Benson Hill Reports Surprise Q1 Earnings with Revenue Beating Estimates by $51.36M

May 11, 2023

Trending News 🌧️

The company’s GAAP EPS of -$0.02 exceeded expectations by $0.17, while its revenue of $134.6M surpassed the anticipated figure of $51.36M. This news has been well received by investors, with shares of Benson Hill ($NYSE:BHIL) increasing in value following the announcement. The increased revenue and EPS can be attributed to strong demand from its customers for its products and services. The company’s innovative software solutions are designed to improve operational efficiency, reduce costs, and enable businesses to scale quickly and easily.

Benson Hill has also seen an increase in sales of its cloud-based solutions, which have been in high demand this past year due to their flexibility and scalability. With a strong financial position and an increased focus on customer satisfaction, it is expected that the company will continue to perform well in the coming quarters.

Earnings

BENSON HILL recently reported its first quarter earnings for FY2022 ending December 31 2022, beating estimates by $51.36M. The total revenue was reported as $99.18M USD, a substantial increase from the previous year’s total revenue of $23.53M USD. This marks a 126.9% increase over the last three years.

Despite the large jump in total revenue, the company reported a net income loss of $53.61M USD. Such a large loss is likely due to increased costs associated with the revenue growth.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Benson Hill. More…

| Total Revenues | Net Income | Net Margin |

| 381.23 | -127.91 | -33.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Benson Hill. More…

| Operations | Investing | Financing |

| -93.4 | -40.25 | 98.01 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Benson Hill. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 500.92 | 307.02 | 0.94 |

Key Ratios Snapshot

Some of the financial key ratios for Benson Hill are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 68.6% | – | -20.5% |

| FCF Margin | ROE | ROA |

| -28.8% | -22.4% | -9.8% |

Price History

The news sent investors into a frenzy, with stock prices soaring 38.2% from their prior closing price of $1.2 to an opening of $1.4 and a close of $1.7. The stock closed at an all-time high and analysts are now expecting BENSON HILL prices to continue to rise. Investors are likely to remain optimistic over the company’s impressive performance, as the company appears to be on track to meet and exceed expectations going forward. Live Quote…

