to execute well on their strategic plans, Intrepid Potash can expect to see gains in the coming months and years. Overall, Intrepid Potash’s future prospects are looking bright, and investors should take notice. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Intrepid Potash. More…

| Total Revenues | Net Income | Net Margin |

| 342.72 | 292.1 | 85.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Intrepid Potash. More…

| Operations | Investing | Financing |

| 88.76 | -56.84 | -8.47 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Intrepid Potash. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 807.91 | 79.44 | 55.21 |

Key Ratios Snapshot

Some of the financial key ratios for Intrepid Potash are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.0% | 67.8% | 30.9% |

| FCF Margin | ROE | ROA |

| 12.9% | 9.1% | 8.2% |

Analysis

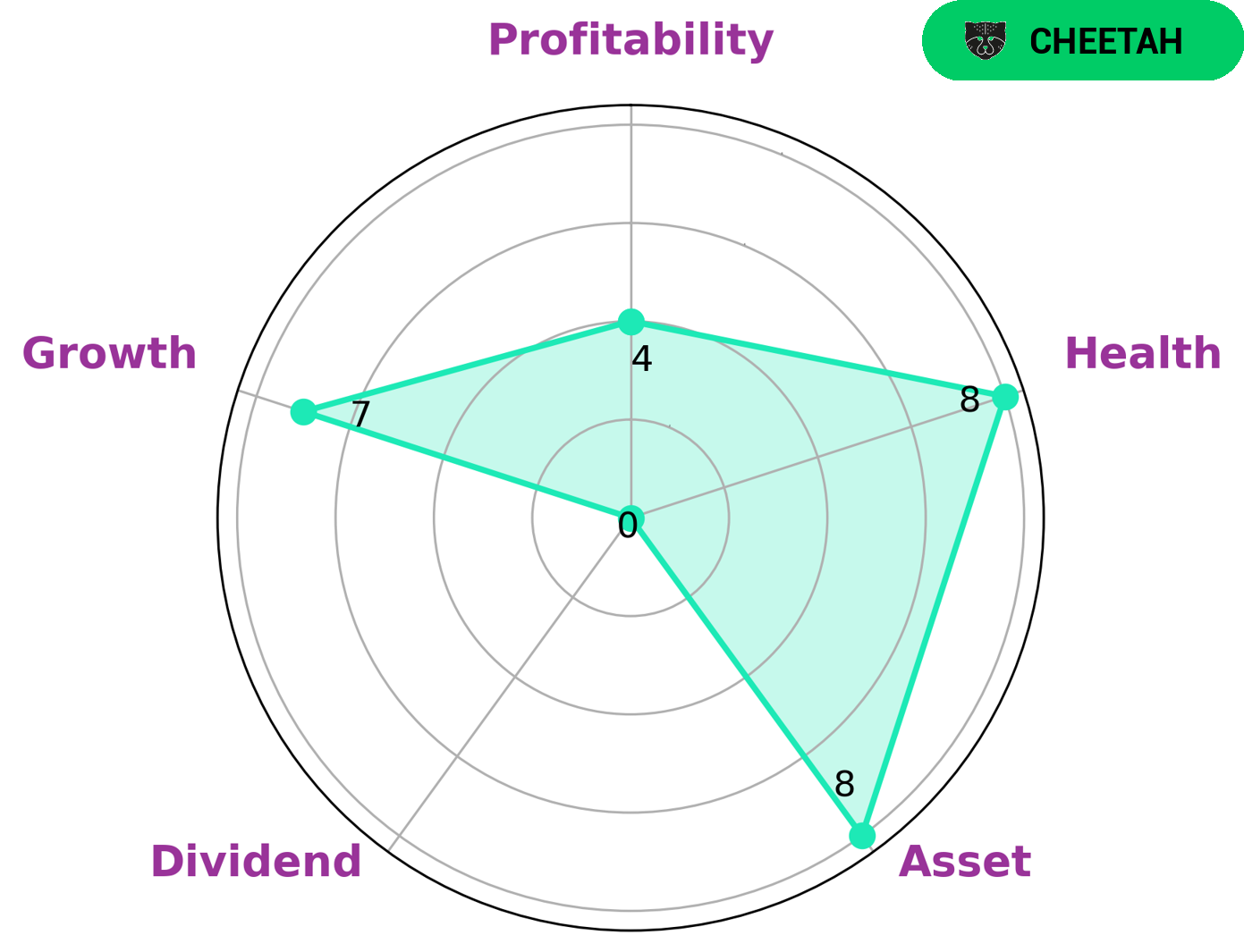

GoodWhale conducted an analysis of INTREPID POTASH‘s wellbeing. The Star Chart showed that INTREPID POTASH is strong in assets and growth, medium on profitability and weak on dividend. Overall, INTREPID POTASH is classified as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to its lower profitability. Given this profile, investors who look for companies that provide high growth potential may be interested in INTREPID POTASH. This is especially true for investors who are comfortable taking on higher risks for potentially higher returns. Additionally, the company has a high health score of 8/10 considering its cashflows and debt capabilities. This shows that INTREPID POTASH is able to sustain future operations in times of crisis. Overall, INTREPID POTASH appears to be an interesting investment opportunity for investors with a higher risk appetite. While its profitability may not be as established as other companies, it may still present an opportunity to gain exposure to a company with potential high growth. Investors should, however, consider the risks involved when investing in a company like INTREPID POTASH. More…

Peers

The company produces potash, a key ingredient in fertilizers, through solution mining and conventional underground mining. Tessenderlo Group NV, Shenzhen Batian Ecotypic Engineering Co Ltd, and Rosier SA are all competitors in the potash industry.

– Tessenderlo Group NV ($LTS:0KCP)

Tessenderlo Group is a Belgian chemical company with a focus on specialty chemicals, agro solutions, and industrial solutions. The company has a market cap of 1.33B as of 2022 and a return on equity of 16.08%. Tessenderlo Group is a leading player in its field and has a strong presence in Europe, North America, and Asia. The company’s products are used in a wide range of industries, including agriculture, construction, automotive, and food and beverage.

– Shenzhen Batian Ecotypic Engineering Co Ltd ($SZSE:002170)

Shenzhen Batian Ecotypic Engineering Co Ltd is a Chinese company that specializes in the design and construction of ecological engineering projects. The company has a market cap of 4.57B as of 2022 and a Return on Equity of 3.84%.

– Rosier SA ($LTS:0EBW)

Rosier SA is a French company that specializes in the manufacture of automotive parts and accessories. The company has a market capitalization of 50.78 million as of 2022 and a return on equity of 64.04%. The company’s products are sold through a network of retailers and distributors in France and other European countries. Rosier SA is a publicly traded company listed on the Euronext Paris Stock Exchange.

Summary

Investors in Intrepid Potash, Inc. have been taking notice as Russell Investments Group Ltd. recently increased their stake in the company. This news has boosted optimism among shareholders as the markets appear to be reacting positively to the news. Intrepid Potash is a leading producer of potassium chloride, or muriate of potash (MOP), which is used in fertilizer and other industrial processes, as well as producing specialty products such as Trio®.

The company has been actively looking for investments with the potential to increase shareholder value. Analysts suggest that investors should keep an eye on Intrepid Potash, Inc. as the company continues to pursue growth opportunities.

Recent Posts