NUFARM LIMITED Reports Second Quarter Earnings Results for Financial Year 2023

June 3, 2023

🌧️Earnings Overview

On May 18, 2023, NUFARM LIMITED ($ASX:NUF) released their financial results for the second quarter of their 2023 fiscal year (ending March 31, 2023), which showed total revenue down by 9.7% year-over-year to AUD 1954.6 million and net income up 51.0% to AUD 149.0 million.

Market Price

The stock opened at AU$5.8 and closed at AU$6.0, soaring by 14.2% from the last closing price of AU$5.3. This impressive move in the stock price represents the confidence of investors who are betting on the company’s growth prospects. The earnings report highlighted strong growth for NUFARM LIMITED in the second quarter. NUFARM LIMITED has been investing in research and development to ensure continued success in the future. The company is also looking to expand its presence in international markets, particularly in Asia and Europe, which could lead to further growth in the coming quarters.

Overall, the second quarter earnings report was a positive signal for NUFARM LIMITED. Investors are optimistic about the company’s continued success and they have responded positively to the news by pushing up the stock price. It will be interesting to see how the company performs as it moves forward from this point. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nufarm Limited. More…

| Total Revenues | Net Income | Net Margin |

| 3.56k | 157.76 | 4.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nufarm Limited. More…

| Operations | Investing | Financing |

| -133.93 | -283.23 | 264.56 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nufarm Limited. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.31k | 2.97k | 6.15 |

Key Ratios Snapshot

Some of the financial key ratios for Nufarm Limited are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.9% | -41.3% | 7.1% |

