Lockheed Martin Awarded $133.62M Modification Contract by US Government for Completion in 2026

February 1, 2023

Trending News ☀️

Lockheed Martin ($NYSE:LMT) is a leading global security and aerospace company, providing innovative solutions for the US government and commercial customers around the world. The company specializes in the development, manufacture, and integration of advanced technology systems, products, and services. It is a publicly-traded company listed on the New York Stock Exchange (NYSE: LMT). Lockheed Martin has recently been awarded a modification contract worth $133.62M by the US Government. This order was issued through a basic ordering agreement, with the Naval Air Systems as the contracting activity. The contract is expected to be completed by October 2026. This award expands upon the existing basic ordering agreement and provides additional aircraft, maintenance and support services.

This contract is part of the US Navy’s efforts to upgrade its fleet of combat aircraft and ensure its readiness for future operations. The contract includes the delivery of various components and services, including aircraft overhaul, maintenance, and sustainment. Lockheed Martin is well positioned to deliver these services due to its extensive experience in the aerospace and defense industry. The company’s commitment to delivering innovative solutions and services to its customers has enabled it to secure this contract. It will also help strengthen the US Navy’s fleet and ensure its readiness for future operations.

Stock Price

The stock opened at $462.3 and closed at $463.3, up by 0.6% from last closing price of 460.6. This positive news has been mostly welcomed by investors, as the company looks to expand its presence in the defense sector. Furthermore, this contract is the latest in a series of lucrative contracts that the company has secured from the US Government in the past few years. The details of this particular contract are still unclear, but it is likely to involve the development and production of some critical military hardware and/or software. Lockheed Martin is well-known for its innovation and technological capabilities, which could prove invaluable to the US Government’s defense needs.

Overall, this latest news should be seen as positive for Lockheed Martin and its investors. With the company’s vast experience in military technology and its impressive track record of successful contracts, there is every chance that this latest agreement will be mutually beneficial for both parties. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lockheed Martin. More…

| Total Revenues | Net Income | Net Margin |

| 65.98k | 5.73k | 8.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lockheed Martin. More…

| Operations | Investing | Financing |

| 7.8k | -1.79k | -7.07k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lockheed Martin. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 52.88k | 43.61k | 45.66 |

Key Ratios Snapshot

Some of the financial key ratios for Lockheed Martin are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.3% | -0.1% | 11.1% |

