KTOS Stock Fair Value Calculator – Signaturefd LLC Increases Stock Holdings in Kratos Defense & Security Solutions, by $66000

April 22, 2023

Trending News ☀️

Signaturefd LLC has recently increased its stock holdings in Kratos Defense & Security ($NASDAQ:KTOS) Solutions, Inc. by a staggering $66000. The news was reported by Defense World. Kratos Defense & Security Solutions, Inc. is a U.S.-based company that offers a range of high-end defense, security, and technology solutions to commercial and government customers worldwide. It specializes in the development and production of unmanned aerial systems, rocket systems, secure communication systems, and other advanced technology solutions. The company’s products are designed to provide superior performance in the most challenging environments.

Kratos Defense & Security Solutions, Inc.’s stock is currently trading at an all-time high and has recently been the target of numerous investors. The latest investment by Signaturefd LLC is a testament to the company’s growing popularity. Investors are looking to the company to continue its track record of delivering superior defense solutions and services. It remains to be seen how this investment will impact the company’s stock in the future.

Share Price

The stock opened at $12.8 and closed at $12.8, a slight decrease of 0.6% from the prior closing price. With this injection of capital, the company is well-positioned to continue to expand and develop new innovative defense and security solutions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for KTOS. More…

| Total Revenues | Net Income | Net Margin |

| 898.3 | -36.9 | -2.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for KTOS. More…

| Operations | Investing | Financing |

| -25.7 | -177.4 | -63.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for KTOS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.55k | 604 | 7.43 |

Key Ratios Snapshot

Some of the financial key ratios for KTOS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.8% | -50.8% | -1.6% |

