Cf Industries Stock Fair Value Calculation – CF Industries: Fertilizer Prices Sliding Now, Shortage Could Return with a Vengeance

June 6, 2023

🌧️Trending News

CF ($NYSE:CF) Industries is a leading global producer and distributor of nitrogen fertilizers. The company is listed on the New York Stock Exchange and is headquartered in Deerfield, Illinois. Fertilizer prices have been in decline over the past year, however the possibility of a shortage resurfacing is a real concern. This could be due to a combination of factors including increased demand for fertilizer, weather conditions and government policies. The decrease in fertilizer prices has been beneficial to producers and farmers who have been able to save money on production costs.

However, if a shortage were to return, the cost of production would likely increase and make farming more expensive. This would directly affect the bottom line of producers and farmers.

Additionally, lower prices could result in lower production levels which could lead to an even greater shortage. In order to prevent a future shortage, CF Industries has taken steps to ensure its production capacities can meet any future demand. This includes investments in new production facilities and technology advancements to increase efficiency. These measures have enabled CF Industries to remain competitive and keep prices low. Overall, the decrease in fertilizer prices is largely beneficial to producers and farmers in the short term. However, CF Industries must remain vigilant to ensure that any future shortage does not occur. The company’s investments in production capacity and technology advancements will help ensure that any potential shortages are prevented.

Market Price

CF Industries, a leading fertilizer manufacturer, has been on an upward trajectory since Monday, as its stock opened at $63.8 and closed at $63.9, representing a 1.5% jump from the prior closing price of $62.9. This comes as the price of urea and the other fertilizers produced by the company have been waning in recent weeks.

However, this could be a short term reprieve for CF Industries, as there is potential for a serious fertilizer shortage if global demand continues to surge. This could drive prices up substantially and blindside CF Industries if they are not adequately prepared for the resulting market shift. Therefore, it is essential for CF Industries to take steps to ensure that they remain competitive in the market, and ready themselves for whatever changes could come their way. This includes monitoring market trends and adjusting their production accordingly to meet the demands of the global market.

Additionally, CF Industries should look for potential opportunities to increase production in order to minimize the effects of any potential shortages. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cf Industries. More…

| Total Revenues | Net Income | Net Margin |

| 10.33k | 3.02k | 31.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cf Industries. More…

| Operations | Investing | Financing |

| 3.41k | -412 | -2.77k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cf Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.4k | 5.31k | 27.98 |

Key Ratios Snapshot

Some of the financial key ratios for Cf Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 31.3% | 73.0% | 44.5% |

