China XLX Fertiliser Offers Impressive Returns in 2023 – Take a Look Under the Bonnet!

March 19, 2023

Trending News ☀️

China ($SEHK:01866) XLX Fertiliser is set to revolutionize the farming industry in 2023, offering impressive returns for investors. Taking a closer look under the bonnet of China XLX Fertiliser reveals a number of key benefits that make this product stand out from the competition. The product is developed using advanced technology to create a fertilizer that is both effective and environmentally friendly. It works by delivering a blend of organic matter and macro-nutrients to the soil, providing optimum plant nutrition and improved crop yields. This is combined with low levels of runoff, meaning that fewer fertilizers are required to maintain healthy soil. It is available at an affordable price, making it an attractive investment for farmers looking to improve their yield and profitability.

Additionally, its easy-to-use form makes it simple for users to apply the fertilizer with minimal effort. With its advanced technology, cost-effectiveness, and easy-to-use form, it is sure to revolutionize the farming industry and become the go-to choice for many farmers.

Share Price

The media’s attention has mostly been positive for China XLX Fertiliser, and the stock opened at and closed at HK$4.0 on Wednesday, representing a decrease of 0.3% from the prior closing price. This company has generated impressive returns in 2023, so it is worth taking a look under the bonnet to see what it’s all about. Investors were impressed with the company’s financial performance in the first half of 2023. The company also reported an increase in sales, which further reflects its potential to generate additional income in the near future. The company has been expanding its operations into countries such as India, Vietnam, and the Philippines, which helps to boost its income and market share.

The company’s management team has also been lauded for its commitment to sustainability and responsible business practices. The team ensures that no resources are wasted and that the environment is protected while still producing high quality products. Its impressive returns in 2023, combined with its commitment to sustainability and social responsibility, make it an attractive option for investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for China Xlx Fertiliser. More…

| Total Revenues | Net Income | Net Margin |

| 21.46k | 1.61k | 7.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for China Xlx Fertiliser. More…

| Operations | Investing | Financing |

| 2.72k | -3.61k | 1.78k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for China Xlx Fertiliser. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 29.15k | 19.62k | 4.86 |

Key Ratios Snapshot

Some of the financial key ratios for China Xlx Fertiliser are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 31.7% | 42.4% | 15.6% |

