Insiders Invest Heavily in Nufarm Limited, Encouraging Development Last Year

December 28, 2022

Trending News ☀️

Nufarm Limited ($ASX:NUF) is an Australian-based agrochemical and seed company, specializing in products designed to improve crop yields and protect crops from pests, weeds, and diseases. It is a publicly traded company listed on the Australian Securities Exchange (ASX). Last year, Nufarm Limited had an encouraging development with insiders investing heavily in the company’s stock. Insiders are those who are closely associated with the company, such as its directors, senior management, and major shareholders. Analysts have cited several factors that have contributed to the encouraging development of Nufarm Limited last year.

First, the company has been expanding its operations into new markets and boosting its customer base. This has helped to diversify its revenue streams and increase profitability. Second, Nufarm Limited has been making strategic acquisitions in the agrochemical and seed industry, which has helped to strengthen its market position. Finally, the company has been investing heavily in research and development, which has led to new products and improved product quality. The company reported a strong increase in revenue and net profit compared to the previous year. The company also saw its gross margin expand and its dividend payout ratio increase significantly. These positive results indicate that the company is in a strong position to continue its growth trajectory in the coming years. The fact that insiders are investing heavily in Nufarm Limited’s stock is an encouraging sign for investors. It suggests that those closest to the company’s operations have faith in its future prospects. Therefore, it may be a good time for investors to consider adding some Nufarm Limited shares to their portfolios.

Price History

At the time of writing, news sentiment surrounding Nufarm Limited has been largely positive. On Tuesday, Nufarm Limited’s stock opened at AU$6.2 and closed at AU$6.1, down by 1.0% from its previous closing price of 6.1. This drop was not an indication of the company’s performance, however, as it has seen steady growth over the course of the year. Insiders at Nufarm Limited have been taking advantage of the company’s growth and have been investing heavily in its stock. This trend has been encouraging, as it shows that those closest to the company believe in its future potential. It also indicates that their confidence in the company’s ability to reach new heights is high.

The company’s success has also been backed up by recent financial results, with a steady increase in sales and profits. This has been further bolstered by strong customer feedback, as Nufarm Limited has consistently improved its products and services to satisfy customers’ needs. Overall, this news is encouraging for investors and shareholders alike, as it shows that Nufarm Limited is on the right track for continued success in the future. With the company’s stock currently trading at AU$6.1, there could be an opportunity for those looking to invest in a stable and growing company. With insiders investing heavily in the company, it looks like Nufarm Limited is on track for further development over the course of 2021 and beyond. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nufarm Limited. More…

| Total Revenues | Net Income | Net Margin |

| 3.77k | 107.44 | 2.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nufarm Limited. More…

| Operations | Investing | Financing |

| 359.57 | -240.41 | -264.37 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nufarm Limited. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.66k | 2.51k | 5.66 |

Key Ratios Snapshot

Some of the financial key ratios for Nufarm Limited are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.1% | -41.3% | 5.4% |