| FCF Margin | ROE | ROA |

| -9.1% | 7.0% | 3.0% |

Analysis

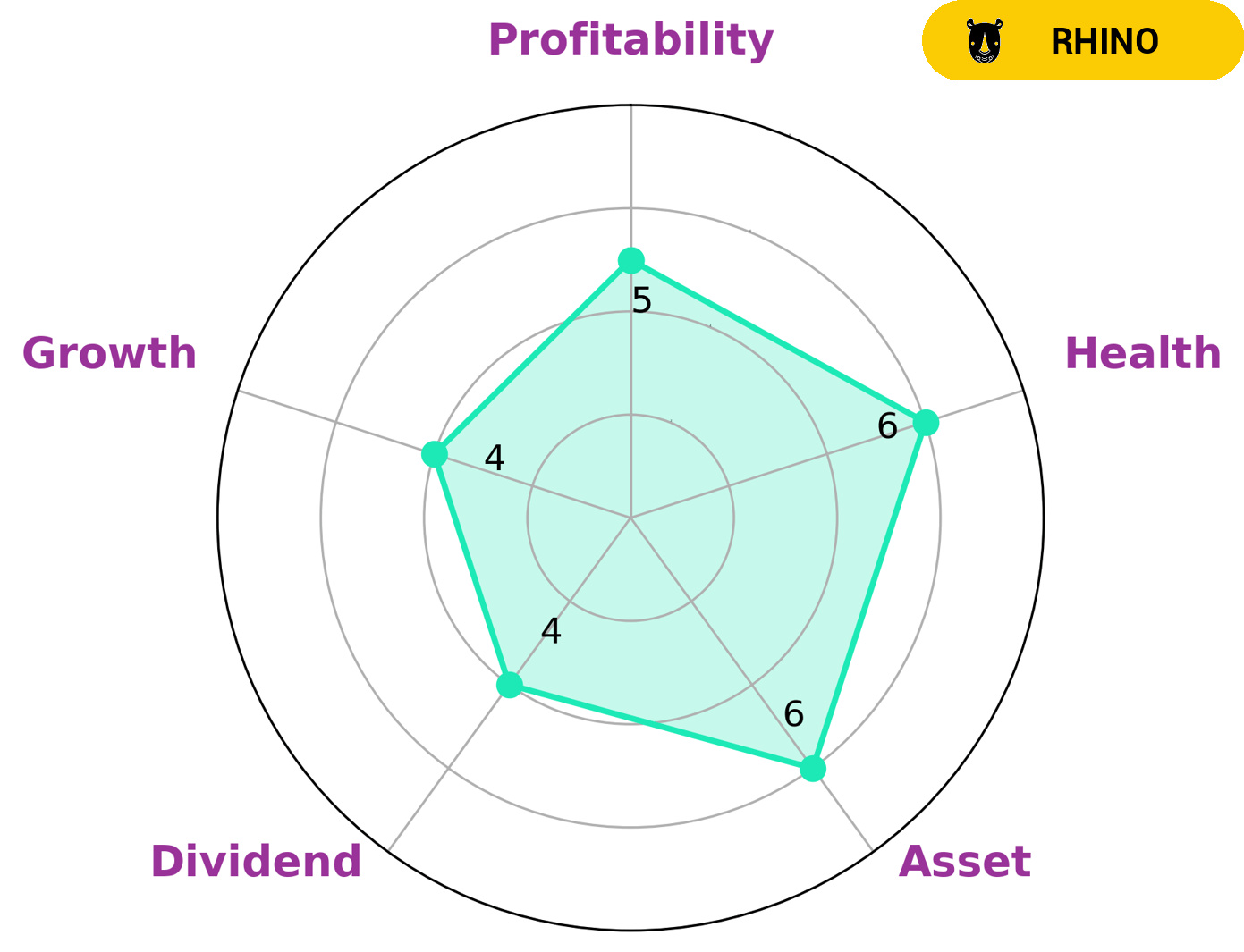

GoodWhale conducted an analysis of NUFARM LIMITED‘s wellbeing and based on the Star Chart, classified NUFARM LIMITED as a ‘rhino’ type of company. This is a company we conclude has achieved moderate revenue or earnings growth. As such, investors looking for a company that has moderate growth may be interested in NUFARM LIMITED. Specifically, NUFARM LIMITED is strong in cashflows and debt, and medium in asset, dividend, growth, and profitability. With an intermediate health score of 6/10, NUFARM LIMITED is likely to pay off its debt and fund future operations. More…

Peers

Nufarm Ltd is an Australian agricultural chemicals company. It is a leading supplier of crop protection products and services in Australia and New Zealand. The company has a strong presence in Asia, Latin America, and Africa. Nufarm Ltd’s main competitors are Kiwa Bio-Tech Products Group Corp, BioNitrogen Holdings Corp, and Equippp Social Impact Technologies Ltd.

– Kiwa Bio-Tech Products Group Corp ($OTCPK:KWBT)

Kiwa Bio-Tech Products Group Corp is a Chinese company that produces and sells organic fertilizer products. The company has a market capitalization of $56.48 million and a negative return on equity of 5.54%. Kiwa Bio-Tech Products Group Corp’s products are designed to improve the quality of soil and promote plant growth. The company’s products are used by farmers and gardeners in China and around the world.

– BioNitrogen Holdings Corp ($OTCPK:BIONQ)

Equippp Social Impact Technologies Ltd is a technology company that provides solutions for social impact. The company offers a range of services, including social media management, website design, and data analysis. It has a market cap of 4.02B as of 2022 and a return on equity of -23.29%. The company’s products and services are used by a variety of organizations, including nonprofits, government agencies, and businesses.

Summary

Nufarm Limited reported their earnings results for the second quarter of their financial year 2023 on May 18, 2023. Total revenue decreased by 9.7%, however net income increased by a significant 51.0%. This was reflected positively in the stock price, which moved up on the same day. For potential investors, the key points to consider are the performance of the company over the last quarter and their financials in comparison to competitors.

Additionally, it is important to evaluate the company’s growth strategy and future objectives. The current environment should also be taken into account when making an investment decision. By carefully analyzing these aspects, investors can make an informed decision about the potential benefits of investing in Nufarm Limited.

Recent Posts