| FCF Margin | ROE | ROA |

| -5.0% | 32.9% | 7.2% |

Analysis

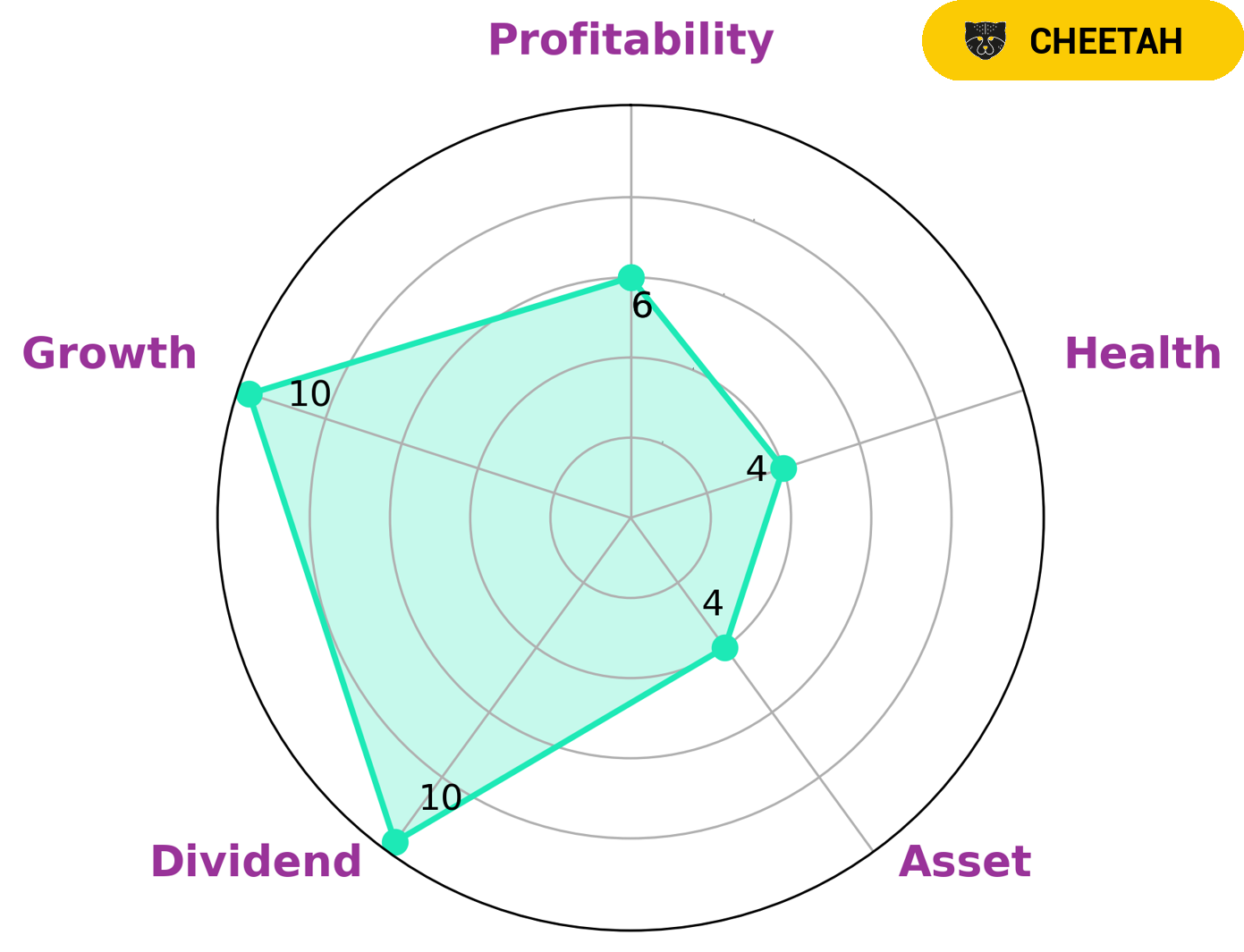

GoodWhale has analyzed the fundamentals of CHINA XLX FERTILISER and classified it as a ‘cheetah’ on the Star Chart. This means that the company has achieved high revenue or earnings growth but is considered less stable due to lower profitability. In other words, this is a company that is likely to be of interest to growth investors who want to capitalize on short-term opportunities. CHINA XLX FERTILISER also has a moderate health score of 4/10 with regard to its cashflows and debt, suggesting that it might be able to safely ride out any crisis without the risk of bankruptcy. In terms of its performance metrics, CHINA XLX FERTILISER is strong in dividend, growth, and medium in asset, profitability, making it an attractive investment for momentum investors who like to take advantage of market trends. Overall, CHINA XLX FERTILISER is an attractive company with good growth potential and low risk. Investors looking for fast returns should definitely consider this company as a potential investment. More…

Peers

The company’s products are used in agriculture, horticulture and turf management. China XLX Fertiliser Ltd is a publicly listed company on the Hong Kong Stock Exchange and has a market capitalisation of HK$5.3 billion as of February 2016. The company’s major competitors are China Agri-Business Inc, Muliang Viagoo Technology Inc, Nanjing Red Sun Co Ltd.

– China Agri-Business Inc ($OTCPK:CHBU)

Muliang Viagoo Technology Inc. is a Chinese company that provides online marketing services. It has a market capitalization of 261.39 million as of 2022 and a return on equity of 8.6%. The company offers services such as search engine optimization, online advertising, and social media marketing. It also provides web design and development services.

– Muliang Viagoo Technology Inc ($NASDAQ:MULG)

Nanjing Red Sun Co Ltd has a market cap of 6.97B as of 2022, a Return on Equity of -107.61%. The company is engaged in the business of coal mining, washing, and sales in China. It is one of the largest coking coal producers in China. The company’s mines are located in Nanjing, Jiangsu Province, China.

Summary

China XLX Fertiliser is a promising investment opportunity for 2023, offering attractive returns. Analysts have highlighted its potential for growth based on its competitive advantages in the market, such as its low-cost production of high-quality fertilisers. Its recent media coverage has been predominantly positive, and investors are showing strong interest in the company. With its robust financials and attractive returns, China XLX Fertiliser is poised to be a smart investment choice for those seeking to diversify their portfolio.

Recent Posts