| FCF Margin | ROE | ROA |

| 5.3% | 5.9% | 2.7% |

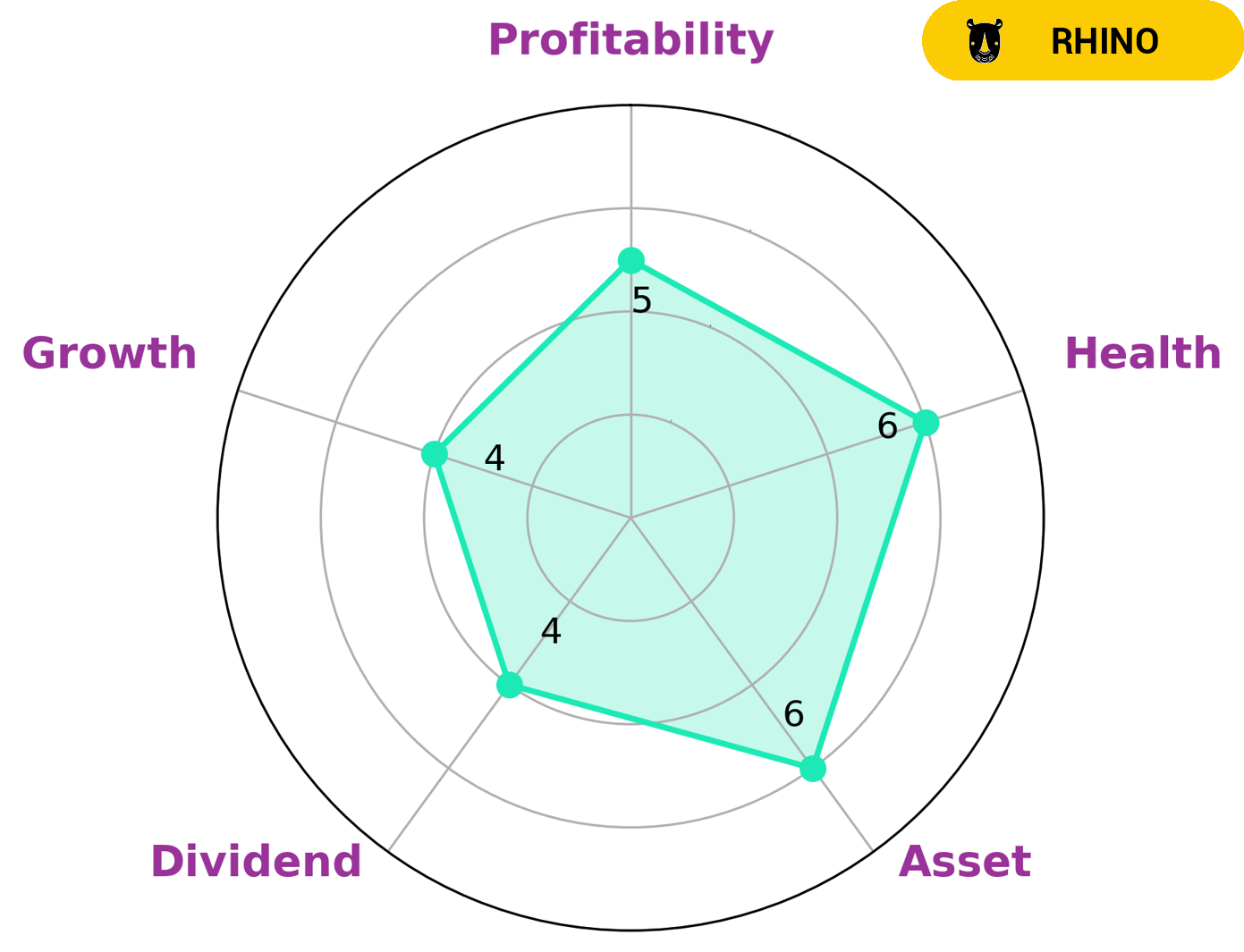

VI Analysis

According to the VI Star Chart, the company is strong in terms of asset, dividend, growth, and profitability. It has an intermediate health score of 6/10 based on its cashflows and debt, showing that it may be able to pay off debt and fund future operations. NUFARM LIMITED is classified as a ‘rhino’—a type of company that has achieved moderate revenue or earnings growth. Investors who may be interested in such a company are those looking for stability and low-risk investments. They may also be attracted to companies with strong fundamentals who are likely to continue growing in the future. Additionally, investors who value dividends and steady returns may find NUFARM LIMITED to be an ideal investment. Overall, NUFARM LIMITED is a company that has potential to become a great investment opportunity due to its strong fundamentals and moderate revenue growth. The company’s intermediate health score highlights its potential to pay off debt and grow in the future. Investors looking for low-risk investments with the potential for steady returns and dividends may find it to be a suitable option. More…

VI Peers

Nufarm Ltd is an Australian agricultural chemicals company. It is a leading supplier of crop protection products and services in Australia and New Zealand. The company has a strong presence in Asia, Latin America, and Africa. Nufarm Ltd’s main competitors are Kiwa Bio-Tech Products Group Corp, BioNitrogen Holdings Corp, and Equippp Social Impact Technologies Ltd.

– Kiwa Bio-Tech Products Group Corp ($OTCPK:KWBT)

Kiwa Bio-Tech Products Group Corp is a Chinese company that produces and sells organic fertilizer products. The company has a market capitalization of $56.48 million and a negative return on equity of 5.54%. Kiwa Bio-Tech Products Group Corp’s products are designed to improve the quality of soil and promote plant growth. The company’s products are used by farmers and gardeners in China and around the world.

– BioNitrogen Holdings Corp ($OTCPK:BIONQ)

Equippp Social Impact Technologies Ltd is a technology company that provides solutions for social impact. The company offers a range of services, including social media management, website design, and data analysis. It has a market cap of 4.02B as of 2022 and a return on equity of -23.29%. The company’s products and services are used by a variety of organizations, including nonprofits, government agencies, and businesses.

Summary

Investors have shown a strong interest in Nufarm Limited with substantial investments made in the company over the past year. This has been an encouraging sign for the development of the company. At the time of writing, overall sentiment towards the stock is largely positive. Analysts have noted that Nufarm is a sound investment, citing its strong financial performance, excellent management team, and diversified portfolio.

The company has a robust balance sheet and a track record of delivering value to shareholders. The stock also offers potential for capital appreciation, as well as a healthy dividend yield. With this in mind, investors may find value in investing in Nufarm Limited.

Recent Posts