Triumph Group Intrinsic Stock Value – TRIUMPH GROUP: Aerospace Prospects Bright, Stock Value Limited

June 10, 2023

☀️Trending News

The Triumph Group ($NYSE:TGI) is a publicly traded aerospace and defense supplier that operates in the military, commercial and business aircraft markets. It is a leading manufacturer and supplier of technologically advanced aerospace and defense products and services. Recently, the company has made an acquisition of Bright Aerospace, which is an aircraft component and subsystems business. The prospects for Bright Aerospace look promising for the Triumph Group, however, there is little potential for the value of the stock to increase. The Triumph Group has a strong portfolio of products and services, which will be bolstered by the addition of Bright Aerospace’s capabilities. This includes engine components, flight control systems, and structural components.

Additionally, the expertise of the Triumph Group in engineering and integrated supply chain support are well-suited to meet the demands of the aerospace industry. Despite these positive prospects, the stock value of the Triumph Group is limited. The stock of the Triumph Group is currently trading near its all-time low, and investor sentiment has been weak. Although the acquisition of Bright Aerospace is expected to lead to improved performance, the stock price is unlikely to reach its previous highs. Nonetheless, investors should keep an eye on the Triumph Group as it continues to strengthen its aerospace business. With a strong portfolio of products and services, plus the addition of Bright Aerospace’s capabilities, there is potential for future success.

Stock Price

TRIUMPH GROUP, a supplier of aerospace and defense products, has seen its stock value increase slightly on Thursday. The stock opened at $11.8 and closed at $12.2, up by 2.3% from the previous closing price of $12.0. Despite this modest increase in stock value, TRIUMPH GROUP’s prospects in the aerospace industry remain bright.

The company has an extensive network of global customers and supplies products for the aerospace and defense markets, including components, assemblies, and aftermarket services. The recent uptick in stock price may indicate that investors are beginning to recognize TRIUMPH’s potential in this space. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Triumph Group. More…

| Total Revenues | Net Income | Net Margin |

| 1.38k | 89.59 | 1.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Triumph Group. More…

| Operations | Investing | Financing |

| -52.25 | -27.17 | 65.79 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Triumph Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.71k | 2.51k | -12.19 |

Key Ratios Snapshot

Some of the financial key ratios for Triumph Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -21.9% | -10.4% | 16.9% |