| FCF Margin | ROE | ROA |

| 28.6% | 54.7% | 21.4% |

Analysis – Cf Industries Stock Fair Value Calculation

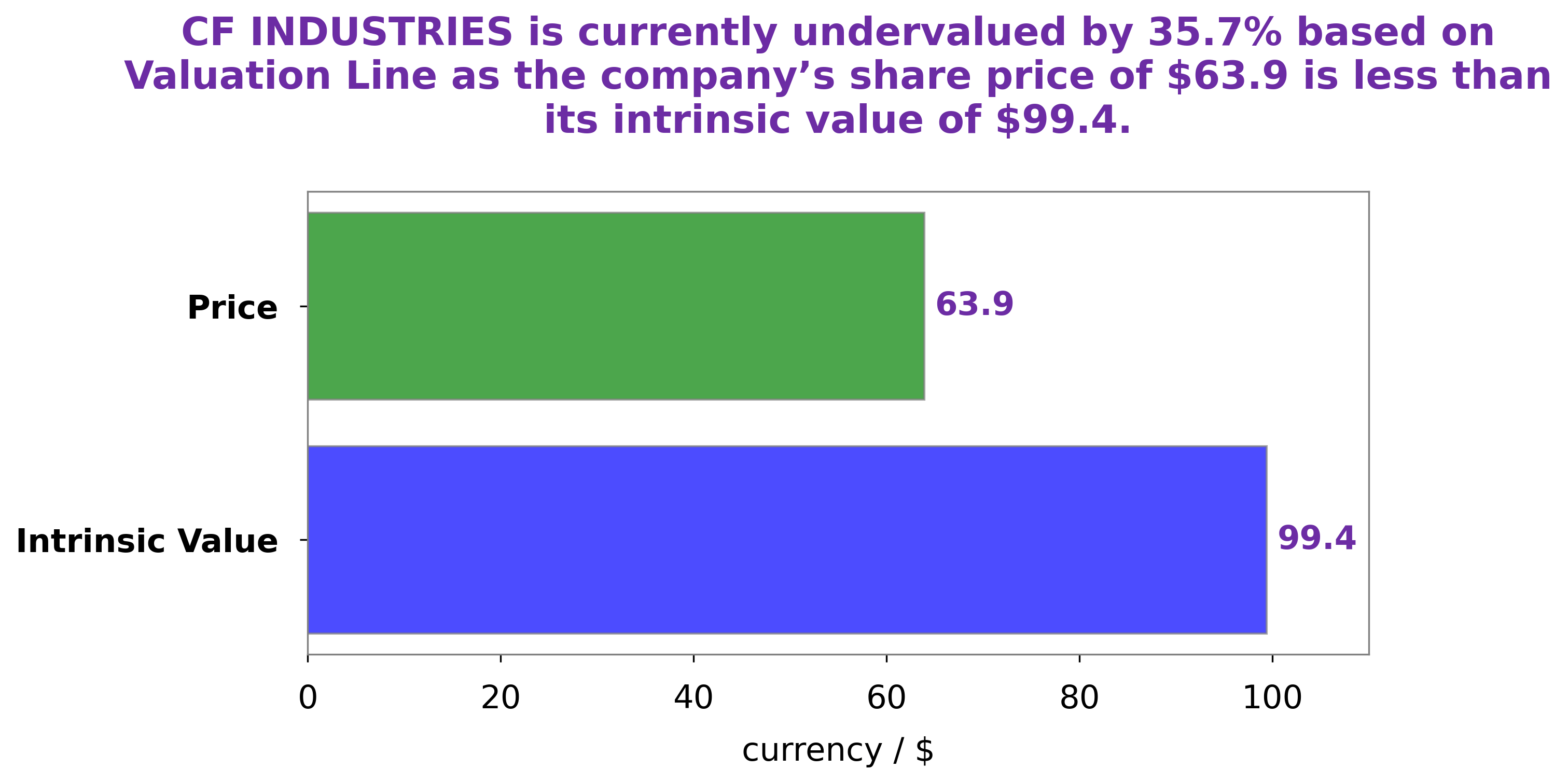

At GoodWhale, we have conducted an analysis of CF INDUSTRIES‘s financials. Our proprietary Valuation Line has calculated the intrinsic value of CF INDUSTRIES’ share at around $99.4. However, CF INDUSTRIES stock is currently traded at $63.9, implying a 35.7% undervaluation. This presents a great buying opportunity for investors to buy the stock at a marked down price. More…

Peers

The company has a number of competitors, including Nutrien Ltd, Intrepid Potash Inc, and The Mosaic Co. While each company has its own strengths and weaknesses, CF Industries Holdings Inc has been able to maintain a strong position in the market by offering a broad range of products and services.

– Nutrien Ltd ($TSX:NTR)

Nutrien Ltd is a Canadian company that produces and sells agricultural products. The company has a market cap of 62.04B as of 2022 and a return on equity of 23.76%. Nutrien is the world’s largest provider of crop inputs and services, and it is a leading producer of potash, nitrogen, and phosphate. The company’s products are used by farmers to grow food, fuel, and fiber crops.

– Intrepid Potash Inc ($NYSE:IPI)

Intrepid Potash Inc is a publicly traded company that mines and produces potash, a potassium-bearing salt, in the United States. The company has a market capitalization of $616.17 million and a return on equity of 8.14%. Intrepid Potash is the largest producer of potash in the U.S. and has been in operation for over 70 years. The company’s potash mines are located in New Mexico, Colorado, and Utah.

– The Mosaic Co ($NYSE:MOS)

Mosaic Co is a publicly traded agricultural company with a market cap of 18.56B as of 2022. The company focuses on the production and marketing of fertilizer and other agricultural products. Mosaic Co has a return on equity of 24.22%.

Summary

CF Industries is a leading producer of fertilizer and is currently experiencing a period of sliding prices. This represents a good opportunity for potential investors as the prices could rise in the future due to an imminent shortage. The company is well positioned to take advantage of the shortage as it has the industry experience and resources to ramp up production when needed.

Additionally, CF Industries operates across multiple geographies, providing a degree of diversification for investors. This further enhances its attractiveness as an investment option. With opportunities in the fertilizer industry at large, those looking to diversify their portfolios should consider CF Industries as an option.

Recent Posts