| FCF Margin | ROE | ROA |

| -7.9% | -1.0% | -0.6% |

Analysis – KTOS Stock Fair Value Calculator

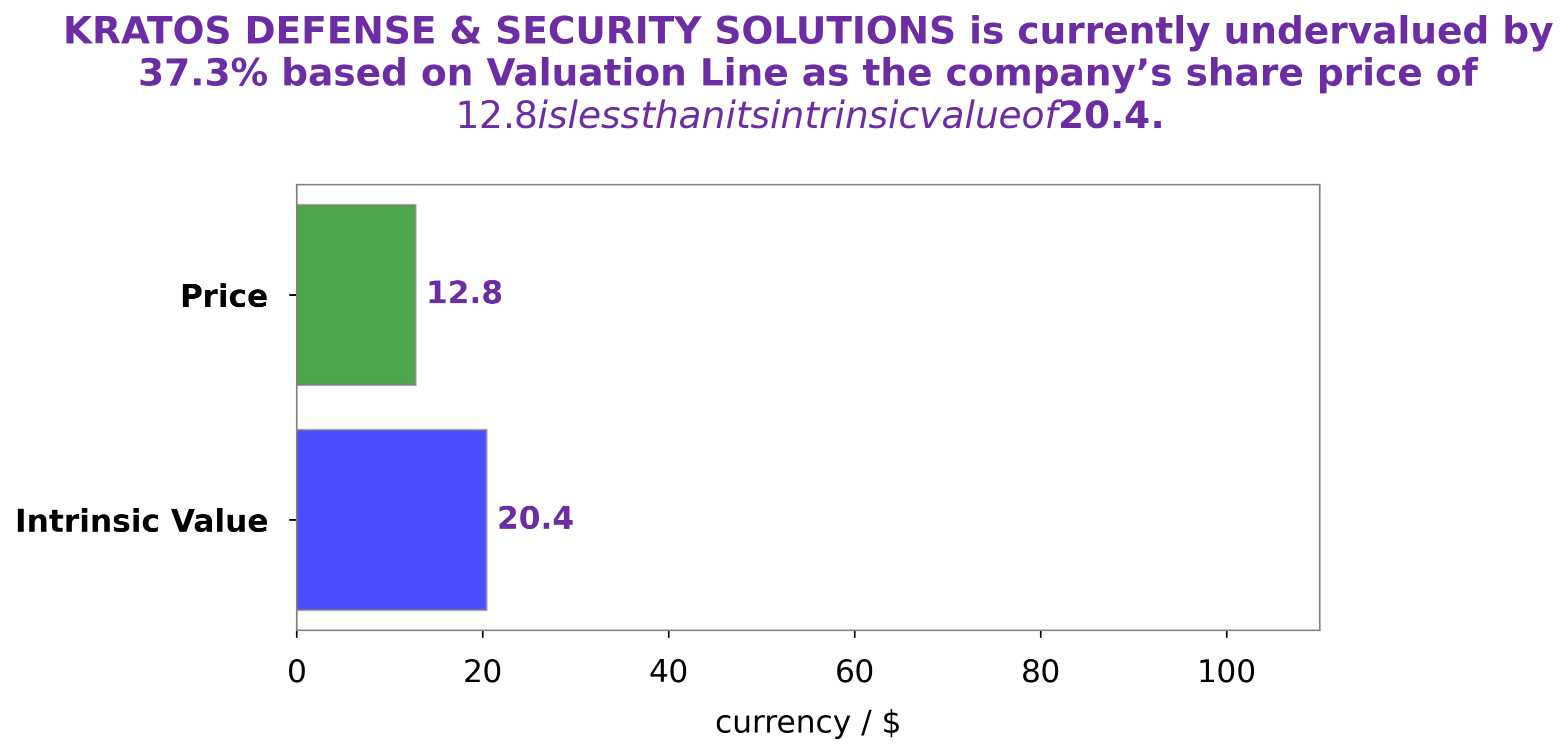

We at GoodWhale have analyzed the financials of KRATOS DEFENSE & SECURITY SOLUTIONS and arrived at the conclusion that the intrinsic value of its share is around $20.4. This was calculated by our proprietary Valuation Line. Currently, KRATOS DEFENSE & SECURITY SOLUTIONS stock is trading at a lower price of $12.8, indicating that it is undervalued by 37.1%. More…

Peers

Its competitors include OHB SE, Elbit Systems Ltd, and General Dynamics Corp.

– OHB SE ($LTS:0FH7)

Manhattan Associates, Inc. (NASDAQ: MANH) is a leading supply chain software solutions company. The company’s solutions are used by retailers, wholesalers and manufacturers to manage inventory, orders and customers. The company’s solutions are used by more than 5,000 customers worldwide, including some of the world’s largest companies. Manhattan Associates is a publicly traded company with a market capitalization of $510.41 million as of 2022. The company has a return on equity of 13.17%.

– Elbit Systems Ltd ($NASDAQ:ESLT)

Elbit Systems Ltd. is an Israel-based international defense electronics company. It develops and produces a wide array of defense-related systems and products for air, land, and sea applications. The company’s products include military aircraft, Unmanned Aerial Vehicles (UAVs), ground vehicles and armor, artillery systems, night vision and electro-optic systems, intelligence gathering, surveillance and reconnaissance systems, naval systems, air defense systems, and electronics warfare systems. Elbit Systems also provides a variety of services, including training, maintenance, and technical support.

– General Dynamics Corp ($NYSE:GD)

As of 2022, General Dynamics Corporation has a market capitalization of 68.46 billion dollars and a return on equity of 15.38%. The company provides business aviation, combat vehicles, weapons systems and munitions, information technology solutions, and shipbuilding products and services worldwide. It operates through four segments: Aerospace, Combat Systems, Information Technology, and Marine Systems.

Summary

Investors should be aware of Kratos Defense & Security Solutions, Inc., a leading supplier of unmanned and autonomous defense platforms, products, and services. The company offers a range of defense and security products to the U.S. Department of Defense and other government agencies. The stock has seen strong year-over-year growth, with recent gains driven by strong development of new products and a reward contract from the U.S. Army. With future contracts on the horizon, Kratos Defense is an attractive option for investors looking to capitalize on the growth of the defense sector.

Recent Posts