Analysis

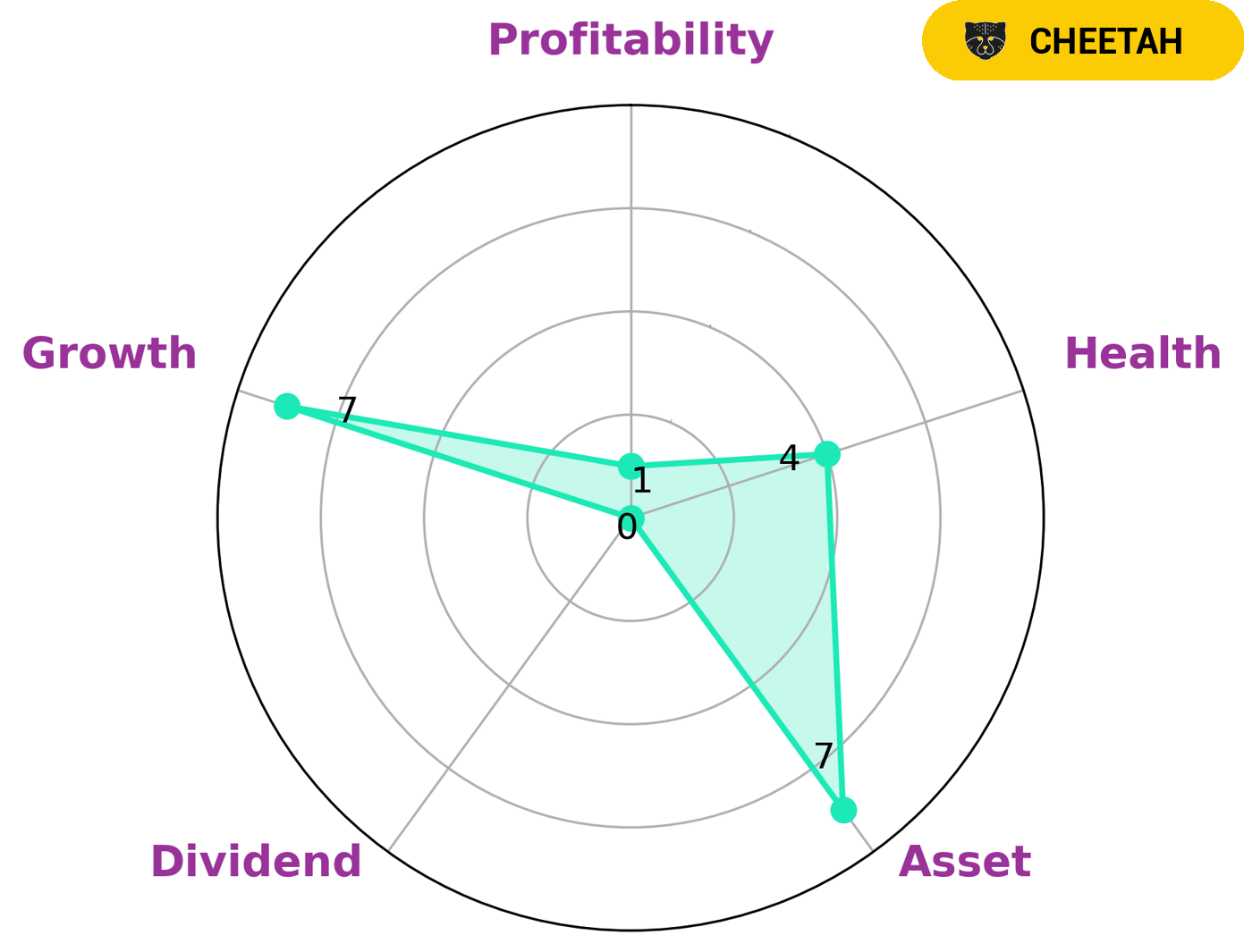

GoodWhale performed an analysis on BENSON HILL’s financials. From Star Chart, BENSON HILL is classified as a ‘cheetah’ – a type of company that has achieved high revenue or earnings growth, but its stability is considered to be lower due to lower profitability. Knowing this, investors that may be interested in such a company are those who are looking to take on more risk and have a higher tolerance for the potential of losses. BENSON HILL has an intermediate health score of 4/10, meaning it might be able to sustain its operations in times of crisis. We assess that BENSON HILL is strong in asset growth, but weak in dividend and profitability. More…

Peers

The company’s products include plant-based proteins, oils, and flours. Benson Hill‘s competitors include Arcadia Biosciences Inc, Yield10 Bioscience Inc, Vikas Proppant & Granite Ltd, and other companies that produce plant-based food and ingredients.

– Arcadia Biosciences Inc ($NASDAQ:RKDA)

Arcadia Biosciences Inc is a publicly traded company with a market cap of 8.35M as of 2022. The company has a Return on Equity of -27.94%. Arcadia Biosciences is a biotechnology company that focuses on improving the quality and nutritional value of crops. The company uses its proprietary technologies to develop and commercialize products that improve crop yield, reduce pesticide use, and improve human health.

– Yield10 Bioscience Inc ($NASDAQ:YTEN)

Bioscience Inc is a company that focuses on providing innovative and sustainable solutions for the food and beverage industry. They have a market cap of 11.94M as of 2022 and a Return on Equity of -68.22%. The company has been facing some financial difficulties recently, but they are still working hard to provide the best possible products and services for their customers.

– Vikas Proppant & Granite Ltd ($BSE:531518)

Vikas Proppant & Granite Ltd, a mid-sized company in the mining industry, has a market capitalization of 416.89 million as of 2022. The company’s return on equity is -1.48%. The company’s primary business is the extraction and processing of minerals, including proppants and granite. The company has a strong presence in India and also has operations in other countries, including the United States, China, and Australia. Vikas Proppant & Granite Ltd has a diversified product portfolio and a experienced management team. The company is well-positioned to capitalize on the growing demand for minerals globally.

Summary

Following this news, the stock price rose on the same day, indicating a positive reaction to the earnings report from investors. Going forward, analysts will be looking to see whether Benson Hill can continue to deliver strong earnings and revenue growth, as well as assessing how their financials compare to competitors in their field. Investors should also pay close attention to the company’s balance sheet and cash flow as signs of fiscal health and sustainability.

Recent Posts