| FCF Margin | ROE | ROA |

| -5.3% | -19.6% | 8.5% |

Analysis – Triumph Group Intrinsic Stock Value

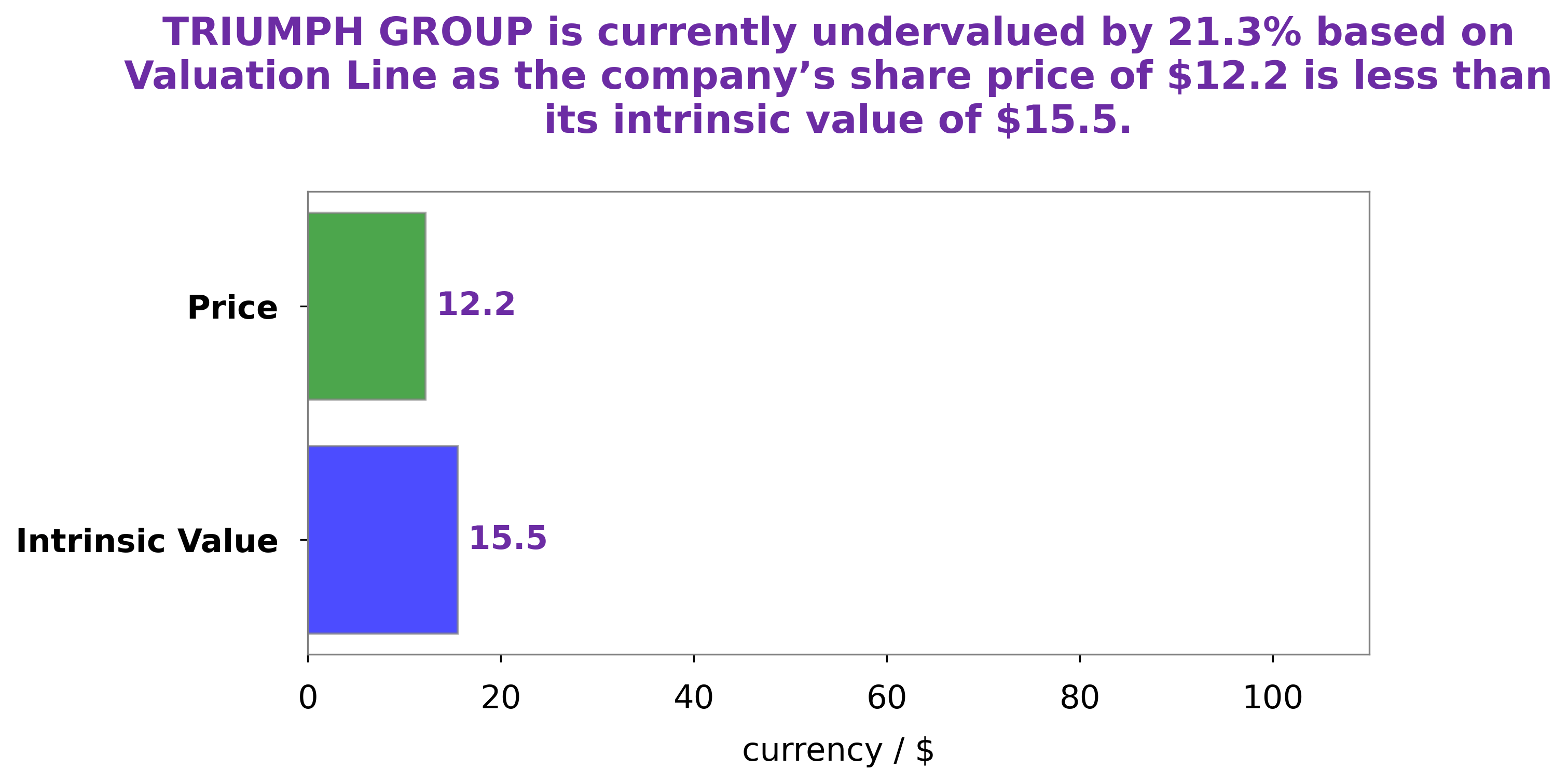

At GoodWhale, we have conducted an analysis of TRIUMPH GROUP‘s wellbeing. By utilizing our proprietary Valuation Line, we have determined that the intrinsic value of TRIUMPH GROUP share is around $15.5. Despite this intrinsic value, the stock is currently traded at $12.2, making it undervalued by 21.3%. This presents an opportunity to invest in TRIUMPH GROUP at a discounted price and potentially realize a positive return in the future. More…

Peers

Their primary competitors include TAT Technologies Ltd, Montana Aerospace AG, and Curtiss-Wright Corp. All four of these companies specialize in providing innovative solutions to the aerospace and defense industries.

– TAT Technologies Ltd ($NASDAQ:TATT)

TAT Technologies Ltd is a leading global provider of services and products to the commercial and military aerospace and ground defense industries. The company has a market capitalization of 49.96M as of 2022. This market cap is a measure of the company’s total value and is calculated by multiplying its share price by the number of its outstanding shares. The company’s return on equity (ROE) for 2022 was -3.59%. This shows that the company’s management has been unsuccessful in generating profits from its investors’ capital. TAT Technologies Ltd focuses on providing solutions for aircraft maintenance, repair and overhaul (MRO), as well as production of heat transfer solutions and other related products.

– Montana Aerospace AG ($LTS:0AAI)

Montana Aerospace AG is a technology company based in Switzerland that specializes in aerospace components and systems. The company has a market cap of 882.67M as of 2022, which is a testament to its success, as it ranks among the top aerospace companies in the world. Montana Aerospace AG has also been able to maintain a negative Return on Equity (ROE) of -2.36%, indicating that the company is not utilizing its assets and equity efficiently. This is a sign of potential financial distress, as the company may not be able to generate enough returns to cover its costs and make profits. However, the company remains well-positioned to benefit from the growing aerospace industry.

– Curtiss-Wright Corp ($NYSE:CW)

Curtiss-Wright Corp is a US-based aerospace and defense company that provides highly engineered products and services to the global aerospace, defense, power generation and general industrial markets. As of 2022, the company has a market cap of 6.35B and a return on equity of 12.86%. The company has a strong track record of delivering superior returns for shareholders, and its success is reflected in its market capitalization. Curtiss-Wright is well positioned to continue to capitalize on the opportunities presented by the global aerospace and defense industry, as well as the broader industrial markets.

Summary

Triumph Group, Inc. is an aerospace company offering a range of products and services for the aerospace and defense industries. The company has a strong presence in the commercial and military aerospace markets, with products and services ranging from complex assemblies to components, and aftermarket support services. According to investing analysis, the prospects for the company’s aerospace business are bright, yet there is little upside potential for the stock due to a lackluster performance in recent years. Factors such as a strong competitive landscape, high overhead costs, and low demand in some segments of the market have weighed on the stock’s performance.

Despite these challenges, Triumph Group has made progress on improving its operational efficiency and reducing costs, while at the same time focusing on innovation to drive growth. These efforts could lead to a more profitable future for the company, however investors should not expect any significant gains for the stock in the near-term.

Recent Posts