| FCF Margin | ROE | ROA |

| 9.3% | 43.0% | 8.6% |

VI Analysis

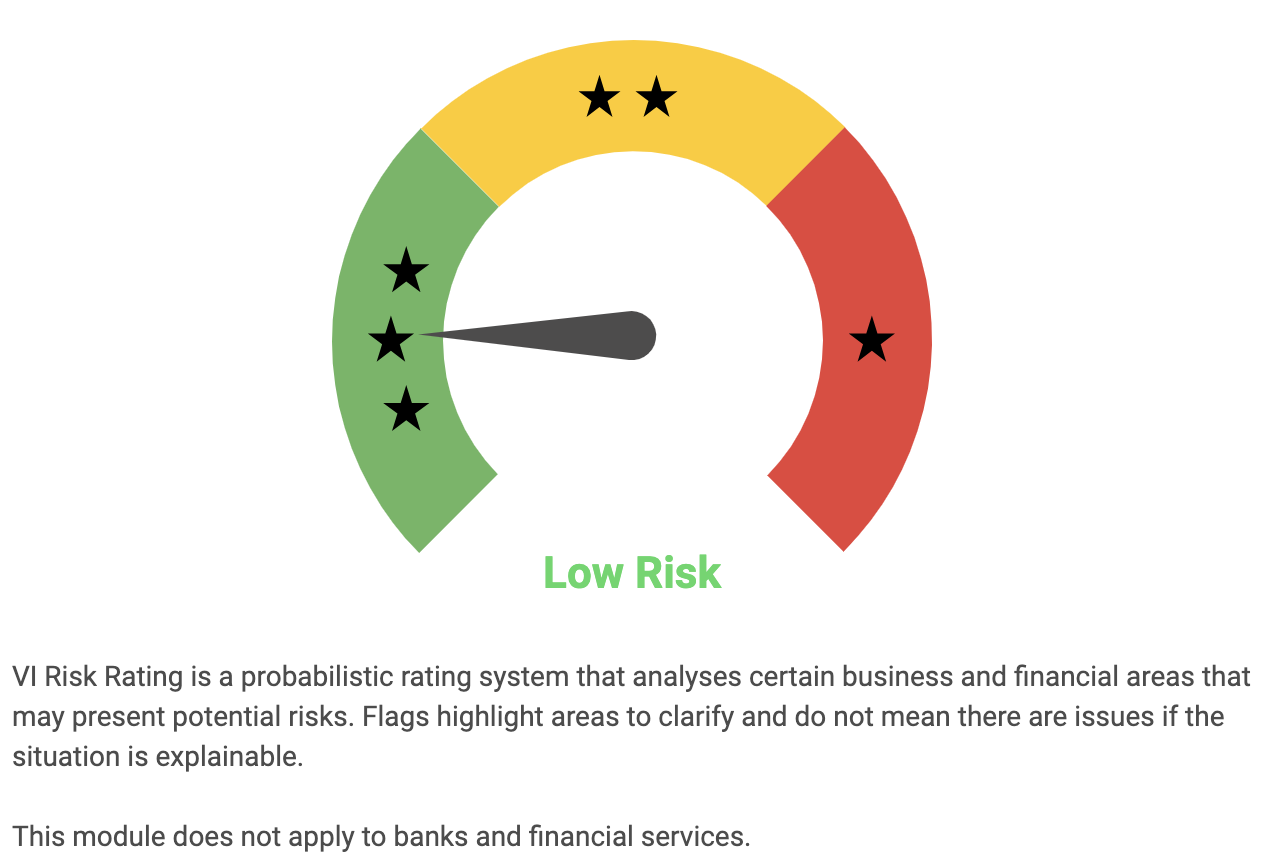

The VI app is a great tool for analysing the fundamental characteristics of Lockheed Martin, a global security and aerospace company. VI Risk Rating shows that Lockheed Martin is a low risk investment when it comes to financial and business aspects, making it a suitable choice for long-term investments. The app also provides users with warnings about potential risks, such as those found in the income sheet and balance sheet. This makes it easier for investors to spot any potential red flags before committing to an investment. VI App also offers users detailed data about the company, including information on its revenue, profit margins and other key metrics. This allows investors to compare the company’s performance against other firms in the industry, giving them a better understanding of their risk exposure. Overall, the VI App provides investors with an easy way to analyse Lockheed Martin’s fundamentals and assess its long-term potential. With detailed insights into the company’s financials and risk profile, investors can make more informed decisions when it comes to investing in this company. To get access to more detailed information, investors can register on the VI App and get an in-depth look at the company’s performance. More…

VI Peers

The U.S. Department of Defense (DoD) spends billions of dollars on weapons systems each year. Major weapons systems contractors compete for these funds. The competition among these companies is fierce. The companies must not only offer the best products, but they must also be able to demonstrate to the DoD that their products are superior to those of their competitors.

Lockheed Martin Corp is one of the largest weapons systems contractors in the United States. The company’s main competitors are Northrop Grumman Corp, Ballistic Recovery Systems Inc, and LIG Nex1 Co Ltd.

– Northrop Grumman Corp ($NYSE:NOC)

Northrop Grumman Corp is an American aerospace and defense technology company with a market cap of 78.41B as of 2022. The company has a Return on Equity of 34.54%. Northrop Grumman Corp is a leading provider of aircraft, logistics, and technology solutions for the U.S. military, government, and commercial customers. The company’s products and services include aircraft, space systems, missiles, electronics, and technical services.

– Ballistic Recovery Systems Inc ($OTCPK:BRSI)

Ballistic Recovery Systems Inc is a world leader in the design, manufacture, and deployment of parachutes and other soft goods for the aerospace industry. The company has a market cap of 4.19M as of 2022 and a ROE of -159.06%. Ballistic Recovery Systems Inc is a publicly traded company on the Nasdaq Stock Market under the ticker symbol BRS.

– LIG Nex1 Co Ltd ($KOSE:079550)

LIG Nex1 Co Ltd is a South Korean defense company specializing in electronics and weaponry. It was founded in 1999 and is headquartered in Seoul. The company has a market cap of 1.87T as of 2022 and a Return on Equity of 14.92%. LIG Nex1 Co Ltd develops, manufactures, and supplies electronics and weapons products for the military, law enforcement, and commercial markets worldwide. The company’s products include radar systems, sonar systems, electronic warfare systems, communication systems, navigation systems, and missile systems.

Summary

Lockheed Martin has recently been awarded a $133.62 million contract modification by the US Government that is set to be completed in 2026. This is a positive financial development for Lockheed Martin and investors should consider taking a closer look at the company. With a long-term contract secured from the US Government, Lockheed Martin’s stock could benefit from increased stability and value.

Furthermore, investors should look at the company’s financials to determine if the company is a good investment. This includes looking at the company’s cash flow, debt-to-equity ratio, earnings growth, and dividend yield to determine if Lockheed Martin is a good long-term investment.

Recent Posts