Analysts Upgrade Ratings and Price Targets for Corteva.

February 9, 2023

Trending News 🌥️

Corteva ($NYSE:CTVA) Inc. is an American-based global agriscience company that specializes in the research, development, and production of agricultural seed, crop protection chemicals, and digital solutions. Recently, investment analysts have upgraded their ratings and price targets for Corteva Inc. Analysts have been impressed by Corteva’s strong financial position and its ability to generate free cash flow. They have also been encouraged by the company’s strategic investments in research and development, which have led to the introduction of new products and technologies that have allowed Corteva to expand its customer base.

In addition, analysts have noted that the company has been successful in reducing its debt and has maintained a strong liquidity position. Analysts have also noted that Corteva’s share price has been steadily increasing over the past year, due in part to the company’s strong performance across all segments, including seed and crop protection. Furthermore, analysts believe that Corteva’s growth will likely continue as the company makes investments in new technologies, continues to develop new products, and expands its global presence. Overall, analysts are optimistic about Corteva’s future prospects, citing its strong financial position, innovation-driven growth strategy, and attractive valuation. With its strong fundamentals and a growing global footprint, Corteva is well positioned to continue to deliver value to shareholders.

Share Price

So far, news coverage has been mostly positive in regards to their progress. On Wednesday, Corteva stock opened at $60.5 and closed at $61.9, up by 1.9% from the prior closing price of $60.7. This suggests that investors and analysts alike are expecting great things from the company in the near future. The upgrades to Corteva’s rating and price target come after a period of strong performance and positive results. In the past few months, the company has achieved record sales and profits, as well as a strong cash position.

This is a testament to the sound business decisions and strategic moves the company has made over the past few years. Overall, analysts’ upgrades to Corteva’s ratings and price targets show that the company is in a great position for success. With a strong balance sheet, a robust portfolio of products, and a talented leadership team, it is likely that Corteva will continue to perform well in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Corteva. More…

| Total Revenues | Net Income | Net Margin |

| 17.45k | 1.15k | 8.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Corteva. More…

| Operations | Investing | Financing |

| 872 | -632 | -1.18k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Corteva. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 42.62k | 17.08k | 35.47 |

Key Ratios Snapshot

Some of the financial key ratios for Corteva are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.0% | 48.9% | 8.6% |

