Key Client Fiduciary Advisors LLC Invests in Howmet Aerospace in 2023.

March 28, 2023

Trending News 🌥️

In 2023, Key Client Fiduciary Advisors LLC made a strategic move to invest in Howmet Aerospace ($NYSE:HWM) Inc., a leading tier-1 aerospace component supplier. With its strong portfolio of world-leading products, Howmet Aerospace Inc. is well poised to take advantage of the growth in the aerospace industry. The company’s portfolio includes complex components for a variety of applications in engines, interiors and structures. In addition to its traditional aerospace products, Howmet Aerospace Inc. also provides its customers with a wide range of services and solutions, from design and prototyping to aftermarket support.

This will enable the company to penetrate new markets, capitalize on existing ones, and strengthen its market position as a leading global supplier of aerospace components. The company is sure to benefit from the new capital, and it is expected that this move will result in further growth and success for Howmet Aerospace Inc. in the upcoming years.

Stock Price

This news has been met with mostly positive media coverage, with stock prices rising to reflect the demand. Howmet Aerospace opened at $40.8 on Monday morning and closed at the same price, up by 1.3% from its last closing price of $40.2. This investment will prove to be beneficial to both the company and the investors, as it is expected to bring growth and stability to Howmet Aerospace Inc. in the coming year. With this new development, Howmet Aerospace is sure to make a name for itself in the industry, and will be well-positioned to capitalize on the opportunities that come its way. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Howmet Aerospace. More…

| Total Revenues | Net Income | Net Margin |

| 5.66k | 467 | 10.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Howmet Aerospace. More…

| Operations | Investing | Financing |

| 733 | -135 | -526 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Howmet Aerospace. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.26k | 6.65k | 8.74 |

Key Ratios Snapshot

Some of the financial key ratios for Howmet Aerospace are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -26.4% | -15.9% | 14.7% |