| FCF Margin | ROE | ROA |

| 1.5% | 3.8% | 2.2% |

Analysis

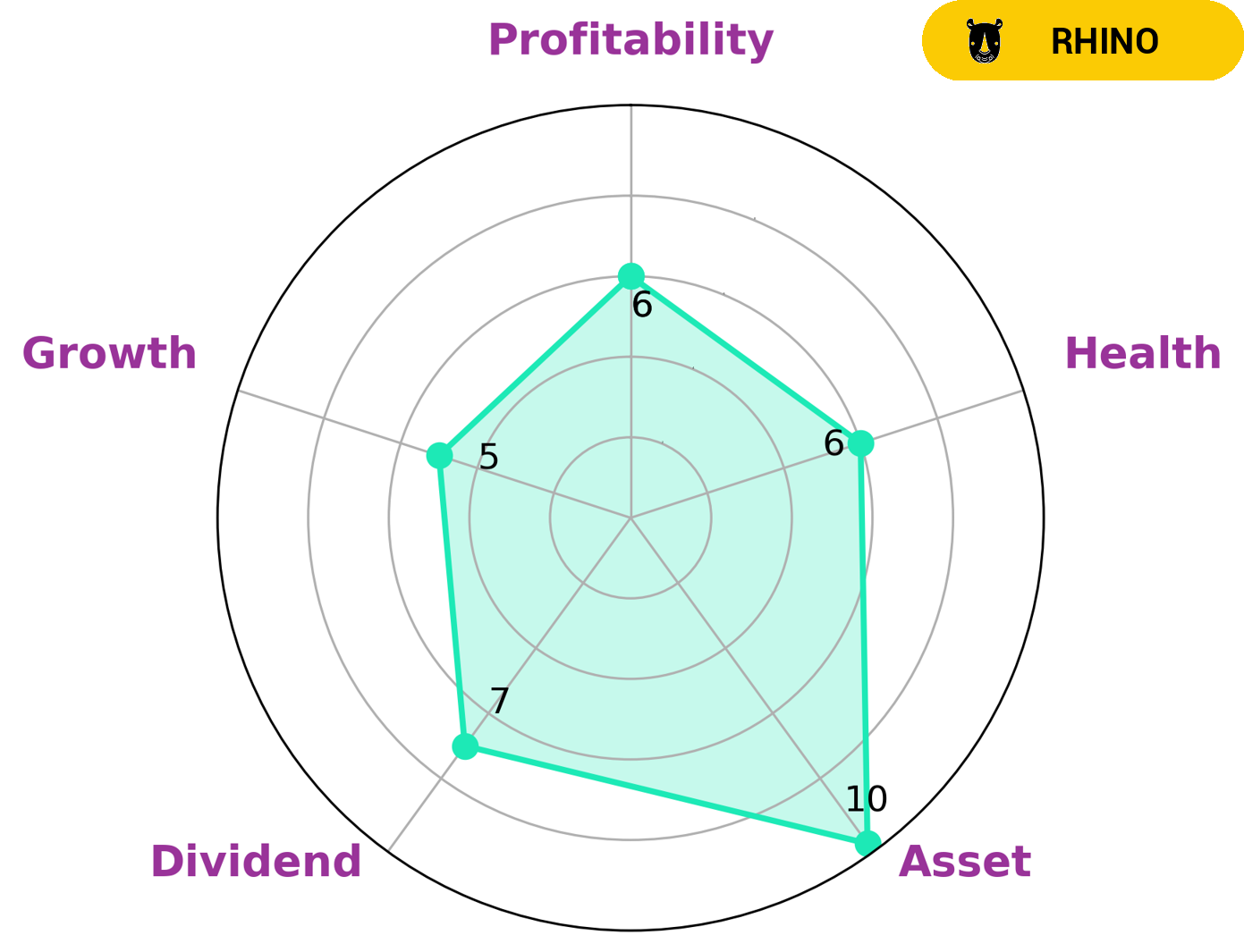

GoodWhale’s analysis of CORTEVA‘s fundamentals has revealed that the company is classified as a ‘rhino’, indicating it has achieved moderate revenue or earnings growth. This type of company might be attractive to investors who are looking for a more conservative approach to investing. CORTEVA is strong in terms of asset and dividend, while its growth and profitability are rated as medium. Its intermediate health score of 6/10 with regard to cashflows and debt suggests that the company is in a position to withstand a crisis without the risk of bankruptcy. Investors looking for a company that has achieved a moderate level of growth, with a reasonable level of security, might find CORTEVA to be an attractive option. The company’s intermediate health score is also an indication that it is in a position to withstand any future financial shocks, making it an even more attractive option for investors. Additionally, CORTEVA’s strong assets and dividend may provide investors with a steady income stream. Overall, CORTEVA is an attractive option for investors who are looking for a moderate level of growth, with a reasonable level of security. Its intermediate health score also implies that it is in a good position to withstand any future financial shocks. Additionally, its strong assets and dividend may provide investors with a steady income stream. More…

Peers

Corteva Inc is an American agriculture company that was formed in 2019. The company specializes in seed and crop protection products. Corteva Inc’s competitors include FMC Corp, Nutrien Ltd, and The Mosaic Co.

– FMC Corp ($NYSE:FMC)

FMC Corporation is a global leader in the agricultural sciences, providing products and services to the agricultural, industrial and consumer markets. The company’s products and services help growers increase yields, improve crop quality and protect crops from pests and disease. FMC’s products also improve the quality of food and other products made from crops.

– Nutrien Ltd ($TSX:NTR)

Nutrien Ltd is a Canadian fertilizer company with a market cap of 60.6B as of 2022. The company has a return on equity of 23.76%, meaning that it is a relatively profitable company. Nutrien produces and sells a variety of fertilizer products, including nitrogen, phosphate, and potash fertilizers. The company also owns and operates a number of mines and processing facilities around the world.

– The Mosaic Co ($NYSE:MOS)

The Mosaic Co is a leading producer and marketer of concentrated phosphate and potash crop nutrients. The company has a market cap of 17.51B as of 2022 and a Return on Equity of 24.22%. The company’s products are used by farmers to improve crop yield and quality. Mosaic is a publicly traded company listed on the New York Stock Exchange.

Summary

Investment analysts have recently upgraded their ratings and price targets for Corteva (NYSE: CTVA). The majority of news coverage has been positive, indicating strong potential for the company’s stock. Analysts have praised Corteva’s strong balance sheet and its diversity of products and services.

They also believe that the company’s focus on sustainability and its commitment to innovation could drive long-term growth. Given the favorable view from analysts, investors should consider Corteva as a potential investment opportunity.

Recent Posts