| FCF Margin | ROE | ROA |

| 9.5% | 15.2% | 5.1% |

Analysis

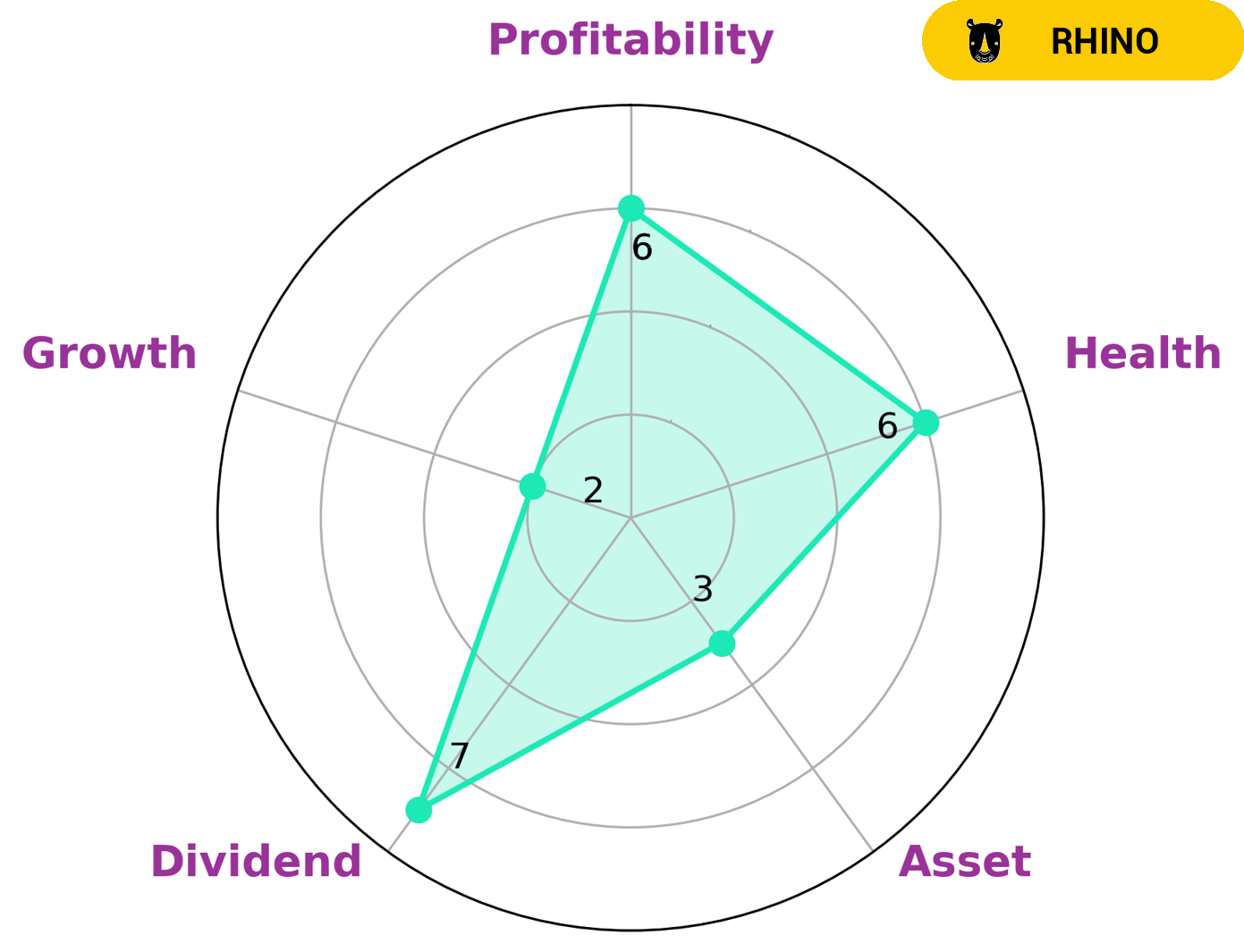

At GoodWhale, we conducted an analysis of HOWMET AEROSPACE‘s fundamentals and found that the company had an intermediate health score of 6/10 with regard to its cashflows and debt. This means that HOWMET AEROSPACE might be able to pay off debt and fund future operations. Our star chart also showed that HOWMET AEROSPACE is strong in dividend, medium in profitability, and weak in asset and growth. Based on this information, we classified HOWMET AEROSPACE as a ‘rhino’, a type of company which has achieved moderate revenue or earnings growth. This kind of company may be of interest to long-term investors who are looking for a steady return, instead of aggressive growth or high dividend yields. Such investors may appreciate HOWMET AEROSPACE’s stability and moderate performance. More…

Peers

Its main competitors are Rolls-Royce Holdings PLC, General Dynamics Corp, and Raytheon Technologies Corp.

– Rolls-Royce Holdings PLC ($LSE:RR.)

Rolls-Royce Holdings PLC is a British multinational engineering company incorporated in February 2011 that owns Rolls-Royce, a business founded in 1904 which today designs, manufactures and distributes power systems for aviation and other industries.

The company has a market cap of 7.25B as of 2022 and a Return on Equity of 21.06%. Rolls-Royce is a global leader in the design, manufacture and distribution of power systems for aviation and other industries. The company’s products and services power more than 35,000 aircraft and over 10,000 ships worldwide.

– General Dynamics Corp ($NYSE:GD)

General Dynamics Corporation is an American aerospace and defense conglomerate company formed by mergers and divestitures, and as of 2012, it is the fifth largest defense contractor in the world. It is headquartered in West Falls Church, The company has a market cap of 68.15B as of 2022 and a Return on Equity of 15.38%. The company is involved in the design, development, and manufacture of products and services for the aerospace and defense industries.

– Raytheon Technologies Corp ($NYSE:RTX)

Raytheon Technologies Corporation is an aerospace and defense company that provides products and services for the commercial, military, and government markets. The company has a market cap of 140.18B as of 2022 and a Return on Equity of 5.82%. Raytheon Technologies is a technology leader in defense, security, and commercial aerospace. The company’s products and services include aircraft engines, radar, and other electronic systems.

Summary

Key Client Fiduciary Advisors LLC has recently invested in Howmet Aerospace Inc. in 2023, and the current media coverage of the investment is mostly positive. An analysis of the investment potential in Howmet Aerospace Inc. shows strong potential for growth due to their competitive advantage in the aviation industry. They have a broad portfolio of high-performance materials and advanced technologies, along with a wide range of services and products, including jet engine components and advanced aerospace systems. Their services include engine components, turbine blades, and 3D printing, while their products include aircraft structures, castings, and components.

The company also has a strong presence in both commercial and military aircraft production, along with a presence in space exploration. With their strong presence in the aerospace industry, Howmet Aerospace Inc. is set to benefit from increased demand for their services and products in the coming years, providing potential investors with an attractive return on investment.

Recent Posts